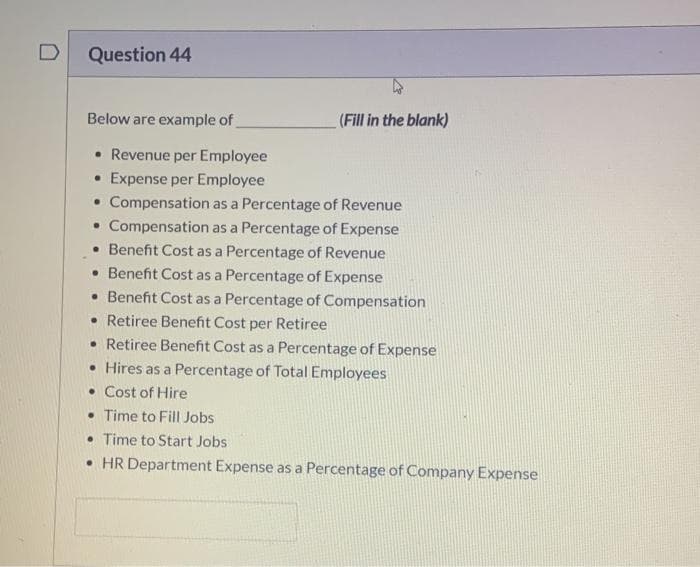

Question 44 Below are example of (Fill in the blank) • Revenue per Employee • Expense per Employee • Compensation as a Percentage of Revenue • Compensation as a Percentage of Expense • Benefit Cost as a Percentage of Revenue • Benefit Cost as a Percentage of Expense • Benefit Cost as a Percentage of Compensation • Retiree Benefit Cost per Retiree • Retiree Benefit Cost as a Percentage of Expense • Hires as a Percentage of Total Employees • Cost of Hire • Time to Fill Jobs • Time to Start Jobs • HR Department Expense as a Percentage of Company Expense

Question 44 Below are example of (Fill in the blank) • Revenue per Employee • Expense per Employee • Compensation as a Percentage of Revenue • Compensation as a Percentage of Expense • Benefit Cost as a Percentage of Revenue • Benefit Cost as a Percentage of Expense • Benefit Cost as a Percentage of Compensation • Retiree Benefit Cost per Retiree • Retiree Benefit Cost as a Percentage of Expense • Hires as a Percentage of Total Employees • Cost of Hire • Time to Fill Jobs • Time to Start Jobs • HR Department Expense as a Percentage of Company Expense

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 13DQ

Related questions

Question

Please do fast ASAP fast

Transcribed Image Text:D

Question 44

Below are example of

(Fill in the blank)

• Revenue per Employee

• Expense per Employee

• Compensation as a Percentage of Revenue

• Compensation as a Percentage of Expense

• Benefit Cost as a Percentage of Revenue

• Benefit Cost as a Percentage of Expense

• Benefit Cost as a Percentage of Compensation

• Retiree Benefit Cost per Retiree

• Retiree Benefit Cost as a Percentage of Expense

• Hires as a Percentage of Total Employees

• Cost of Hire

• Time to Fill Jobs

• Time to Start Jobs

• HR Department Expense as a Percentage of Company Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you