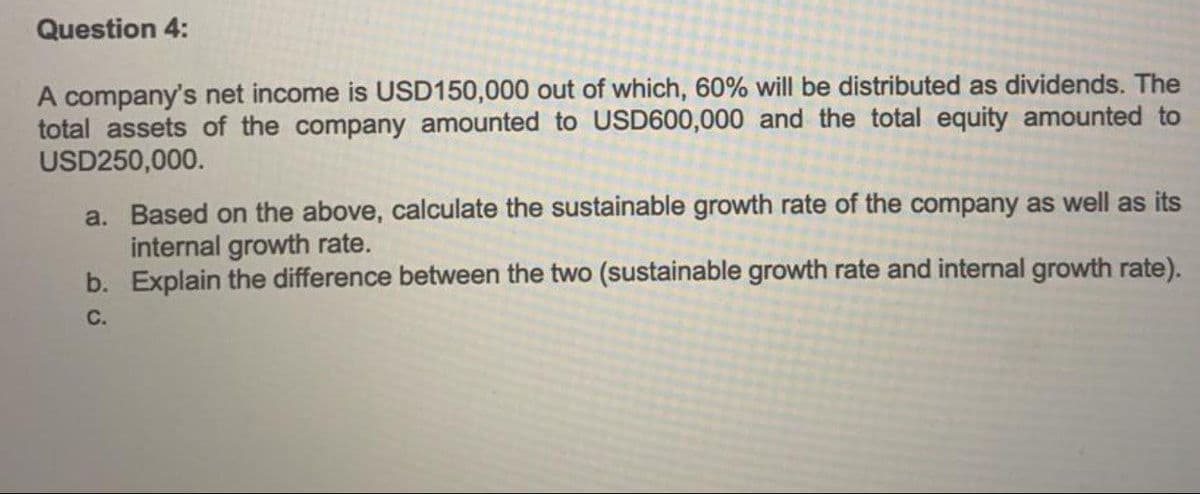

A company's net income is USD150,000 out of which, 60% will be distributed as dividends. The total assets of the company amounted to USD600,000 and the total equity amounted to USD250,000. a. Based on the above, calculate the sustainable growth rate of the company as well as its internal growth rate. b. Explain the difference between the two (sustainable growth rate and internal growth rate).

A company's net income is USD150,000 out of which, 60% will be distributed as dividends. The total assets of the company amounted to USD600,000 and the total equity amounted to USD250,000. a. Based on the above, calculate the sustainable growth rate of the company as well as its internal growth rate. b. Explain the difference between the two (sustainable growth rate and internal growth rate).

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 4DQ

Related questions

Question

Transcribed Image Text:Question 4:

A company's net income is USD150,000 out of which, 60% will be distributed as dividends. The

total assets of the company amounted to USD600,000 and the total equity amounted to

USD250,000.

a. Based on the above, calculate the sustainable growth rate of the company as well as its

internal growth rate.

b. Explain the difference between the two (sustainable growth rate and internal growth rate).

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub