QUESTION 2 Mark is a U.S. veteran who served in the U.S. Army and is receiving $10,000 annually in disat brackets, Mark, who is a single filer, will owe: O Mark will owe 10% of taxable income O Mark will owe $9.950 at 10% and $995 plus 12% for any amount over $9.950 O Mark will not owe any taxes since he is a U.S. Veteran. None of these are correct.

QUESTION 2 Mark is a U.S. veteran who served in the U.S. Army and is receiving $10,000 annually in disat brackets, Mark, who is a single filer, will owe: O Mark will owe 10% of taxable income O Mark will owe $9.950 at 10% and $995 plus 12% for any amount over $9.950 O Mark will not owe any taxes since he is a U.S. Veteran. None of these are correct.

Chapter5: Corporations: Earnings & Profits And Dividend Distributions

Section: Chapter Questions

Problem 29P

Related questions

Question

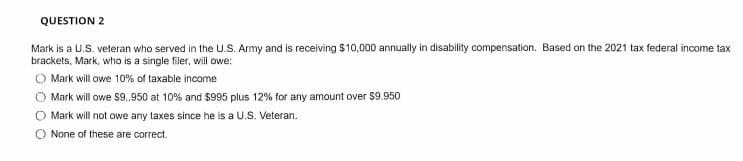

Transcribed Image Text:QUESTION 2

Mark is a U.S. veteran who served in the U.S. Army and is receiving $10,000 annually in disability compensation. Based on the 2021 tax federal income tax

brackets, Mark, who is a single filer, will owe:

Mark will owe 10% of laxable income

Mark will owe S9.,950 at 10% and $995 plus 12% for any amount over $9.950

Mark will not owe any laxes since he is a U.S. Veteran.

O None of these are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT