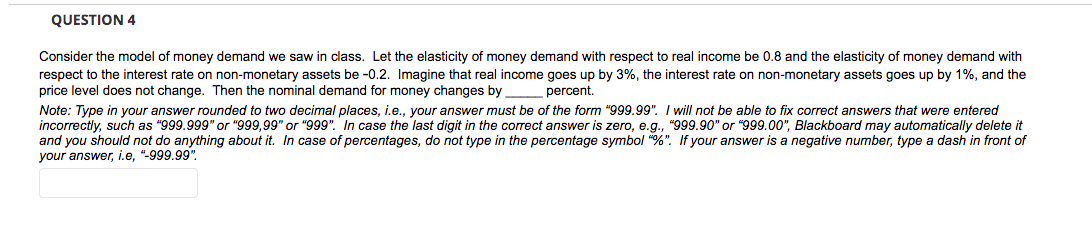

QUESTION 4 Consider the model of money demand we saw in class. Let the elasticity of money demand with respect to real income be 0.8 and the elasticity of money demand with respect to the interest rate on non-monetary assets be -0.2. Imagine that real income goes up by 3%, the interest rate on non-monetary assets goes up by 1%, and the price level does not change. Then the nominal demand for money changes by. percent.

QUESTION 4 Consider the model of money demand we saw in class. Let the elasticity of money demand with respect to real income be 0.8 and the elasticity of money demand with respect to the interest rate on non-monetary assets be -0.2. Imagine that real income goes up by 3%, the interest rate on non-monetary assets goes up by 1%, and the price level does not change. Then the nominal demand for money changes by. percent.

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter22: Money Growth And Inflation

Section: Chapter Questions

Problem 5CQQ

Related questions

Question

Transcribed Image Text:QUESTION 4

Consider the model of money demand we saw in class. Let the elasticity of money demand with respect to real income be 0.8 and the elasticity of money demand with

respect to the interest rate on non-monetary assets be -0.2. Imagine that real income goes up by 3%, the interest rate on non-monetary assets goes up by 1%, and the

price level does not change. Then the nominal demand for money changes by

percent.

Note: Type in your answer rounded to two decimal places, i.e., your answer must be of the form "999.99". I will not be able to fix correct answers that were entered

incorrectly, such as "999.999" or "999,99" or "999". In case the last digit in the correct answer is zero, e.g., "999.90" or "999.00", Blackboard may automatically delete it

and you should not do anything about it. In case of percentages, do not type in the percentage symbol "%". If your answer is a negative number, type a dash in front of

your answer, i.e, "-999.99".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning