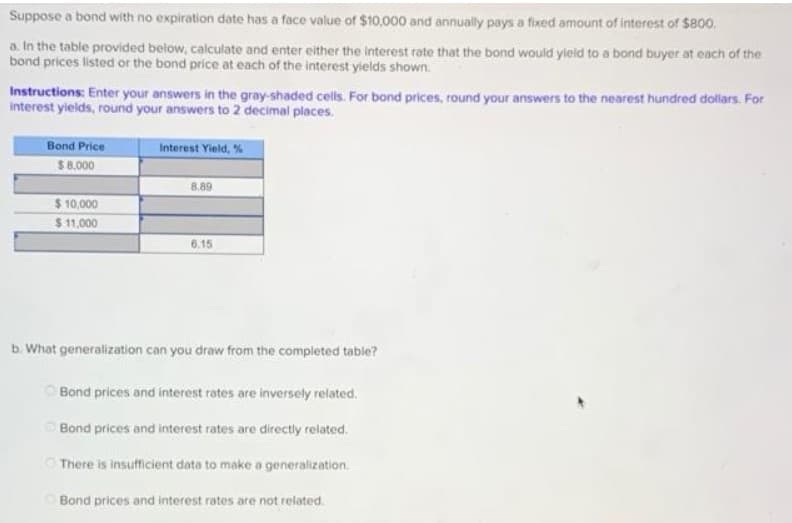

Suppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount of interest of $800. a. In the table provided below, calculate and enter either the interest rate that the bond would yield to a bond buyer at each of the bond prices listed or the bond price at each of the interest yields shown. Instructions: Enter your answers in the gray-shaded cells. For bond prices, round your answers to the nearest hundred dollars. For interest yields, round your answers to 2 decimal places. Bond Price Interest Yield, % $8,000 8.89 $ 10,000 $11,000 6.15 b. What generalization can you draw from the completed table? Bond prices and interest rates are inversely related. Bond prices and interest rates are directly related. There is insufficient data to make a generalization. Bond prices and interest rates are not related.

Suppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount of interest of $800. a. In the table provided below, calculate and enter either the interest rate that the bond would yield to a bond buyer at each of the bond prices listed or the bond price at each of the interest yields shown. Instructions: Enter your answers in the gray-shaded cells. For bond prices, round your answers to the nearest hundred dollars. For interest yields, round your answers to 2 decimal places. Bond Price Interest Yield, % $8,000 8.89 $ 10,000 $11,000 6.15 b. What generalization can you draw from the completed table? Bond prices and interest rates are inversely related. Bond prices and interest rates are directly related. There is insufficient data to make a generalization. Bond prices and interest rates are not related.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 9P

Related questions

Question

100%

Pls help with below homework.

Transcribed Image Text:Suppose a bond with no expiration date has a face value of $10,000 and annually pays a fixed amount of interest of $800.

a. In the table provided below, calculate and enter either the interest rate that the bond would yleld to a bond buyer at each of the

bond prices listed or the bond price at each of the interest yields shown.

Instructions: Enter your answers in the gray-shaded cells. For bond prices, round your answers to the nearest hundred dollars. For

interest yields, round your answers to 2 decimal places.

Bond Price

Interest Yield, %

$8,000

8.89

$ 10,000

$11,000

6.15

b. What generalization can you draw from the completed table?

Bond prices and interest rates are inversely related.

Bond prices and interest rates are directly related.

There is insufficient data to make a generalization.

Bond prices and interest rates are not related.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning