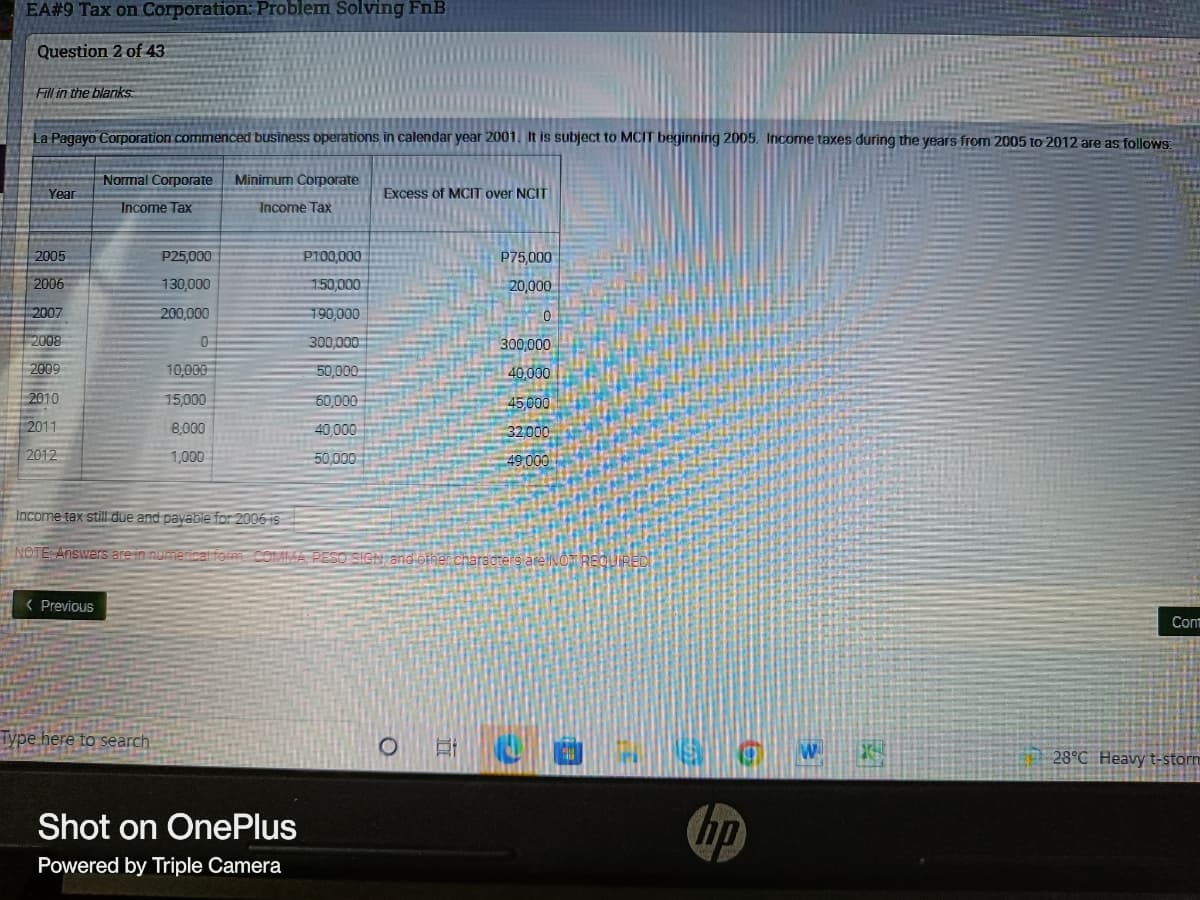

Question 2 of 43 Fill in the blanks La Pagayo Corporation commenced business operations in calendar year 2001. It is subject to MCIT beginning 2005. Income taxes during the years from 2005 to 2012 are as follows: Year Normal Corporate Income Tax Minimum Corporate Income Tax Excess of MCIT over NCIT 2005 P25,000 P100,000 P75,000 2006 130,000 150,000 20,000 2007 200,000 190,000 0 2008 0 300,000 300,000 2009 10,000 50,000 40,000 2010 15,000 60,000 45,000 2011 8,000 40,000 32000 2012 1,000 50,000 49,000 Income tax still due and payable for 2006 is NOTE Answers are in numerical form COMMA PESO SIGN and other chat

Question 2 of 43 Fill in the blanks La Pagayo Corporation commenced business operations in calendar year 2001. It is subject to MCIT beginning 2005. Income taxes during the years from 2005 to 2012 are as follows: Year Normal Corporate Income Tax Minimum Corporate Income Tax Excess of MCIT over NCIT 2005 P25,000 P100,000 P75,000 2006 130,000 150,000 20,000 2007 200,000 190,000 0 2008 0 300,000 300,000 2009 10,000 50,000 40,000 2010 15,000 60,000 45,000 2011 8,000 40,000 32000 2012 1,000 50,000 49,000 Income tax still due and payable for 2006 is NOTE Answers are in numerical form COMMA PESO SIGN and other chat

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 25P: LO.2 Oak Corporation has the following general business credit carryovers. If the general business...

Related questions

Question

100%

Transcribed Image Text:EA# 9 Tax on Corporation: Problem Solving FnB

Question 2 of 43

Fill in the blanks

La Pagayo Corporation commenced business operations in calendar year 2001. It is subject to MCIT beginning 2005. Income taxes during the years from 2005 to 2012 are as follows:

Normal Corporate

Year

Minimum Corporate

Income Tax

Excess of MCIT over NCIT

Income Tax

2005

P25,000

P100,000

P75,000

2006

130,000

150,000

20,000

2007

200,000

190,000

0

2008

0

300,000

300,000

2009

10,000

50,000

40,000

2010

15,000

60,000

45,000

2011

8,000

40,000

32,000

2012

1,000

50,000

49,000

Income tax still due and payable for 2006 is

NOTE: Answers are in numerical form. COMMA, PESO SIGN and other cha

< Previous

Cont

Type here to search

O E

28°C Heavy t-storm

Shot on OnePlus

Powered by Triple Camera

hp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT