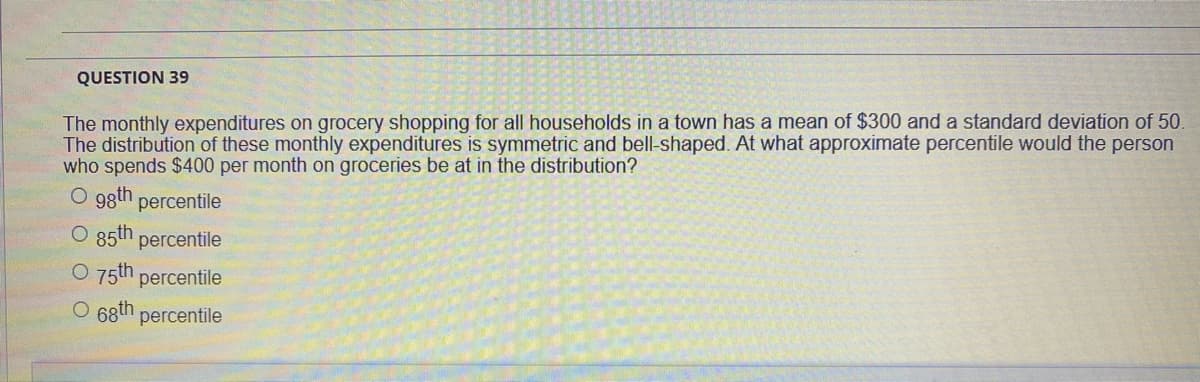

QUESTION 39 The monthly expenditures on grocery shopping for all households in a town has a mean of $300 and a standard deviation of 50. The distribution of these monthly expenditures is symmetric and bell-shaped. At what approximate percentile would the person who spends $400 per month on groceries be at in the distribution? O 98th percentile O 85th percentile O 75th percentile O 68th percentile

QUESTION 39 The monthly expenditures on grocery shopping for all households in a town has a mean of $300 and a standard deviation of 50. The distribution of these monthly expenditures is symmetric and bell-shaped. At what approximate percentile would the person who spends $400 per month on groceries be at in the distribution? O 98th percentile O 85th percentile O 75th percentile O 68th percentile

A First Course in Probability (10th Edition)

10th Edition

ISBN:9780134753119

Author:Sheldon Ross

Publisher:Sheldon Ross

Chapter1: Combinatorial Analysis

Section: Chapter Questions

Problem 1.1P: a. How many different 7-place license plates are possible if the first 2 places are for letters and...

Related questions

Concept explainers

Contingency Table

A contingency table can be defined as the visual representation of the relationship between two or more categorical variables that can be evaluated and registered. It is a categorical version of the scatterplot, which is used to investigate the linear relationship between two variables. A contingency table is indeed a type of frequency distribution table that displays two variables at the same time.

Binomial Distribution

Binomial is an algebraic expression of the sum or the difference of two terms. Before knowing about binomial distribution, we must know about the binomial theorem.

Topic Video

Question

100%

Transcribed Image Text:QUESTION 39

The monthly expenditures on grocery shopping for all households in a town has a mean of $300 and a standard deviation of 50.

The distribution of these monthly expenditures is symmetric and bell-shaped. At what approximate percentile would the person

who spends $400 per month on groceries be at in the distribution?

O 9gth

percentile

O 85th percentile

O 75th percentile

O 68th

percentile

![QUESTION 41

An investor has decided to form a portfolio by putting 45% of his money into Google's stock and the remaining money into Apple's

stock. The investor assumes that the expected returns will be 12% on Google and 20% on Apple, and that the standard deviations

will be 0.10 and 0.20, respectively. What is the expected (mean) return on the portfolio?

OE [Return on portfolio] = 0.4160

O E [Return on portfolio] = 0.1560

O E [Return on portfolio] = 0.1640

OE [Return on portfolio] = 0.6140](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fce5febb7-d3d7-4c2f-8983-ba36bb85d089%2Ff69175ac-669b-4af8-859b-787ed2a268ed%2Fphykd2s_processed.jpeg&w=3840&q=75)

Transcribed Image Text:QUESTION 41

An investor has decided to form a portfolio by putting 45% of his money into Google's stock and the remaining money into Apple's

stock. The investor assumes that the expected returns will be 12% on Google and 20% on Apple, and that the standard deviations

will be 0.10 and 0.20, respectively. What is the expected (mean) return on the portfolio?

OE [Return on portfolio] = 0.4160

O E [Return on portfolio] = 0.1560

O E [Return on portfolio] = 0.1640

OE [Return on portfolio] = 0.6140

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, probability and related others by exploring similar questions and additional content below.Recommended textbooks for you

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON