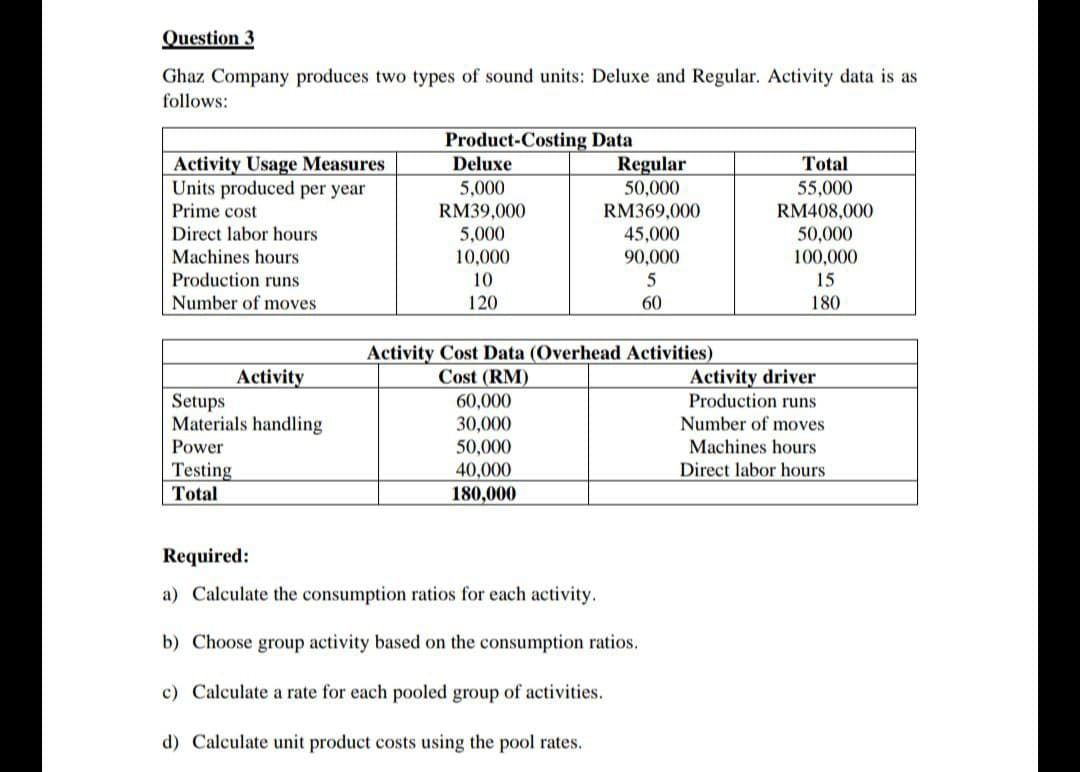

Question 3 Ghaz Company produces two types of sound units: Deluxe and Regular. Activity data is as follows: Activity Usage Measures Units produced per year Prime cost Product-Costing Data Regular 50,000 Deluxe Total 5,000 55,000 RM39,000 5,000 10,000 10 RM369,000 RM408,000 Direct labor hours 45,000 50,000 100,000 15 Machines hours 90,000 Production runs 5 Number of moves 120 60 180 Activity Cost Data (Overhead Activities) Cost (RM) Activity driver Production runs Activity Setups Materials handling 60,000 30,000 Number of moves Power 50,000 Machines hours Direct labor hours Testing Total 40,000 180,000 Required: a) Calculate the consumption ratios for each activity. b) Choose group activity based on the consumption ratios. c) Calculate a rate for each pooled group of activities. d) Calculate unit product costs using the pool rates.

Question 3 Ghaz Company produces two types of sound units: Deluxe and Regular. Activity data is as follows: Activity Usage Measures Units produced per year Prime cost Product-Costing Data Regular 50,000 Deluxe Total 5,000 55,000 RM39,000 5,000 10,000 10 RM369,000 RM408,000 Direct labor hours 45,000 50,000 100,000 15 Machines hours 90,000 Production runs 5 Number of moves 120 60 180 Activity Cost Data (Overhead Activities) Cost (RM) Activity driver Production runs Activity Setups Materials handling 60,000 30,000 Number of moves Power 50,000 Machines hours Direct labor hours Testing Total 40,000 180,000 Required: a) Calculate the consumption ratios for each activity. b) Choose group activity based on the consumption ratios. c) Calculate a rate for each pooled group of activities. d) Calculate unit product costs using the pool rates.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter2: Basic Managerial Accounting Concepts

Section: Chapter Questions

Problem 39E: Cost Classification Loring Company incurred the following costs last year: Required: 1. Classify...

Related questions

Question

Transcribed Image Text:Question 3

Ghaz Company produces two types of sound units: Deluxe and Regular. Activity data is as

follows:

Activity Usage Measures

Units produced per year

Prime cost

Product-Costing Data

Deluxe

5,000

RM39,000

Regular

50,000

Total

55,000

RM408,000

RM369,000

Direct labor hours

Machines hours

5,000

45,000

50,000

10,000

90,000

100,000

Production runs

Number of moves

10

15

120

60

180

Activity Cost Data (Overhead Activities)

Activity

Cost (RM)

Activity driver

Production runs

Setups

Materials handling

Power

60,000

30,000

Number of moves

50,000

Machines hours

Testing

Total

40,000

Direct labor hours

180,000

Required:

a) Calculate the consumption ratios for each activity.

b) Choose group activity based on the consumption ratios.

c) Calculate a rate for each pooled group of activities.

d) Calculate unit product costs using the pool rates.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,