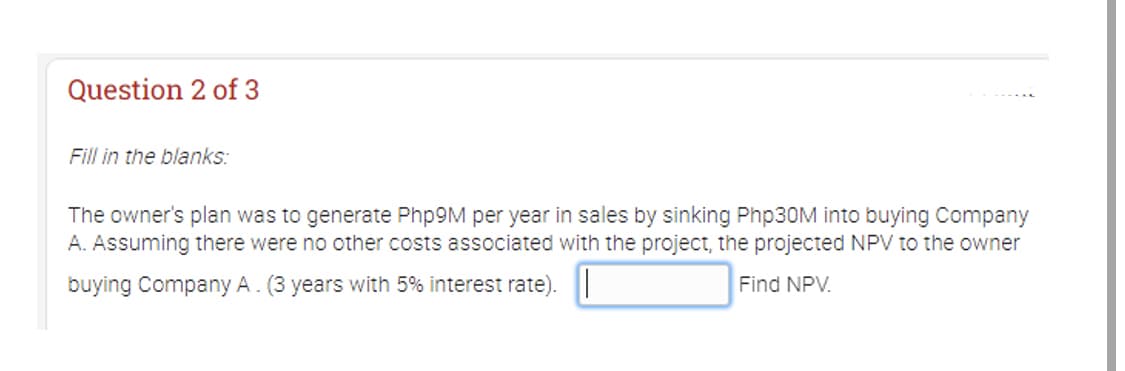

Question 2 of 3 Fill in the blanks: The owner's plan was to generate Php9M per year in sales by sinking Php30M into buying A. Assuming there were no other costs associated with the project, the projected NPV to buying Company A. (3 years with 5% interest rate). Find NPV.

Question 2 of 3 Fill in the blanks: The owner's plan was to generate Php9M per year in sales by sinking Php30M into buying A. Assuming there were no other costs associated with the project, the projected NPV to buying Company A. (3 years with 5% interest rate). Find NPV.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 13EA: Jullo Company is considering the purchase of a new bubble packaging machine. If the machine will...

Related questions

Question

Note: For the denominator do not round down or up just copy e.g. (1.20)^5 = 2.48832. Then for the answer with decimal point - 2 decimal points and no round down or up e.g. 200/2.48832 = 80.3755144033 should be 80.37

Transcribed Image Text:Question 2 of 3

Fill in the blanks:

The owner's plan was to generate Php9M per year in sales by sinking Php30M into buying Company

A. Assuming there were no other costs associated with the project, the projected NPV to the owner

buying Company A. (3 years with 5% interest rate). |

Find NPV.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub