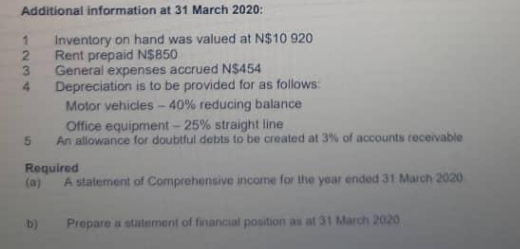

Additional information at 31 March 2020: 1 2 3 Inventory on hand was valued at N$10 920 Rent prepaid N$850 General expenses accrued N$454 Depreciation is to be provided for as follows: Motor vehicles -40% reducing balance b) Office equipment - 25% straight line An allowance for doubtful debts to be created at 3% of accounts receivable Required (a) A statement of Comprehensive income for the year ended 31 March 2020 Prepare a statement of financial position as at 31 March 2020

Additional information at 31 March 2020: 1 2 3 Inventory on hand was valued at N$10 920 Rent prepaid N$850 General expenses accrued N$454 Depreciation is to be provided for as follows: Motor vehicles -40% reducing balance b) Office equipment - 25% straight line An allowance for doubtful debts to be created at 3% of accounts receivable Required (a) A statement of Comprehensive income for the year ended 31 March 2020 Prepare a statement of financial position as at 31 March 2020

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 10E: Kling Company was organized in late 2019 and began operations on January 2, 2020. Prior to the start...

Related questions

Question

please answer both parts

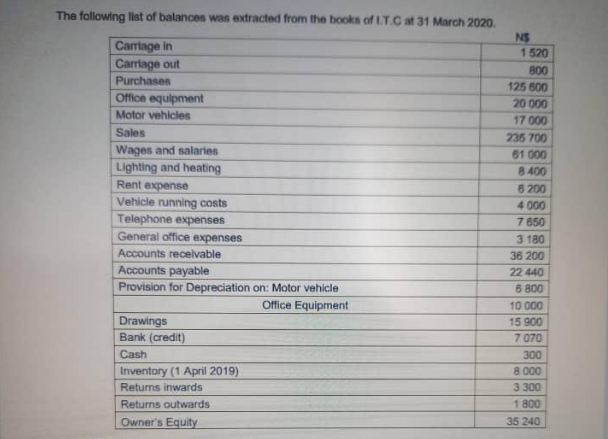

Transcribed Image Text:The following list of balances was extracted from the books of I.T.C at 31 March 2020.

Carriage in

Carriage out

Purchases

Office equipment

Motor vehicles

Sales

Wages and salaries

Lighting and heating

Rent expense

Vehicle running costs

Telephone expenses

General office expenses

Accounts receivable

Accounts payable

Provision for Depreciation on: Motor vehicle

Office Equipment

Drawings

Bank (credit)

Cash

Inventory (1 April 2019)

Returns inwards

Returns outwards

Owner's Equity

N$

1520

800

125 600

20 000

17 000

235 700

61 000

8400

6 200

4000

7650

3 180

36 200

22 440

6800

10 000

15 900

7 070

300

8 000

3.300

1800

35 240

Transcribed Image Text:Additional information at 31 March 2020:1

1

2

3

4

5

Inventory on hand was valued at N$10 920

Rent prepaid N$850

b)

General expenses accrued N$454

Depreciation is to be provided for as follows:

Motor vehicles -40% reducing balance

Office equipment - 25% straight line

An allowance for doubtful debts to be created at 3% of accounts receivable

Required

(a) A statement of Comprehensive income for the year ended 31 March 2020

Prepare a statement of financial position as at 31 March 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning