Question 2 The accountant for Wilfred Trading Company prepared the following Adjusted Trial Balance at 31 December 2019. Wilfred Trading Company Adjusted Trial Balance 31 December 2019 $14,910 $7,000 $500 Cash Accounts Receivable Supplies Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Interest Payable Income Tax Payable Salaries Payable Dividend Payable Share Capital Ordinary Retained Earnings $3,500. $2,200 $15,000 $1,625 $100 $1,220 009$ $14,000 $5,500 Dividends Sales $19,780 000 000$ Sales Returns and Allowances Cost of goods sold Salaries Expense Travel Expense Rent Expense Miscellaneous Expense Supplies Expense Depreciation Expense Interest Expense Income Tax Expense Insurance Expense $3,460 $1,300 $1,200 $230 $750 $1,500 $1,200 $2,000 $200 $64,075 Totals $64,075 Required a) Prepare the income statement and statement of retained earnings for the year ended 31 December 2019. (Missing figures (?) above should be found and included in the statements.) b) Prepare the statement of financial position as at 31 December 2019. c) Suppose Wilfred Trading Company only started operation on 1 December 2018, compute the followings according to the adjusted trial balance: i) Years of useful life for Equipment all purchased on the first day of business, with straight-line depreciation and residual value of $3,000, with partial year depreciation rounded to the nearest full month; ii) The depreciation expense for the year ended 2019 if double declining balance is used, with residual value of $3,000 and partial year depreciation rounded to the nearest full month; iii) Why may Wilfred Trading Company choose the double declining balance method? Name one more depreciation method and explain the difference between this and the other methods. d) Compute Cash flow from financing activities for the year ended 31 December 2019 assuming the following balance at 31 December 2018: $10,000 $12,000 Notes Payable Share Capital Dividend Payable . Interest Payable $100 ..... .... (For the purpose of part (ii), payments of interest and dividend are treated as financing activities.) The 6-year $10,000 notes payable was issued on 1 December 2018, with interest payable annually on December 1. Prepare all journal entries that should be prepared in relation to the notes payable and interests in 2019. Show the date of each journal entry.

Question 2 The accountant for Wilfred Trading Company prepared the following Adjusted Trial Balance at 31 December 2019. Wilfred Trading Company Adjusted Trial Balance 31 December 2019 $14,910 $7,000 $500 Cash Accounts Receivable Supplies Inventory Prepaid Insurance Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Interest Payable Income Tax Payable Salaries Payable Dividend Payable Share Capital Ordinary Retained Earnings $3,500. $2,200 $15,000 $1,625 $100 $1,220 009$ $14,000 $5,500 Dividends Sales $19,780 000 000$ Sales Returns and Allowances Cost of goods sold Salaries Expense Travel Expense Rent Expense Miscellaneous Expense Supplies Expense Depreciation Expense Interest Expense Income Tax Expense Insurance Expense $3,460 $1,300 $1,200 $230 $750 $1,500 $1,200 $2,000 $200 $64,075 Totals $64,075 Required a) Prepare the income statement and statement of retained earnings for the year ended 31 December 2019. (Missing figures (?) above should be found and included in the statements.) b) Prepare the statement of financial position as at 31 December 2019. c) Suppose Wilfred Trading Company only started operation on 1 December 2018, compute the followings according to the adjusted trial balance: i) Years of useful life for Equipment all purchased on the first day of business, with straight-line depreciation and residual value of $3,000, with partial year depreciation rounded to the nearest full month; ii) The depreciation expense for the year ended 2019 if double declining balance is used, with residual value of $3,000 and partial year depreciation rounded to the nearest full month; iii) Why may Wilfred Trading Company choose the double declining balance method? Name one more depreciation method and explain the difference between this and the other methods. d) Compute Cash flow from financing activities for the year ended 31 December 2019 assuming the following balance at 31 December 2018: $10,000 $12,000 Notes Payable Share Capital Dividend Payable . Interest Payable $100 ..... .... (For the purpose of part (ii), payments of interest and dividend are treated as financing activities.) The 6-year $10,000 notes payable was issued on 1 December 2018, with interest payable annually on December 1. Prepare all journal entries that should be prepared in relation to the notes payable and interests in 2019. Show the date of each journal entry.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 58APSA

Related questions

Question

Answer Question 2

Transcribed Image Text:Question 2

The accountant for Wilfred Trading Company prepared the following Adjusted Trial Balance at

31 December 2019.

Wilfred Trading Company

Adjusted Trial Balance

31 December 2019

$14,910

$7,000

$500

Cash

Accounts Receivable

Supplies

Inventory

Prepaid Insurance

Equipment

Accumulated Depreciation-Equipment

Notes Payable

Accounts Payable

Interest Payable

Income Tax Payable

Salaries Payable

Dividend Payable

Share Capital Ordinary

Retained Earnings

$3,500.

$2,200

$15,000

$1,625

$100

$1,220

009$

$14,000

$5,500

Dividends

Sales

$19,780

000

000$

Sales Returns and Allowances

Cost of goods sold

Salaries Expense

Travel Expense

Rent Expense

Miscellaneous Expense

Supplies Expense

Depreciation Expense

Interest Expense

Income Tax Expense

Insurance Expense

$3,460

$1,300

$1,200

$230

$750

$1,500

$1,200

$2,000

$200

$64,075

Totals

$64,075

Required

a) Prepare the income statement and statement of retained earnings for the year ended 31

December 2019. (Missing figures (?) above should be found and included in the statements.)

b) Prepare the statement of financial position as at 31 December 2019.

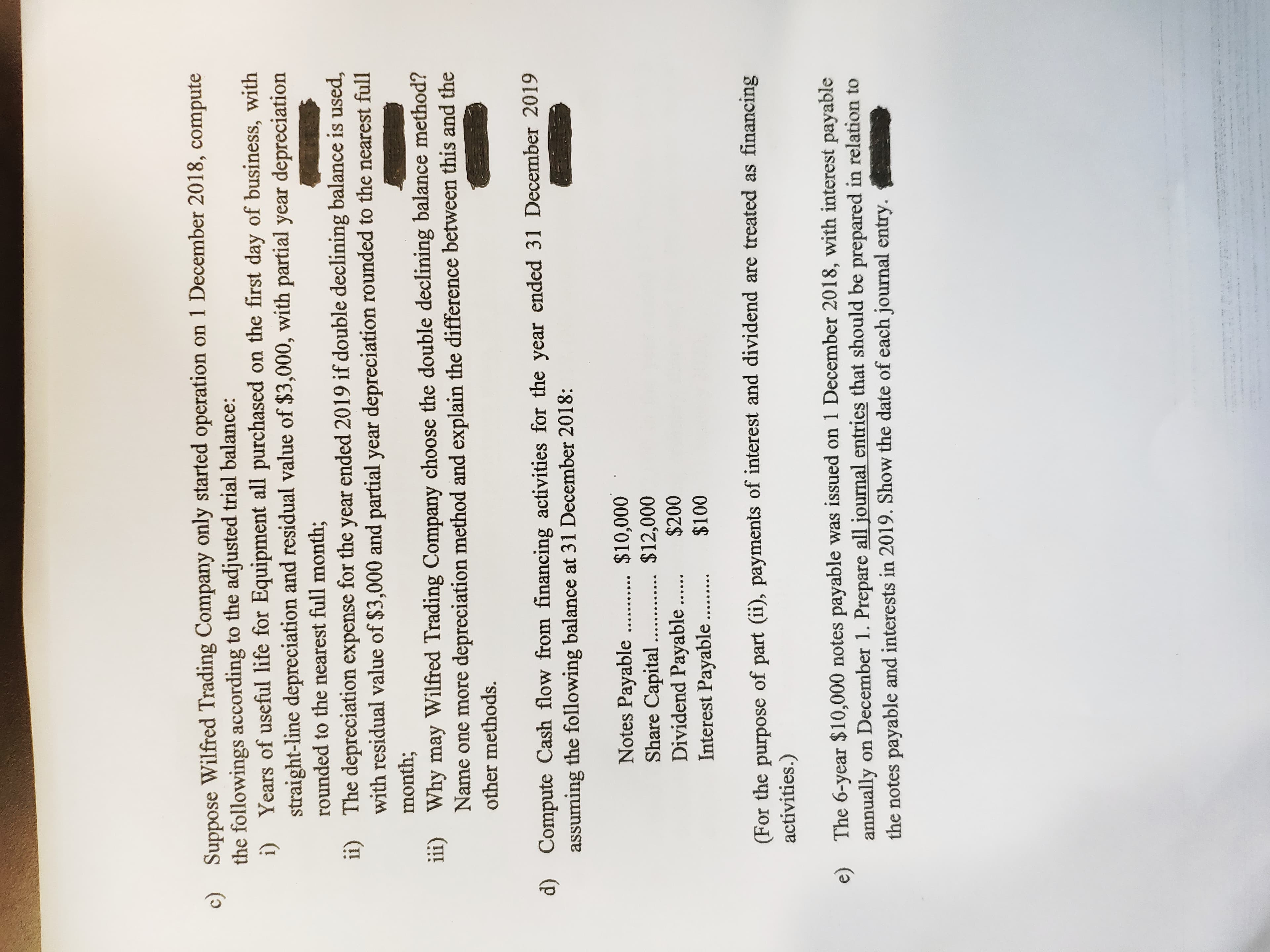

Transcribed Image Text:c) Suppose Wilfred Trading Company only started operation on 1 December 2018, compute

the followings according to the adjusted trial balance:

i) Years of useful life for Equipment all purchased on the first day of business, with

straight-line depreciation and residual value of $3,000, with partial year depreciation

rounded to the nearest full month;

ii) The depreciation expense for the year ended 2019 if double declining balance is used,

with residual value of $3,000 and partial year depreciation rounded to the nearest full

month;

iii) Why may Wilfred Trading Company choose the double declining balance method?

Name one more depreciation method and explain the difference between this and the

other methods.

d) Compute Cash flow from financing activities for the year ended 31 December 2019

assuming the following balance at 31 December 2018:

$10,000

$12,000

Notes Payable

Share Capital

Dividend Payable .

Interest Payable

$100

..... ....

(For the purpose of part (ii), payments of interest and dividend are treated as financing

activities.)

The 6-year $10,000 notes payable was issued on 1 December 2018, with interest payable

annually on December 1. Prepare all journal entries that should be prepared in relation to

the notes payable and interests in 2019. Show the date of each journal entry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT