Question 4 Assume that there is a machine, with a cost of P171,307, 2/3 depreciated on a straight-line basis, with a book value of P41,603 and with a remaining useful life of 5 years. The old machine has a P1,032 disposal value now; in 5 years its disposal value will be zero. A new machine is available that will dramatically reduce operating costs. Annual revenue of P133,301 will not change regardless of the decision. The new machine will cost P61,813 have zero disposal value at the end of its 5-year life. The new machine promises to slash variable operating costs from P52,521 per year to P80,000 per year. What is the total cost if the equipment will be replaced? Consider that old machine can be sold. Use comma as necessary. Answer should only be an integer. No need to indicate currency in answer.

Question 4 Assume that there is a machine, with a cost of P171,307, 2/3 depreciated on a straight-line basis, with a book value of P41,603 and with a remaining useful life of 5 years. The old machine has a P1,032 disposal value now; in 5 years its disposal value will be zero. A new machine is available that will dramatically reduce operating costs. Annual revenue of P133,301 will not change regardless of the decision. The new machine will cost P61,813 have zero disposal value at the end of its 5-year life. The new machine promises to slash variable operating costs from P52,521 per year to P80,000 per year. What is the total cost if the equipment will be replaced? Consider that old machine can be sold. Use comma as necessary. Answer should only be an integer. No need to indicate currency in answer.

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: REPLACEMENT ANALYSIS The Dauten Toy Corporation currently uses an injection molding machine that was...

Related questions

Question

Solutions only thank you.

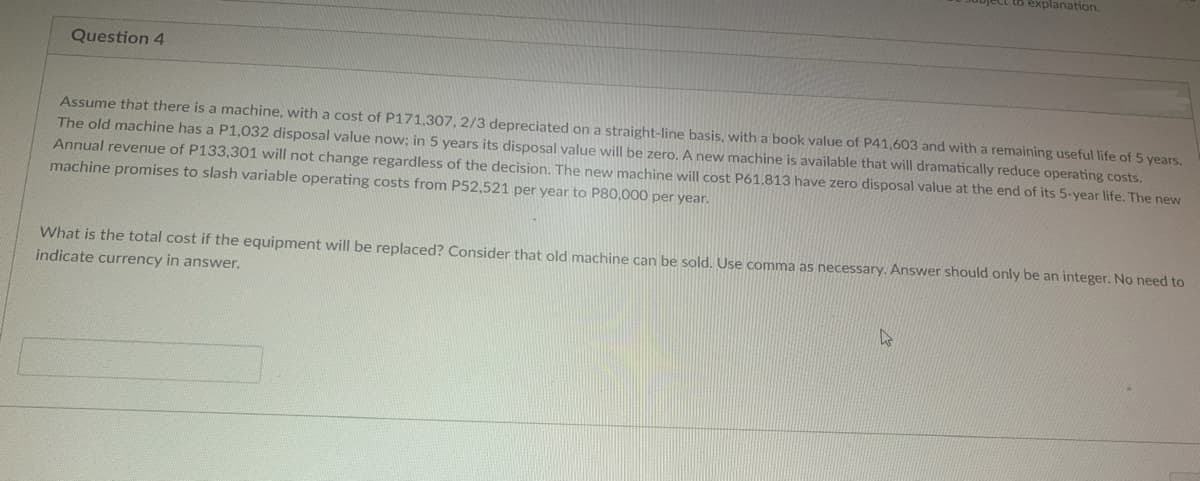

Transcribed Image Text:Question 4

ject to explanation.

Assume that there is a machine, with a cost of P171,307, 2/3 depreciated on a straight-line basis, with a book value of P41,603 and with a remaining useful life of 5 years.

The old machine has a P1,032 disposal value now; in 5 years its disposal value will be zero. A new machine is available that will dramatically reduce operating costs.

Annual revenue of P133,301 will not change regardless of the decision. The new machine will cost P61,813 have zero disposal value at the end of its 5-year life. The new

machine promises to slash variable operating costs from P52,521 per year to P80,000 per year.

What is the total cost if the equipment will be replaced? Consider that old machine can be sold. Use comma as necessary. Answer should only be an integer. No need to

indicate currency in answer.

W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub