Question 2.6 LA Fashion records indicate that the balance in their cash account (in the ledger) at the end of the month is $3,918. Comparing the corporation's records with the monthly bank statement reveals several additional cash transactions, such as a $40 bank service charge, a $500 note receivable collected by the bank plus interest earned of $25, and an NSF (dishonoured) cheque for $250 from a customer. There are also deposits in transit of $3,022, and three outstanding cheques totalling $597. Determine the corporation's adjusted cash balance. NOTE: Enter only the number of dollars, do not enter the dollar, "$", symbol. Therefore if your answer is "$10", enter only "10".

Question 2.6 LA Fashion records indicate that the balance in their cash account (in the ledger) at the end of the month is $3,918. Comparing the corporation's records with the monthly bank statement reveals several additional cash transactions, such as a $40 bank service charge, a $500 note receivable collected by the bank plus interest earned of $25, and an NSF (dishonoured) cheque for $250 from a customer. There are also deposits in transit of $3,022, and three outstanding cheques totalling $597. Determine the corporation's adjusted cash balance. NOTE: Enter only the number of dollars, do not enter the dollar, "$", symbol. Therefore if your answer is "$10", enter only "10".

Chapter6: Business Expenses

Section: Chapter Questions

Problem 43P

Related questions

Question

![Question 2.6

LA Fashion records indicate that the balance in their cash account (in the ledger) at the end of the

month is $3,918. Comparing the corporation's records with the monthly bank statement reveals

several additional cash transactions, such as a $40 bank service charge, a $500 note receivable

collected by the bank plus interest earned of $25, and an NSF (dishonoured) cheque for $250 from a

customer. There are also deposits in transit of $3,022, and three outstanding cheques totalling $597.

Determine the corporation's adjusted cash balance. NOTE: Enter only the number of dollars, do not

enter the dollar, "$" , symbol. Therefore if your answer is "$10", enter only "10".

Question 27

Question 2.7

Prepare the journal entries necessary to adjust the cash account balance based on the information

provided in Question 2.6 (above).

[ Select ]

40

[ Select ]

40

[ Select ]

500

[ Select ]

500

[ Select ]

25

[ Select ]

25

[ Select ]

250

[ Select ]

250

<>

>

<>](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fad9f85fe-0b70-4ba7-9aaa-2221d86301ac%2F7f32546a-b428-4d80-a6fd-22a38a590986%2Fdadvdft_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Question 2.6

LA Fashion records indicate that the balance in their cash account (in the ledger) at the end of the

month is $3,918. Comparing the corporation's records with the monthly bank statement reveals

several additional cash transactions, such as a $40 bank service charge, a $500 note receivable

collected by the bank plus interest earned of $25, and an NSF (dishonoured) cheque for $250 from a

customer. There are also deposits in transit of $3,022, and three outstanding cheques totalling $597.

Determine the corporation's adjusted cash balance. NOTE: Enter only the number of dollars, do not

enter the dollar, "$" , symbol. Therefore if your answer is "$10", enter only "10".

Question 27

Question 2.7

Prepare the journal entries necessary to adjust the cash account balance based on the information

provided in Question 2.6 (above).

[ Select ]

40

[ Select ]

40

[ Select ]

500

[ Select ]

500

[ Select ]

25

[ Select ]

25

[ Select ]

250

[ Select ]

250

<>

>

<>

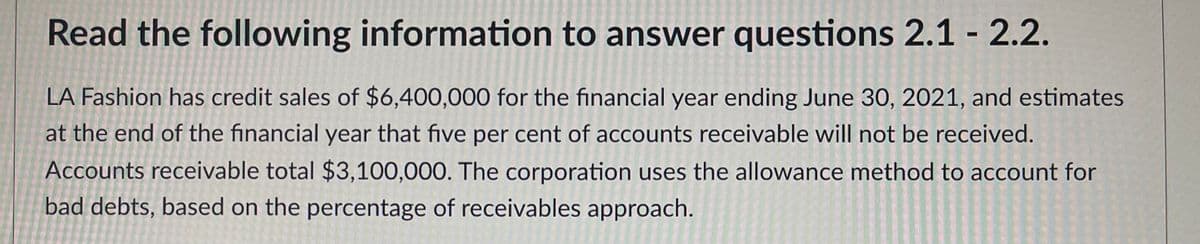

Transcribed Image Text:Read the following information to answer questions 2.1 - 2.2.

LA Fashion has credit sales of $6,400,000 for the financial year ending June 30, 2021, and estimates

at the end of the financial year that five per cent of accounts receivable will not be received.

Accounts receivable total $3,100,000. The corporation uses the allowance method to account for

bad debts, based on the percentage of receivables approach.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning