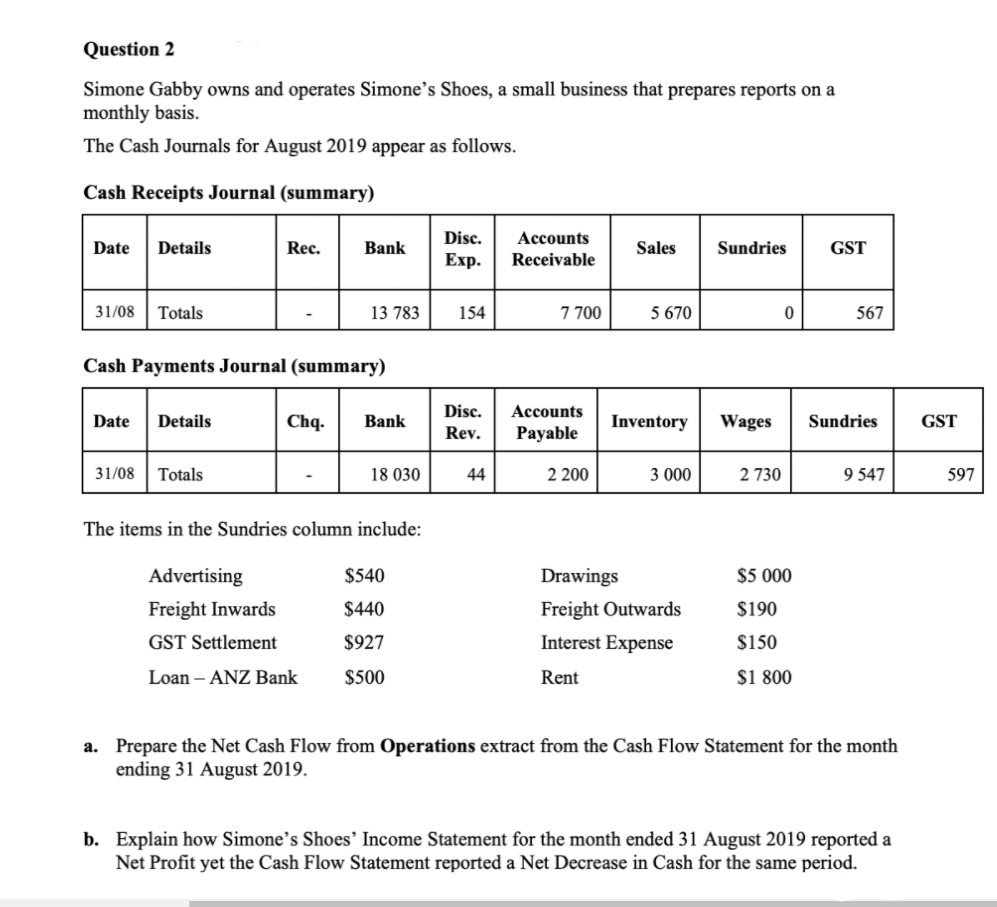

Question 2 Simone Gabby owns and operates Simone's Shoes, a small business that prepares reports on a monthly basis. The Cash Journals for August 2019 appear as follows. Cash Receipts Journal (summary) Disc. Accounts Date Details Rec. Bank Sales Sundries GST Еxp. Receivable 31/08 Totals 13 783 154 7 700 5 670 567 Cash Payments Journal (summary) Disc. Асcounts Date Details Chq. Bank Inventory Wages Sundries GST Rev. Payable 31/08 Totals 18 030 44 2 200 3 000 2 730 9 547 597 The items in the Sundries column include: Advertising $540 Drawings $5 000 Freight Inwards $440 Freight Outwards $190 GST Settlement $927 Interest Expense $150 Loan – ANZ Bank $500 Rent $1 800 a. Prepare the Net Cash Flow from Operations extract from the Cash Flow Statement for the month ending 31 August 2019. b. Explain how Simone’s Shoes’ Income Statement for the month ended 31 August 2019 reported a Net Profit yet the Cash Flow Statement reported a Net Decrease in Cash for the same period.

Question 2 Simone Gabby owns and operates Simone's Shoes, a small business that prepares reports on a monthly basis. The Cash Journals for August 2019 appear as follows. Cash Receipts Journal (summary) Disc. Accounts Date Details Rec. Bank Sales Sundries GST Еxp. Receivable 31/08 Totals 13 783 154 7 700 5 670 567 Cash Payments Journal (summary) Disc. Асcounts Date Details Chq. Bank Inventory Wages Sundries GST Rev. Payable 31/08 Totals 18 030 44 2 200 3 000 2 730 9 547 597 The items in the Sundries column include: Advertising $540 Drawings $5 000 Freight Inwards $440 Freight Outwards $190 GST Settlement $927 Interest Expense $150 Loan – ANZ Bank $500 Rent $1 800 a. Prepare the Net Cash Flow from Operations extract from the Cash Flow Statement for the month ending 31 August 2019. b. Explain how Simone’s Shoes’ Income Statement for the month ended 31 August 2019 reported a Net Profit yet the Cash Flow Statement reported a Net Decrease in Cash for the same period.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter2: Analyzing Transactions Into Debit And Credit Parts

Section: Chapter Questions

Problem 3AP

Related questions

Question

Transcribed Image Text:Question 2

Simone Gabby owns and operates Simone's Shoes, a small business that prepares reports on a

monthly basis.

The Cash Journals for August 2019 appear as follows.

Cash Receipts Journal (summary)

Disc.

Accounts

Date

Details

Rec.

Bank

Sales

Sundries

GST

Еxp.

Receivable

31/08

Totals

13 783

154

7 700

5 670

567

Cash Payments Journal (summary)

Disc.

Асcounts

Date

Details

Chq.

Bank

Inventory

Wages

Sundries

GST

Rev.

Payable

31/08

Totals

18 030

44

2 200

3 000

2 730

9 547

597

The items in the Sundries column include:

Advertising

$540

Drawings

$5 000

Freight Inwards

$440

Freight Outwards

$190

GST Settlement

$927

Interest Expense

$150

Loan – ANZ Bank

$500

Rent

$1 800

a. Prepare the Net Cash Flow from Operations extract from the Cash Flow Statement for the month

ending 31 August 2019.

b. Explain how Simone’s Shoes’ Income Statement for the month ended 31 August 2019 reported a

Net Profit yet the Cash Flow Statement reported a Net Decrease in Cash for the same period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning