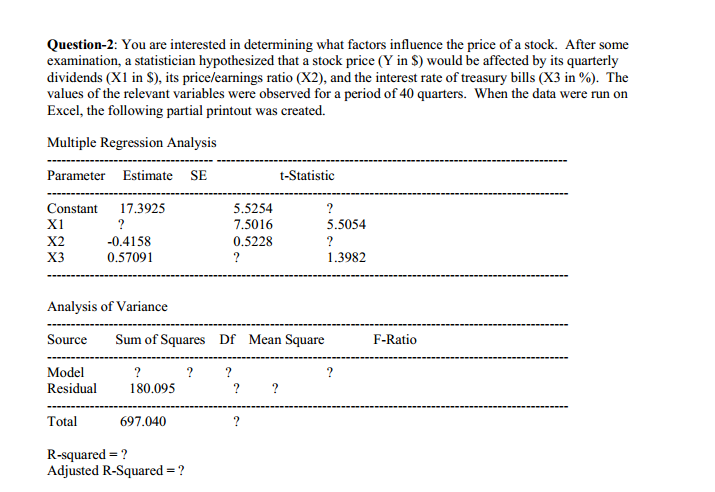

Question-2: You are interested in determining what factors influence the price of a stock. After some examination, a statistician hypothesized that a stock price (Y in $) would be affected by its quarterly dividends (X1 in S), its price/earnings ratio (X2), and the interest rate of treasury bills (X3 in %). The values of the relevant variables were observed for a period of 40 quarters. When the data were run on Excel, the following partial printout was created. Multiple Regression Analysis Parameter Estimate SE t-Statistic Constant 17.3925 ? 5.5254 7.5016 ? 5.5054 X1 X2 X3 -0.4158 0.57091 0.5228 ? ? 1.3982 Analysis of Variance Source Sum of Squares Df Mean Square F-Ratio Model Residual ? ? ? ? ? 180.095 ? Total 697.040 ? R-squared = ? Adjusted R-Squared = ?

Question-2: You are interested in determining what factors influence the price of a stock. After some examination, a statistician hypothesized that a stock price (Y in $) would be affected by its quarterly dividends (X1 in S), its price/earnings ratio (X2), and the interest rate of treasury bills (X3 in %). The values of the relevant variables were observed for a period of 40 quarters. When the data were run on Excel, the following partial printout was created. Multiple Regression Analysis Parameter Estimate SE t-Statistic Constant 17.3925 ? 5.5254 7.5016 ? 5.5054 X1 X2 X3 -0.4158 0.57091 0.5228 ? ? 1.3982 Analysis of Variance Source Sum of Squares Df Mean Square F-Ratio Model Residual ? ? ? ? ? 180.095 ? Total 697.040 ? R-squared = ? Adjusted R-Squared = ?

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section5.3: The Natural Exponential Function

Problem 40E

Related questions

Topic Video

Question

ANSWER THE FOLLOWING QUESTION.

Transcribed Image Text:Question-2: You are interested in determining what factors influence the price of a stock. After some

examination, a statistician hypothesized that a stock price (Y in $) would be affected by its quarterly

dividends (X1 in $), its price/earnings ratio (X2), and the interest rate of treasury bills (X3 in %). The

values of the relevant variables were observed for a period of 40 quarters. When the data were run on

Excel, the following partial printout was created.

Multiple Regression Analysis

Parameter Estimate SE

t-Statistic

Constant

17.3925

5.5254

?

X1

?

7.5016

5.5054

X2

-0.4158

0.5228

?

X3

0.57091

?

1.3982

Analysis of Variance

Source

Sum of Squares Df Mean Square

F-Ratio

Model

?

?

?

Residual

180.095

?

Total

697.040

R-squared = ?

Adjusted R-Squared = ?

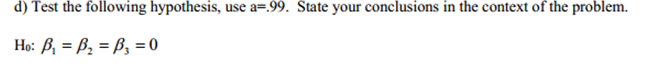

Transcribed Image Text:d) Test the following hypothesis, use a=.99. State your conclusions in the context of the problem.

Ho: B, = Bz = B, = 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning