Question 2 Jeanius plc is considering an investment of £10 million in a new trouser production plant. The project business plan is based on the following assumptions: • The project will start on 1st January 2022. The initial investment is assumed to be incurred at the start of the project. • Production will start on 1st January 2024. • Production will be 2 million pairs of trousers each year for the first 8 years of production and then increased to 4 million pairs. Profits will be £0.75 per pair of trousers to be received at the beginning of each calendar year. Profits increase by 90% minh orting in the 2rd voor of production

Question 2 Jeanius plc is considering an investment of £10 million in a new trouser production plant. The project business plan is based on the following assumptions: • The project will start on 1st January 2022. The initial investment is assumed to be incurred at the start of the project. • Production will start on 1st January 2024. • Production will be 2 million pairs of trousers each year for the first 8 years of production and then increased to 4 million pairs. Profits will be £0.75 per pair of trousers to be received at the beginning of each calendar year. Profits increase by 90% minh orting in the 2rd voor of production

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 16P: REPLACEMENT CHAIN The Lesseig Company has an opportunity to invest in one of two mutually exclusive...

Related questions

Question

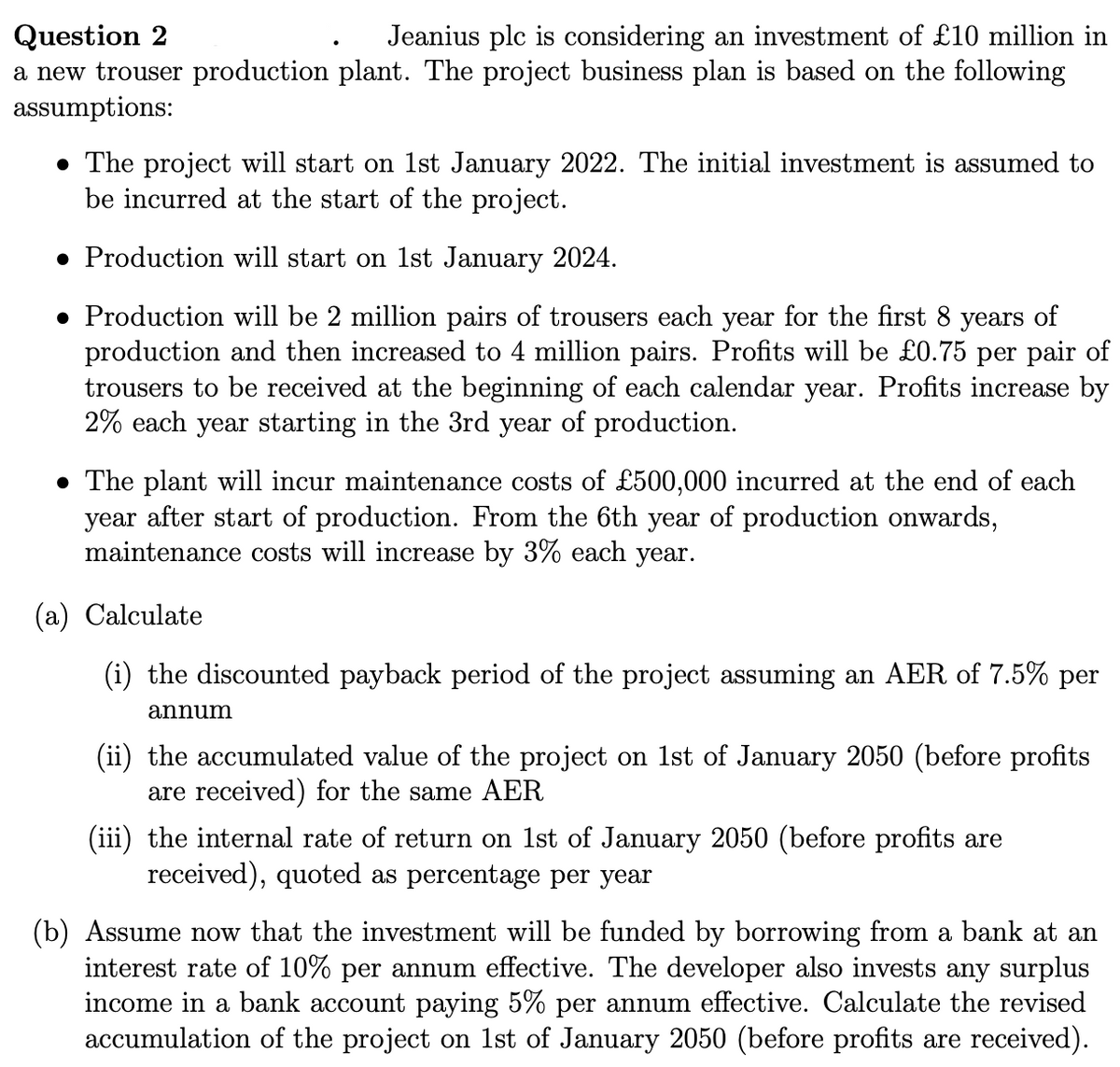

Transcribed Image Text:Question 2

Jeanius plc is considering an investment of £10 million in

a new trouser production plant. The project business plan is based on the following

assumptions:

• The project will start on 1st January 2022. The initial investment is assumed to

be incurred at the start of the project.

Production will start on 1st January 2024.

• Production will be 2 million pairs of trousers each year for the first 8 years of

production and then increased to 4 million pairs. Profits will be £0.75 per pair of

trousers to be received at the beginning of each calendar year. Profits increase by

2% each year starting in the 3rd year of production.

• The plant will incur maintenance costs of £500,000 incurred at the end of each

year after start of production. From the 6th year of production onwards,

maintenance costs will increase by 3% each year.

(a) Calculate

(i) the discounted payback period of the project assuming an AER of 7.5% per

annum

(ii) the accumulated value of the project on 1st of January 2050 (before profits

are received) for the same AER

(iii) the internal rate of return on 1st of January 2050 (before profits are

received), quoted as percentage per year

(b) Assume now that the investment will be funded by borrowing from a bank at an

interest rate of 10% per annum effective. The developer also invests any surplus

income in a bank account paying 5% per annum effective. Calculate the revised

accumulation of the project on 1st of January 2050 (before profits are received).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning