Question 25: Which statement regarding Form W-3 is inaccurate? Answer: A. Form W-3 contains earnings information for multiple employees. В. Form W-3 must be signed by the employer to be valid. C. Form W-3 is submitted to the Social Security Administration and provided to each employee. D. Form W-3 includes federal and state tax information.

Question 25: Which statement regarding Form W-3 is inaccurate? Answer: A. Form W-3 contains earnings information for multiple employees. В. Form W-3 must be signed by the employer to be valid. C. Form W-3 is submitted to the Social Security Administration and provided to each employee. D. Form W-3 includes federal and state tax information.

Chapter9: Payroll, Estimated Payments, And Retirement Plans

Section: Chapter Questions

Problem 5MCQ

Related questions

Question

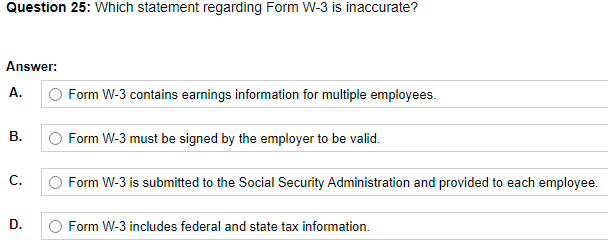

Transcribed Image Text:Question 25: Which statement regarding Form W-3 is inaccurate?

Answer:

O Form W-3 contains earnings information for multiple employees.

А.

В.

O Form W-3 must be signed by the employer to be valid.

С.

O Form W-3 is submitted to the Social Security Administration and provided to each employee.

D.

O Form W-3 includes federal and state tax information.

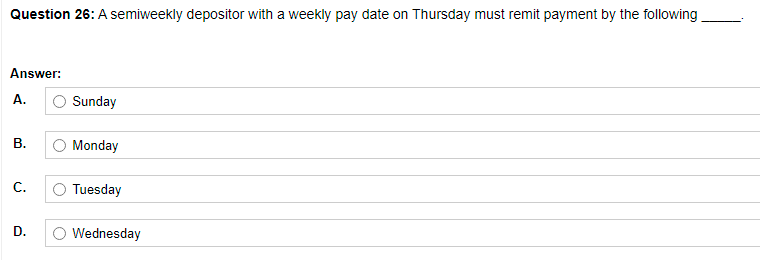

Transcribed Image Text:Question 26: A semiweekly depositor with a weekly pay date on Thursday must remit payment by the following

Answer:

A.

Sunday

В.

Monday

С.

Tuesday

Wednesday

D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you