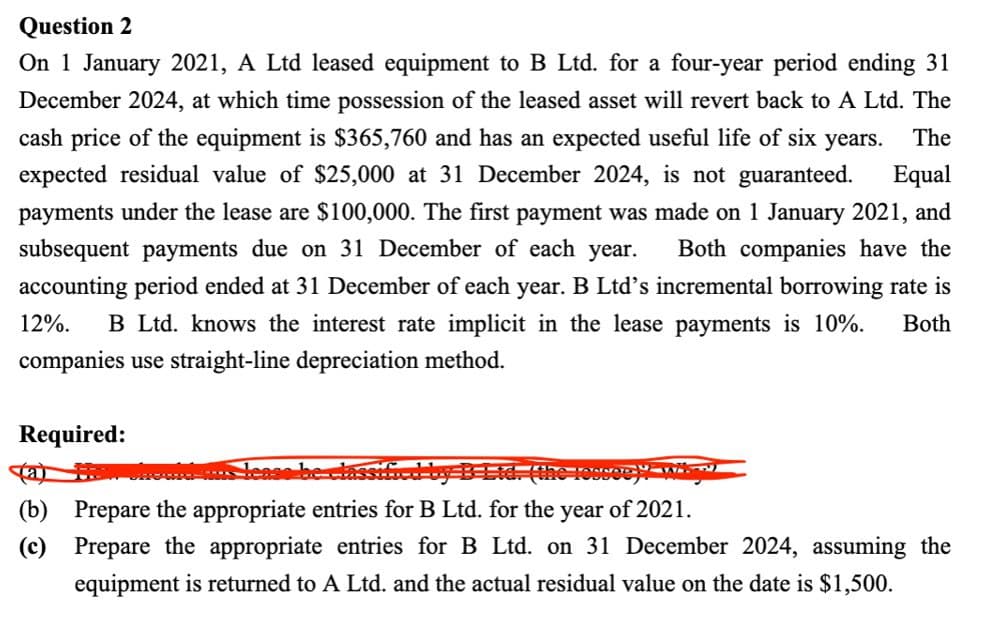

Question 2 On 1 January 2021, A Ltd leased equipment to B Ltd. for a four-year period ending 31 December 2024, at which time possession of the leased asset will revert back to A Ltd. The cash price of the equipment is $365,760 and has an expected useful life of six years. The expected residual value of $25,000 at 31 December 2024, is not guaranteed. Equal payments under the lease are $100,000. The first payment was made on 1 January 2021, and subsequent payments due on 31 December of each year. Both companies have the accounting period ended at 31 December of each year. B Ltd's incremental borrowing rate is 12%. B Ltd. knows the interest rate implicit in the lease payments is 10%. companies use straight-line depreciation method. Required: (b) Prepare the appropriate entries for B Ltd. for the year of 2021. Both (c) Prepare the appropriate entries for B Ltd. on 31 December 2024, assuming the equipment is returned to A Ltd. and the actual residual value on the date is $1,500.

Question 2 On 1 January 2021, A Ltd leased equipment to B Ltd. for a four-year period ending 31 December 2024, at which time possession of the leased asset will revert back to A Ltd. The cash price of the equipment is $365,760 and has an expected useful life of six years. The expected residual value of $25,000 at 31 December 2024, is not guaranteed. Equal payments under the lease are $100,000. The first payment was made on 1 January 2021, and subsequent payments due on 31 December of each year. Both companies have the accounting period ended at 31 December of each year. B Ltd's incremental borrowing rate is 12%. B Ltd. knows the interest rate implicit in the lease payments is 10%. companies use straight-line depreciation method. Required: (b) Prepare the appropriate entries for B Ltd. for the year of 2021. Both (c) Prepare the appropriate entries for B Ltd. on 31 December 2024, assuming the equipment is returned to A Ltd. and the actual residual value on the date is $1,500.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 2E: Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement...

Related questions

Question

please need help with must must explanation , narrations , computation for each entry and for each calculation , parts answer in text form

Transcribed Image Text:Question 2

On 1 January 2021, A Ltd leased equipment to B Ltd. for a four-year period ending 31

December 2024, at which time possession of the leased asset will revert back to A Ltd. The

cash price of the equipment is $365,760 and has an expected useful life of six years. The

expected residual value of $25,000 at 31 December 2024, is not guaranteed. Equal

payments under the lease are $100,000. The first payment was made on 1 January 2021, and

subsequent payments due on 31 December of each year. Both companies have the

accounting period ended at 31 December of each year. B Ltd's incremental borrowing rate is

12%. B Ltd. knows the interest rate implicit in the lease payments is 10%.

companies use straight-line depreciation method.

Required:

(b) Prepare the appropriate entries for B Ltd. for the year of 2021.

Both

(c) Prepare the appropriate entries for B Ltd. on 31 December 2024, assuming the

equipment is returned to A Ltd. and the actual residual value on the date is $1,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT