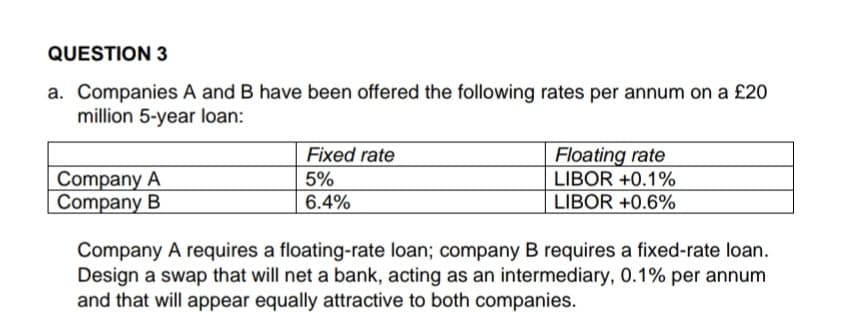

QUESTION 3 a. Companies A and B have been offered the following rates per annum on a £20 million 5-year loan: Company A Company B Fixed rate 5% 6.4% Floating rate LIBOR +0.1% LIBOR +0.6% Company A requires a floating-rate loan; company B requires a fixed-rate loan. Design a swap that will net a bank, acting as an intermediary, 0.1% per annum and that will appear equally attractive to both companies.

Q: Sunland Company is considering two different, mutually exclusive capital expenditure proposals.…

A: Annuity is a series of equal payments at equal interval for a specified period of time. With…

Q: Mary is to receive an annuity with 30 annual payments. The first payment of $1,000 is due…

A: No. of Payments = 30 Payments (PMT) = 1000 Interest Rate = 12% Growth Rate = -5%

Q: WellyWeta workshop is considering buying a machine that costs $545,000. The machine will be…

A: To determine the which option we should choose, we first need to determine the NPV of owning and…

Q: 13. Suppose that an FI holds two loans with the following characteristics. Annual Spread between…

A: Working Note#1 Calculation of return and risk on loan #1 Formula for return=(Annual fees+ Annual…

Q: Your company currently has $1,000 par, 5.25% coupon bonds with 10 years to maturity and a price of…

A: Bonds are the company's liabilities issued to raise the funds required to finance the company's…

Q: X Ltd. has 10 lakhs equity shares outstanding at the beginning of the accounting year 2016. The…

A: Given: Equity shares = 10,00,000 Industry P/E ratio = 8.35 Earnings per share = 20 P/E ratio of the…

Q: An investor has $1000 initial wealth for investment and he borrows another $1000 at the risk free…

A: The beta is said to be the measure of systematic risk of the investment and and it is used to…

Q: The Modigliani and Miller theories are based on several unrealistic assumptions about debt…

A: The capital structure refers to the combination of debt and equity which is used in financing its…

Q: Assume that NASA is allowed to select one of three commercial projects for the next space shuttle…

A: Economic value added is the firm’s economic value added by its operations. Formula for EVA =Net…

Q: Answer Tabulate & use the cash flow diagram below to calculate the amount of money in year 5 that is…

A: Interest rate = 5% Year 0 to Year 3 = -$1500 Year 7 to Year 13 = -$3500

Q: Denali Inc. is acquiring Whitney Corp. at an exchange ratio of 2:1. After the deal is announced,…

A: Merger arbitrage refers to the opportunity of earning profits from the disparity of the stock prices…

Q: Finance what is cost of equity as an effective annual rate given that they pay semi annually,…

A: Dividend - This is the amount which is paid by the company to its shareholders. Dividend includes…

Q: TikTok is considering a project that will cost $ 800,000 and is expected to last for 10 years and…

A: The internal rate of return the rate of return which generated by project and it is calculated on…

Q: 16. What is the total variance of the following portfolio including 2 assets invested in the ratio…

A: Formula to be used: Portfolio variance=(WA2 x σ2A)+(WB2 x σ2B)+ (2 x WA x σA x WB x σB x r) Data…

Q: Following is financial information for three ventures: Venture XX Venture YY Venture ZZ…

A: Particulars Venture XX Venture YY Venture ZZ After-tax property margins 5% 25% 15% Asset…

Q: A French company is considering a project in US. The project will cost $100M. The cash flows are…

A: In this question, the home currency is € and the foreign currency is $. We need to convert the cash…

Q: Maulis Inc. is considering a project that has the following cash flow and WACC data. What is the…

A: A capital budgeting technique used to assess how profitable a project is the discounted payback…

Q: Ten years after purchasing shares in a mutual fund for $7600, the shares are sold for 11,900. What…

A: The rate of return refers to the minimum return to be earned over an investment by the investors in…

Q: Calculate the cost of capital of a bond selling to yeild 13% for the purchaser of the bond. The…

A: Yield to purchaser = r = 13% Tax rate = t = 34%

Q: 7. Complete the last four columns of the table below using an effective tax rate of 40% for an asset…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Suppose that a bank has agreed to the following terms of an interest rate swap: - The notional…

A: Bond-price valuation method: Finding a bond's fair market value is known as bond valuation. The…

Q: A company's stock price rose 2.8% in 2011, and in 2012, it increased 79.7%. a. Compute the…

A: The mean refers to the average value of the complete data where the data can be the stock returns.…

Q: importance of risk management mechanism in the banking sector

A: A vital and quickly changing aspect of a bank's operations is risk management. Risk management…

Q: QUESTION 2 Using the following information, calculate the price of a 12-month long call option using…

A: A call option refers to a derivative instrument that provides its holder the choice of purchasing…

Q: Esfandairi Enterprises is considering a new three-year expansion project that requires an initial…

A: Initial Fixed Assets = $2.35 million Life of Fixed Assets = 3 years Annual Sales = $1,669,000 Costs…

Q: In 1895, the first U.S. Open Golf Championship was held. The winner's prize money was $240. In 2019,…

A: The annual percentage increase refers to the average level of increase in the value of the prize to…

Q: XYZ's stock price and dividend history are as follows: Year Beginning-of-Year Price Dividend…

A: The average return of an investment portfolio over a certain time period is determined using the…

Q: An all-equity company decides to recapitalize. The company has an unlevered beta of 1.1, the market…

A: The Modigliani-Miller (MM) approach, developed by Franco Modigliani and Merton Miller, is a theory…

Q: Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50)…

A: To determine the cash payback period, we first need to determine the average cash flow using the…

Q: As an owner of your own company, you are considering three mutually exclusive alternatives to…

A: Mutually exclusive alternatives are those alternatives in which only one of the alternatives will be…

Q: Who is the minister of finance

A: Introduction: Ministry of finance is concerned with financial legislation, Union budget, taxation,…

Q: Company X is expected to pay dividend of $6/share next year and maintains a constant dividend growth…

A: In the given case, we have provided the expected dividend per share for the next year, constant…

Q: Calculate the IRR of a project requiring an investment outlay of $ 10,000 resulting in cash inflows…

A: Initial investment outlay = i = $10,000 Cash flow for Year 1 = cf1 = $2000 Cash flow for Year 2 =…

Q: an investor purchases a 5%2year annual coupon TIPS at its par value of $1,000 and the CPI increases…

A: TIPS these are treasury securities which have protection for inflation that means value of bond and…

Q: Ivanhoe Company is considering three long-term capital investment proposals. Each investment has a…

A: Net present value and the annual rate of return are the modern methods of capital budgeting that are…

Q: A firm is considering the project who have following cash flows Aways Year Rs. Year Rs. 3 4 5 0 1 2…

A: Net Present Value (NPV) of the project is the sum of the present value of all expected cash flows.…

Q: You are a provider of portfolio insurance and are establishing a four-year program. The portfolio…

A: Portfolio value = $70 million Minimum return = 10% Standard deviation = 25% T-bill = 6.2%

Q: Problem 1 A retiree strongly believe that investing in a non-dividend paying growth firm will…

A: "Since there are multiple questions asked, as per the guidelines I am answering Problem 1. In case…

Q: An all-equity company decides to recapitalize. The company has an unlevered beta of 1.1, the market…

A: Here, Beta 1.1 Market risk premium 6% Risk free rate 5% Tax rate 25% Debt ratio 25%

Q: Sub : Finance Pls answer very fast.I ll upvote correct answer . Thank You ( dont use CHATGPT ) A…

A: A company is planning to introduce a new product in near future , in order to have sufficient money…

Q: What is a zero-coupon bond? What is the value of a zero-coupon bond with a par value of £100 that…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, one must be answered…

Q: 1. Toiletry Products, Inc. manufactures diapers. As their target customers age and pass on, sales of…

A: Current Dividend (D)=$2.50 Growth rate (g)=4% Required return (ke)=12% Required: Stock Price=?

Q: As the CFO of Yo co., you are considering three projects with different levels of risks. You…

A: WACC is the average cost of capital of the company. the relationship between WACC and the rate of…

Q: Ayayai Industries is considering the purchase of new equipment costing $1,500,000 to replace…

A: NPV represents the value generated by an investment or a project expressed in absolute profitability…

Q: Examine the accompanying figure, which presents cu- mulative abnormal returns both before and after…

A: Insider trading refers to the buying or selling of a company's shares by individuals who have access…

Q: The most recent financial statements for Mandy Company are shown here: Income Statement Balance…

A: Sustainable growth rate means the rate at which the company is expecting to grow with the retained…

Q: The current USD/GBP exchange rate is 1.8 dollars per pound. The six-month forward exchange rate is…

A: Interest Rate Parity refers to the concept in the foreign exchange where any investor have an…

Q: Net PPE is currently $79M and its sales are $90M. Ben is projecting that the sales will be growing…

A: Capital investment refers to an amount that is being invested by the investors in the business for…

Q: You are a consultant to a large manufacturing corporation considering a project with the following…

A: Expected return as per CAPM = (Rf+ Beta * (Market risk premium)) The CAPM return is a theoretical…

Q: John Regan, an employee at Home Depot, made deposits of $790 at the end of each year for 6 years.…

A: The concept of time value of money will be used here. To compute the future value of a cash flow…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Company X and Company Y have been offered for the following rates per annum on a RM30 million 5-year loan. Company X Company Y Fixed rate 12.5% 12.5% Floating rate 3-month KLIBOR+2% 3-month KLIBOR + 2.75% Preferred loan Fixed rate Floating rate You work for KL Bank, and thinks that the quoted rate are arbitrageable by means of an interest rate swap. Design a fixed-for-floating interest rate swap. Show the percentage gain to each party, assuming that the mispricing is split equally among three parties.Company A and B have been offered the following rates per annum on a £50 million, 10 - year loan. Company A borrows at a fixed rate of 6% and floating rate of (LIBOR + 0.4)%. Company B borrows at a fixed rate of 7% and a floating rate of (LIBOR + 0.6)%. a) Company A requires a floating rate loan, whereas company B requires a fixed rate loan. In which market does company A have a comparative advantage? Design at least two different swaps that will give a bank, acting as an intermediary 0.6% p.a. and that will appear equally attractive to both companies. Explain how to achieve this, using diagrams and text. b) Design a Swap that is the most beneficial to company A. Explain using text and diagram. c) Suppose that company A has an asset worth £10 million yielding an interest of 7%. Suppose that A is a company based in Japan. Explain how it can use a currency swap to transform the asset to an asset paying Yen (currency in Japan).Company A borrows $2 million at Libor + 3% for five years and Company B takes a $2 million five-year loan at a fixed 7% interest rate. The two companies enters into an interest rate swap arrangement, where Company A will pay Company B a fixed 6% interest rate on a notional $2 million and Company B will pay Company A Libor + 2% on a notional $2 million. What has been accomplished? Question 16 options: Both companies have been able to link the payment to Libor Company A has achieved payments mirroring a fixed interest rate while Company B will be paying a floating rate Company A has achieved payments mirroring a floating interest rate while Company B has achieved a fixed rate Both companies will be paying the same interest rate for the duration of the loan

- Consider an FI with the following off-balance-sheet items: A two-year loan commitment with a face value of $120 million, a standby letter of credit with a face value of $20 million and trade-related letters of credit with a face value of $70 million. 1). What is the total credit equivalent amount? 2). All counterparties have a credit rating of BBB. What is the capital amount of the FI needs to hold against these exposures assuming CAR of 10.5%?Consider an FI with the following off-balance-sheet items: A two-year loan commitment with a face value of $120 million, a standby letter of credit with a face value of $20 million and trade-related letters of credit with a face value of $70 million. All counterparties have a credit rating of BBB. Assuming a required capital ratio of 8%, what is the capital amount the FI needs to hold against these exposures? ANSWER MUST BE 7.52 million8. Seeing further financing opportunity with the firm, mCommerceBank has sweetend the deal further. The bank has agreed to provide loan of $2102, at a rate of 8% per annum, and payments of $95.05 per month (at the end) till the loan is repaid completely. (i) Enter the values of Present Value, Type and PMT in cells C59, C61 and C62 respectively. (ii) Write a formula in cell C58 to compute the monthly interest rate charged by the bank.(iii) Write a formula in cell C64 to compute the loan duration (number of months).

- A company FORTIS, issued a 5 years loan with a gloating rate EURIBOR + 0.75%. It sets up a fixed / variable swap with a bank. The quotation of the swap is as follows: 5-year swap: EURIBOR /3.75%. What is the cost of borrowing of this company after swap? a. 0.75%b. 4.5%c. EURIBOR + 4.5%d. None of the aboveConsider an FI with the following off-balance-sheet items: A two-year loan commitment with a face value of $120 million, a standby letter of credit with a face value of $20 million and trade-related letters of credit with a face value of $70 million. All counterparties have a credit rating of BBB. What is the total capital amount the FI needs to hold against these exposures? (Assume data obtained from 2020 FI records) Select one: A. $5.04 million B. $9.87 million C. $8.4 million D. $7.52 millionFinance Suppose two companies, Firm A and B, both wish to borrow $10 million for five years and have been offered the following rates firm A fixed rate 4%, firm A floating rate six month LIBOT -0.1% firm B, fixed 5.2% floating six months libor +0.6% Enter into a swap agreement to exchange interest-rate payments such that: – Firm A ends up with floating-rate funds. – Firm B ends up with fixed-rate funds. explain how much A and b have after a swap?With a swap, Firm A now pays LIBOR − 0.35% With a swap, Firm B now pays 4.95%. Explain how -0.35% and 4.95% are attained with proper working

- Time. Deposit borrowing Rate. Rate 3 month. 4%. 4.2 6 month. 4.60%. 4.9 9 month. 5.2. 5.4 12 month. 5.5. 5.8 An MNC company would deposit $45mil in 3 month for 3 month . The company decide to enter FRA Agreement suppose the company decide to buy a EuroDollar cont 1. What is the Eurodollar contrace? How many contract should MNC buy? Explain 2. What is the quoted price of this contract? 3. What is the quoted price of this contract after 3 month ? 4. How many pips (base point) did the rate move? 5. How much is the profit or the loss of the company ?(Motivation for Interest rate swap) National Bank has a $200b Adjustable Rate Mortgage (ARM) as a liability on its balance sheet. The interest rate on the ARM is 2.34%+Libor. As a result, the bank will have to pay floating interest. The bank is considering hedging the risk in the interest payment to the ARM with a three-year interest rate swap. What will be the Bank's net interest rate of payment if it chooses the right swap? Answer: ____________%. Euro-€ Swiss franc U. S. dollar Japanese yen Years Bid Ask Bid Ask Bid Ask Bid Ask 2 3.08 3.12 1.68 1.76 5.43 5.46 0.45 0.49 3 3.25 3.29 2.41 2.68 5.78 6.02 0.56 0.592. An investor borrows $2m from XYZ Bank at LIBOR-90 plus a quoted margin of 2%. If the LIBOR-90 effective for the 90-day loans equals 5%, the amount of interest that the investor will pay XYZ Bank is closest to: A. $140,000 B. $35,000 C. $65,000