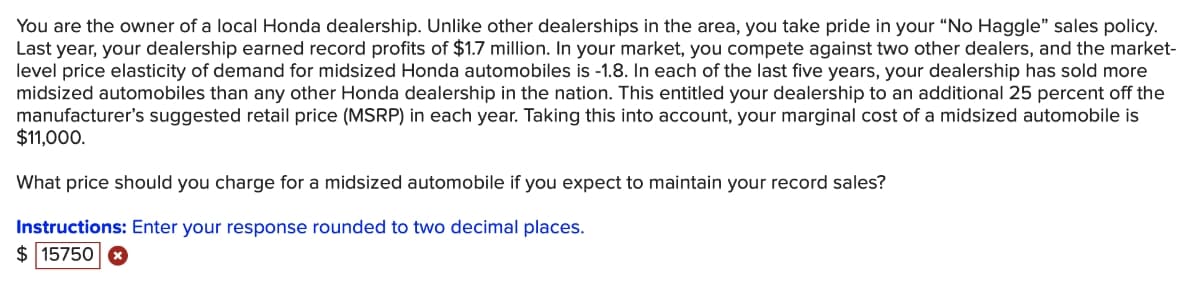

suggested retail price (MSRP) in each

Q: Required: (a) The business needs to have a sense of its future cash flows and therefore requires the…

A: A statement of estimation of cash inflows into and outflows from a business for a specific period is…

Q: Mark borrowed an amount of P8,830 from Brian and after 2 years, he borrowed again an amount of…

A: Compound interest (or compounding interest) is the interest on a loan or deposit calculated based on…

Q: 6. In partnership liquidation the first cash distribution should be made for A) partner capital B)…

A: Answer:- Partnership liquidation meaning:- Liquidation of partnership takes place when partners…

Q: Moore Corp. issued 5.5% two-year bonds payable with a face amount of $60,000 when the market…

A: Bonds Payable - Bonds are the obligation that required to be paid at fixed duration of time. It…

Q: Beamish Inc., which produces a single product, has provided the following data for its most recent…

A: As per absorption costing the unit product cost includes direct material, direct labor, variable…

Q: On January 31, 2021, the Term Deposit Account is closed and the balance is transferred to the Demand…

A: Term Deposit Account Demand Deposit Account

Q: Subway, the fast food restaurant franchise, recently announced it is bringing back the "$5 Footlong"…

A: Requirement 1:- Variable Costs :- Variable costs are operating costs that change in proportion to…

Q: Insight on Business: Class Discussion Internet Sales Tax Battle Given the nature of the Internet,…

A: In the given case the services are being consumed at the place of residence of the consumer...In…

Q: If ending inventory of finished goods is understated, net income will be: A) Overstated B)…

A: * As per Bartle by policy, if multiple unrelated questions are there then asnwer first only. If the…

Q: any

A: Initial Transaction Translate at the historic rate on 1 Jan 2022 FC2000001.18 = $169,491

Q: The following book and fair values were available for Westmont Company as of March 1. Fair Value $…

A: based on the data given in the problem we need to provide with the journal entry on acquisition o…

Q: You have been asked by the audit manager to undertake preliminary analytical procedures. a)…

A: Analytical Procedures It is important for the Auditors include the analytical procedures in the…

Q: Following is a list of cost terms described in the chapter as well as a list of brief descriptive…

A: Cost accounting is a type of accounting that tracks all of the expenses of production, including…

Q: Each relational database table contains records (listed in ) and attributes (listed in columns; rows…

A: Relational database is a database which provides data access to database that are connected to one…

Q: a) In each of the following parts, write an expression that shows the relationship among the listed…

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: During 2018, a textbook written by Mercer Co. personnel was sold to Roark Publishing, Inc., for…

A: There are two forms of accounting, which is being used. One is cash basis of accounting and other is…

Q: Yuan Company has a cycle time of 3 days, uses Raw and In Process account (RIP) and expenses all…

A: Given as, Opening Raw Material 356000 Opening WIP 42600 Opening finished goods 45000

Q: Turner plc is considering whether to buy a machine costing K100,000 through a three-year loan with…

A: Decision-making between buying with a loan and leasing out can be done by making a comparison of NPV…

Q: 1. A company, extends credit to its customers. Total Sales is 2 Million, credit Sales is 850,000,…

A: Journal Entry Account Titles and Explanation Debit Credit Bad Debts Expense 21,800…

Q: 6) Which of the following are the normal baiances of Sales, Sales discounts, and Sales returms and…

A: Introduction: Accounting: Accounting is an art of recording , classifying and summarising and…

Q: The stockholders’ equity accounts of Willis Corporation at January 1 appear below: 8 Percent…

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued…

Q: SALLAT Household Furnishings & Appliances is a family-owned business. You are the management…

A: The question is related to Cash Budget. Cash Budget is summary of cash receipts and cash payments…

Q: Textron Inc. has two divisions, Kelly Aerospace, and Cessna Aircraft. The company is attempting to…

A: Hi student Since there are multiple questions, we will answer only first question. If you want…

Q: for November. Variable Actual Fixed Element Element per Total for per Month Well Serviced November…

A: A spending variance seems to be the difference between the estimated cost and the real cost of an…

Q: 910,00 80,000

A: In this question, we have to compute the payroll-related costs.

Q: W. W. Phillips Company produced 4,000 leather recliners during the year. These reclinerssell for…

A: Cost accounting is widely used by cost accountants to determine the cost per unit of the product…

Q: a. Sampson Co. sold merchandise to Batson Co. on account, $20,100, terms 2/15, net 45. b. The cost…

A: 1)Journal entries in the books of Sampson co. : Sl. No General journal L.F Debit Credit a)…

Q: Write a concise answer between 350 to 400 words for each question.

A: Audit refers to the process of checking the financial records of a company. The process of auditing…

Q: For each scenario, use the items in the tables to indicate whether the item will improve or decrease…

A: Credit card is the card through which the holder of the card gets the loan from the bank as per the…

Q: The Principal City prepared the Trial Balance of the corporate-type fund as of December 31, 20X1.…

A: A statement that presents the income and expenses of the owner's funds is known as a Statement of…

Q: Alva Community Hospital has five laboratory technicians who are responsible for doing a seriesof…

A: The amount of product produced determines variable costs. Labor, commissions, and raw materials are…

Q: Several years ago, Western Electric Corp. purchased equipment for $22,000,000. Western uses…

A: The calculation of book depreciation and tax depreciation has been made as follows: Book…

Q: Required: (a) The business needs to have a sense of its future cash flows and therefore requires the…

A: A Cash Budget is a statement of Estimated Cash Flow in a given future period. The cash budgeted…

Q: The accountant of Meema Inc. established a petty cash fund of P1,400. During September, the fund…

A: The petty cash fund is created to maintain the cash balance for day to day transactions of the…

Q: Sam had $69,487 of income from wages and $215 of taxable interest. Sam also made contributions of…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Identify the most important reasons for performing analytical procedures. b) Describe the broad…

A: Analytical procedure is the procedure which is carried out by the auditors at the preliminary stage…

Q: 30. T/F. GAO stands for Government Accounting Office

A: The question is related to true or false.

Q: 7. An investor owns 500 shares of stock in a firm with a debt/equity ratio = 1.0. The investor…

A: The investors owns share in equity = 500 shares * $2 = $1,000. Debt / equity = 1, it means that the…

Q: A business purchased a motor car on 1 July 20OX3 for $20,000. It is to be depreciated at 20 per cent…

A: The errors in accounting that affect the profit are called the error of commission and error of…

Q: Showtime Company's ending inventory at December 31, 2020, includes the following items: Units on Net…

A: Lets understand the basics. As per IAS 2 "Inventories" needs to be valued at the lower of cost or…

Q: , Inc., includes the following selected accounts in its general ledger at December 31, 2018:…

A: Liabilities section of Suburban, Inc.'s, Balance Sheet at December 31,2018 , Current…

Q: 29. T/F. Only Comprehensive and Value-for-Money audits are true performance Qudits.

A: Performance audit is a independent,objective and reliable examination of entity. And check…

Q: Husky Corporation is a general contractor which occasionally invests excess cash in debt securities.…

A: Journal Entries in the book of Accounts of Husky Corporation. Date Particulars Ref. Debit ($)…

Q: Beginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory…

A: Inventory valuation is based on the flow of exemption used by the company. There are many methods…

Q: Nevens Company uses a periodic inventory system. During November, the following transactions…

A: The cost of things on board at the end of a reporting period is referred to as ending inventory. The…

Q: QUESTION 11 planning should be based on the organization's strategic or master plan goals and…

A: Planning is the process of making plans to accomplish the desired goal. Planning is the primary step…

Q: Which of the following is a capital expenditure? Select one: a. Cleaning, waxing, and polishing a…

A: EXPENSES CAN BE DEFINED AS REVENUE AND CAPITAL EXPENDITURE . REVENUE EXPENDITURE ARE THISE WHICH ARE…

Q: Refer to the information for Sundahl Company on the previous page.Required:1. Prepare a common-size…

A: A common size balance sheet allows for the relative percentage of each expense as a % of sales…

Q: i) Determine the minimum transfer price that the Components Division would accept. Determine the…

A: Component Division Good Division Product Division Component Division…

Q: Another team member who is preparing the Budgeted Balance Sheet for the business for the same…

A: The expected trade receivables and payables calculation help the company to manage its cash flow and…

Step by step

Solved in 2 steps

- Bienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.JW Office Supplies, Inc., is a wholesale distributor of office supplies. It sells pencils and pens, paper goods (including computer paper and forms), staplers, calendars, and other items, excluding furniture and other major items such as copy machines that you would expect to find in an office. Sales have been growing at 5 percent per year during the past several years. Mr. Kay, the president of JW Office Supplies, recently attended a national office supplies convention. In conversations during that convention, he discovered that sales for ABC Office Supplies competitors have been growing at 15 percent per year. Arriving back home, he did a quick investigation and discovered the following: JW Office Supplies customer turnover is significantly higher than the industry average. JW Office Supplies vendor turnover is significantly lower than the industry average. The new market analysis system was supposed to be ready two years ago but has been delayed for more than one year in systems development. A staff position, reporting to the president, for a person to prepare and analyze cash budgets was created two years ago but has never been filled. Mr. Kay has called on you to conduct a systems survey of this situation. You are to assume that a request for systems development has been prepared and approved. The information system at JW Office Supplies is much like that depicted in Chapters 10 through 16. Make and describe all assumptions that you believe are necessary to solve any of the following: a. What are the specific tasks of this systems survey? b. Indicate specific quantifiable benefits and costs that should be examined in assessing the economic feasibility of any solutions that might be proposed. Explain how you would go about quantifying each benefit or cost. c. Propose and explain three different scopes for the systems analysis. Use a context diagram to describe each scope alternative. Hint: What subsystems might be involved in an analysis?Bannister Company, an electronics firm, buys circuit boards and manually inserts various electronic devices into the printed circuit board. Bannister sells its products to original equipment manufacturers. Profits for the last two years have been less than expected. Mandy Confer, owner of Bannister, was convinced that her firm needed to adopt a revenue growth and cost reduction strategy to increase overall profits. After a careful review of her firms condition, Mandy realized that the main obstacle for increasing revenues and reducing costs was the high defect rate of her products (a 6 percent reject rate). She was certain that revenues would grow if the defect rate was reduced dramatically. Costs would also decline as there would be fewer rejects and less rework. By decreasing the defect rate, customer satisfaction would increase, causing, in turn, an increase in market share. Mandy also felt that the following actions were needed to help ensure the success of the revenue growth and cost reduction strategy: a. Improve the soldering capabilities by sending employees to an outside course. b. Redesign the insertion process to eliminate some of the common mistakes. c. Improve the procurement process by selecting suppliers that provide higher-quality circuit boards. Required: 1. State the revenue growth and cost reduction strategy using a series of cause-and-effect relationships expressed as if-then statements. 2. Illustrate the strategy using a strategy map. 3. Explain how the revenue growth strategy can be tested. In your explanation, discuss the role of lead and lag measures, targets, and double-loop feedback.

- Garrison Boutique, a small novelty store, just spent $4,000 on a new software program that will help in organizing its inventory. Due to the steep learning curve required to use the new software, Garrison must decide between hiring two part-time college students or one full-time employee. Each college student would work 20 hours per week, and would earn $1 S per hour. The full-time employee would work 40 hours per week and would earn $15 per hour plus the equivalent of $2 per hour in benefits. Employees are given two polo shirts to wear as their uniform. The polo-shirts cost Garrison $10 each. What are the relevant costs, relevant revenues, sunk costs, and opportunity costs for Garrison?Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateway’s work comes from contractswith city and state agencies in Nebraska. The company’s sales volume averages $3 million, andprofits vary between 0 and 10% of sales.Sales and profits have been somewhat below average for the past 3 years due to a recessionand intense competition. Because of this competition, Jack constantly reviews the prices thatother companies bid for jobs. When a bid is lost, he analyzes the reasons for the differencesbetween his bid and that of his competitors and uses this information to increase the competitiveness of future bids.Jack believes that Gateway’s current accounting system is deficient. Currently, all expensesare simply deducted from revenues to arrive at operating income. No effort is made to distinguish among the costs of laying pipe, obtaining contracts, and administering the company. Yetall bids are…Floating Homes, Inc., is a manufacturer of luxury pontoon and houseboats that sell for $40,000 to $100,000. To estimate its revenues for the following year, Floating Homes divides its boat sales into three categories based on selling price (high, medium, and low) and estimates the number of units it expects to sell under three different economic scenarios. These scenarios include a recession (Scenario I), a continuation of current conditions in which the economy is level or unchanged (Scenario II), and a strong economy (Scenario III). These estimates are as follows: Scenario 1 Recession Scenario 2 Level economy Scenario 3 Strong economy Probability 25% 50% 25% High priced boats Unit sales 50 400 1,000 Average price per unit $90,000 $90,000 $90,000 Medium-Priced Boats Unit sales 100 800 3,000 Average price per unit $70,000 $70,000 $70,000 Low-priced boats…

- Harrison Jones is a marketer of facial care products. It plans on introducing a new product line next year and is not quite certain whether its sales team can accomplish the sales objectives. It must determine how much dollar business it must do to at least break even. Its historical average annual sales has been $10,000,000 and its cost of sales has been $4,500,000. Its planned investment in the new business is $450,000. How much dollar business must Harrison Jones do in order to recoup its planned investment?You are the manager of World Wide Athlete, a chain of six sporting goods shops in your area. The shops sell 10 racing bikes per week at a retail price of $649.99. Recently, you put the bikes on sale at $599.99. At the sale price, 13 bikes were sold during the one week sale. (a) What was your markdown percent on the bikes? (Round your answer to one decimal place.) _______% (b) What is the percent increase in number of bikes sold during the sale? _______% (c) How much more revenue (in $) would be earned in 6 months by permanently selling the bikes at the lower price rather than having a 1 week sale each month? (6 sale weeks in 26 weeks.) $ _______ more revenue (d) As manager of World Wide Athlete, would you recommend this permanent price reduction? Explain. (Just consider revenue, ignore cost.) ____Yes, permanent markdown increases revenue significantly. ____No, permanent markdown decreases revenue significantly. ____No, permanent markdown does not change…Stubs-R-Us is a local event ticket broker. Last year, the company sold 760,000 tickets with an average commission of $10. Because of the general economic climate, Stubs expects ticket volume to decline by 20 percent. In addition, employees at a local insurance company headquarters accounted for 5 percent of Stubs’ volume. The headquarters relocated to another state and all the employees closed their accounts. Offsetting these factors is the observation that the average commission per sale is likely to increase by 15 percent because the average ticket prices are expected to be larger in the coming year. Required: Estimate commission revenues for Stubs-R-Us for the coming year.

- In the current year, Big Burgers, Inc., expanded its fast-food operations by opening several new stores in Texas. The company incurred the following costs in the current year: market appraisal ($50,000), consulting fees ($72,000), advertising ($47,000), and traveling to train employees ($31,000). The company is willing to incur these costs because it foresees strong customer demand in Texas for the next several years. What amount should Big Burgers report as an expense in its income statement associated with these costs?You are the manager of World Wide Athlete, a chain of six sporting goods shops in your area. The shops sell 10 racing bikes per week at a retail price of $679.99. Recently, you put the bikes on sale at $599.99. At the sale price, 12 bikes were sold during the one week sale. (a) What was your markdown percent on the bikes? (Round your answer to one decimal place.) % (b) What is the percent increase in number of bikes sold during the sale? % (c) How much more revenue (in $) would be earned in 6 months by permanently selling the bikes at the lower price rather than having a 1 week sale each month? (6 sale weeks in 26 weeks.) $ more revenue (d) As manager of World Wide Athlete, would you recommend this permanent price reduction? Explain. (Just consider revenue, ignore cost.) Yes, permanent markdown increases revenue significantly.No, permanent markdown decreases revenue significantly. No, permanent markdown does not change revenue.You are analyzing two companies that manufacture electronic toys—Like Games Inc. and Our Play Inc. Like Games was launched eight years ago, whereas Our Play is a relatively new company that has been in operation for only the past two years. However, both companies have an equal market share with sales of $200,000 each. You’ve collected company data to compare Like Games and Our Play. Last year, the average sales for all industry competitors was $510,000. As an analyst, you want to make comments on the expected performance of these two companies in the coming year. You’ve collected data from the companies’ financial statements. This information is listed as follows: (Note: Assume there are 365 days in a year.) Data Collected (in dollars) Like Games Our Play Industry Average Accounts receivable 5,400 7,800 7,700 Net fixed assets 110,000 160,000 433,500 Total assets 190,000 250,000 469,200 Using this information, complete the following statements to include in your…