QUESTION 23. * X, Y; and Z were in partnership sharing profits or losses as follows; X 0.35 and Z 0.25 Statement of financial position as at 31/12/2011 TZS “O00" Non current assets 37,500 26,000 63,500 Premises Plant & Machinery ( note 1) Current assets 21,000 14,000 33,500 68,500 132,000 Inventory Debtors Bank Total assets Capital and liabilities Capital accounts 45,000 2500 15,000 85,000 Current accounts 6,000 4,000 Y 3,000 Loan: Y 15,000 19,000 47,000 Creditors Total capitals and liabilities 132,000 Y retired on 31/12/2011 and X and Z continues in partnership sharing or losses 0.6 and 0.4 respectively. Half of Y S loan was repaid on 1/1/2012 and it was also agreed that TZS 40,000,000 of the balance remaining due to him should remain as a loan to the partnership It was also agreed that adjustments were to made to the statement of financial position on 31/12/2011 in respect of the following. y a) Plan & machinery was revalued at TZS 29,000,000 and premise also revalued at TZS 46,000,000 b) Debtors figure above is after deduction of provision on debtors amounted to TZS 3,000,000. This provision is to be increased by TZS 600,000. c) Creditors for general expenses amounted to TZS 2,500,000 were omitted from the books. d) TZS 2,000,000 was to be written off in stock in respect of obsolete items included there in. v e) Provision for TZS 800,000 was to be met for professional charges connected with revaluation account. The partnership agreed that on the retirement of Y, goodwill was valued at TZS 40,000,000. No account was to be maintained in the books but adjusting entries between partners are to be made on their capital accounts. Required: Prepare Partner's capital account. Partner's current account in columnar form. Y's Loan account. Statement of Financial Position after Y's retired. a) b) c) d)

QUESTION 23. * X, Y; and Z were in partnership sharing profits or losses as follows; X 0.35 and Z 0.25 Statement of financial position as at 31/12/2011 TZS “O00" Non current assets 37,500 26,000 63,500 Premises Plant & Machinery ( note 1) Current assets 21,000 14,000 33,500 68,500 132,000 Inventory Debtors Bank Total assets Capital and liabilities Capital accounts 45,000 2500 15,000 85,000 Current accounts 6,000 4,000 Y 3,000 Loan: Y 15,000 19,000 47,000 Creditors Total capitals and liabilities 132,000 Y retired on 31/12/2011 and X and Z continues in partnership sharing or losses 0.6 and 0.4 respectively. Half of Y S loan was repaid on 1/1/2012 and it was also agreed that TZS 40,000,000 of the balance remaining due to him should remain as a loan to the partnership It was also agreed that adjustments were to made to the statement of financial position on 31/12/2011 in respect of the following. y a) Plan & machinery was revalued at TZS 29,000,000 and premise also revalued at TZS 46,000,000 b) Debtors figure above is after deduction of provision on debtors amounted to TZS 3,000,000. This provision is to be increased by TZS 600,000. c) Creditors for general expenses amounted to TZS 2,500,000 were omitted from the books. d) TZS 2,000,000 was to be written off in stock in respect of obsolete items included there in. v e) Provision for TZS 800,000 was to be met for professional charges connected with revaluation account. The partnership agreed that on the retirement of Y, goodwill was valued at TZS 40,000,000. No account was to be maintained in the books but adjusting entries between partners are to be made on their capital accounts. Required: Prepare Partner's capital account. Partner's current account in columnar form. Y's Loan account. Statement of Financial Position after Y's retired. a) b) c) d)

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.3APE

Related questions

Question

100%

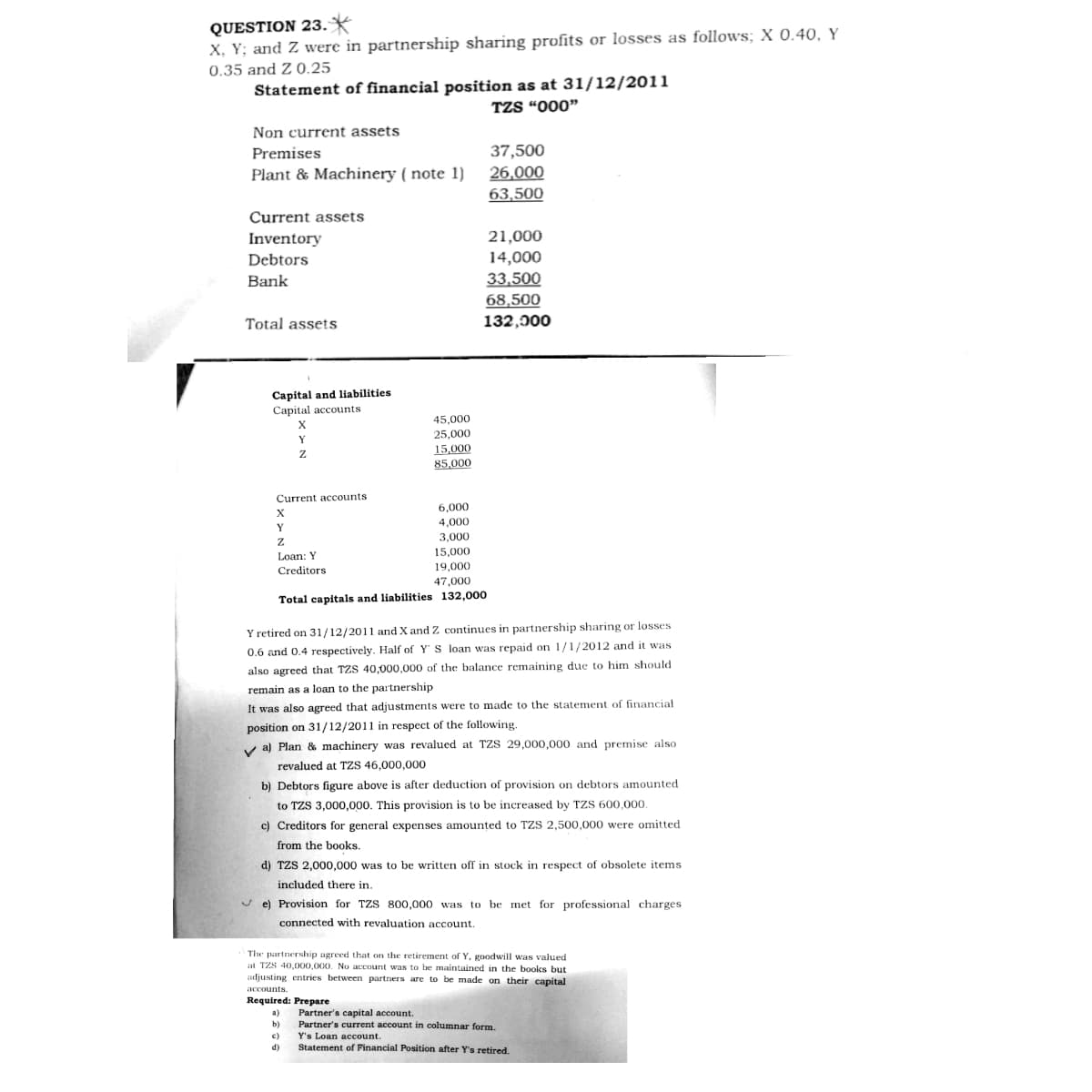

Transcribed Image Text:QUESTION 23. *

X, Y; and Z were in partnership sharing profits or losses as follows; X 0.40, Y

0.35 and Z 0.25

Statement of financial position as at 31/12/2011

TZS “000"

Non current assets

Premises

37,500

Plant & Machinery ( note 1) 26,000

63,500

Current assets

Inventory

21,000

14,000

33,500

68,500

Debtors

Bank

Total assets

132,000

Capital and liabilities

Capital accounts

45,000

25,000

X

Y

15,000

85,000

Current accounts

6,000

4,000

Y

3,000

Loan: Y

15,000

Creditors

19,000

47,000

Total capitals and liabilities 132,000

Y retired on 31/12/2011 and X and Z continues in partnership sharing or losses

0.6 and 0.4 respectively. Half of Y' S loan was repaid on 1/1/2012 and it was

also agreed that TZS 40,000,000 of the balance remaining due to him should

remain as a loan to the partnership

It was also agreed that adjustments were to made to the statement of financial

position on 31/12/2011 in respect of the following.

v a) Plan & machinery was revalued at TZS 29,000,000 and premise also

revalued at TZS 46,000,000

b) Debtors figure above is after deduction of provision on debtors amounted

to TZS 3,000,000. This provision is to be increased by TZS 600,000.

c) Creditors for general expenses amounted to TZS 2,500,000 were omitted

from the books.

d) TZS 2,000,000 was to be written off in stock in respect of obsolete items

included there in.

e) Provision for TZS 800,000 was to be met for professional charges

connected with revaluation account.

The partnership agreed that on the retirement of Y, goodwill was valued

at TZS 40,000,000. No account was to be maintained in the books but

adjusting entries between partners are to be made on their capital

accounts.

Required: Prepare

Partner's capital account.

Partner's current account in columnar form.

Y's Loan account.

Statement of Financial Position after Y's retired.

a)

b)

c)

d)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,