X Ltd. has 10 lakhs equity shares outstanding at the beginning of the accounting year 2016. The appropriate P/E ratio for the industry in which D Ltd. is 8.35. The earnings per share is Rs. 15 in the last twelve months and current P/E ratio for the company is 10. The EPS is expected to be Rs. 20 at the end of the accounting year and the company has an investment budget of Rs. 4 crores. Based on M-M approach calculate the market price of share of the company. (a) When the Board of Directors of the company has recommended Rs. 8 per share as dividend which is () declared, and (ii) not declared. (b) How many new shares are to be issued by the company at the end of the accounting year when () the above dividends are distributed, and fin dividends are not distributed. (c) Show that the market value of the shares of the company at the end of the accounting vear will remain the same whether dividends are distributed or not declared. Question 1. Price per share at the end of the year when dividend is not declared (i.e. D1 = 0) Select one: O a. 168 • b. 160 O c. 165 O d. 163 Price per share at the end of the year when dividend is declared (i.e. D1 = 8): Select one: • а. 165 O b. 168 O c. 163 O d. 160 How many new shares are to be issued by the company at the end of the accounting ear when the above dividends are distributed, Select one: a. 170500 (appx.) b. 175000 (appx.) c . d . How many new shares are to be issued by the company at the end of the accounting year when dividends are not distributed. Select one: O a. 175000 (appx.) • b. 129040 (appx) O c. 119048 (appx.) O d. 170500 (appx) Valuation of the firm when dividend is not paid OR paid Select one O a.=15.00,00,000 O b.=16,00,00,000 c. = d. =

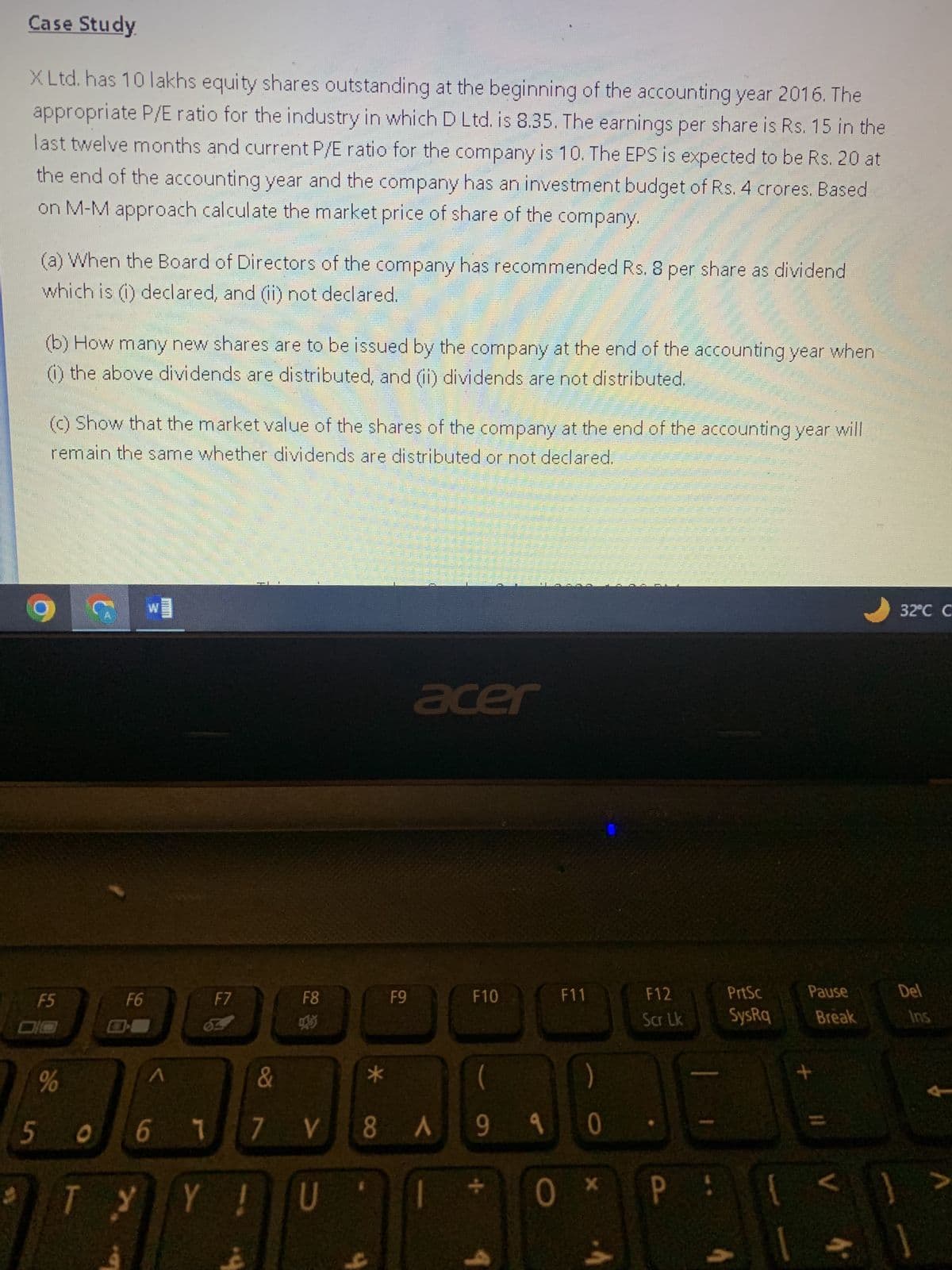

X Ltd. has 10 lakhs equity shares outstanding at the beginning of the accounting year 2016. The appropriate P/E ratio for the industry in which D Ltd. is 8.35. The earnings per share is Rs. 15 in the last twelve months and current P/E ratio for the company is 10. The EPS is expected to be Rs. 20 at the end of the accounting year and the company has an investment budget of Rs. 4 crores. Based on M-M approach calculate the market price of share of the company.

(a) When the Board of Directors of the company has recommended Rs. 8 per share as dividend which is () declared, and (ii) not declared.

(b) How many new shares are to be issued by the company at the end of the accounting year when () the above dividends are distributed, and fin dividends are not distributed.

(c) Show that the market value of the shares of the company at the end of the accounting vear will remain the same whether dividends are distributed or not declared.

Question 1. Price per share at the end of the year when dividend is

not declared (i.e. D1 = 0)

Select one:

O a. 168

• b. 160

O c. 165

O d. 163

Price per share at the end of the year when dividend is declared (i.e.

D1 = 8):

Select one:

• а. 165

O b. 168

O c. 163

O d. 160

How many new shares are to be issued by the company at the end of the accounting ear when the above dividends are distributed,

Select one:

a. 170500 (appx.)

b. 175000 (appx.)

c .

d .

How many new shares are to be issued by the company at the end of the accounting year when dividends are not distributed.

Select one:

O a. 175000 (appx.)

• b. 129040 (appx)

O c. 119048 (appx.)

O d. 170500 (appx)

Valuation of the firm when dividend is not paid OR paid

Select one

O a.=15.00,00,000

O b.=16,00,00,000

c. =

d. =

Trending now

This is a popular solution!

Step by step

Solved in 5 steps