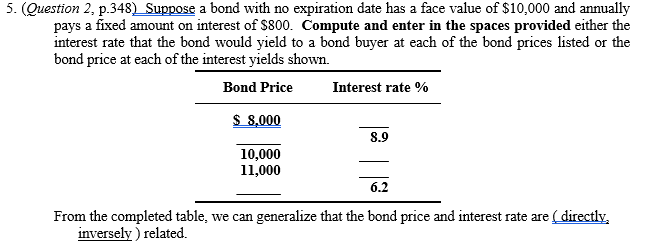

(Question 2, p.348) Suppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount on interest of $800. Compute and enter in the spaces provided either the interest rate that the bond would yield to a bond buyer at each of the bond prices listed or the bond price at each of the interest yields shown. Bond Price Interest rate % $ ,000 8.9 10,000 11,000 6.2 From the completed table, we can generalize that the bond price and interest rate are (directly, inversely ) related.

(Question 2, p.348) Suppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount on interest of $800. Compute and enter in the spaces provided either the interest rate that the bond would yield to a bond buyer at each of the bond prices listed or the bond price at each of the interest yields shown. Bond Price Interest rate % $ ,000 8.9 10,000 11,000 6.2 From the completed table, we can generalize that the bond price and interest rate are (directly, inversely ) related.

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 7PROB

Related questions

Question

Transcribed Image Text:5. (Question 2, p.348)_ Suppose a bond with no expiration date has a face value of $10,000 and annually

pays a fixed amount on interest of $800. Compute and enter in the spaces provided either the

interest rate that the bond would yield to a bond buyer at each of the bond prices listed or the

bond price at each of the interest yields shown.

Bond Price

Interest rate %

$ 8,000

8.9

10,000

11,000

6.2

From the completed table, we can generalize that the bond price and interest rate are ( directly,

inversely ) related.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning