QUESTION 5 5.1 Study the extracts of the Cash Flow Statement of Conlog Limited for the year ended 31 December 2020 and answer the following: 5.1.1 What do you understand by "Cash flow from operating activities R 150 000"? 5.1.2 Name three transactions that improve cash flow but do not increase profit. 5.1.3 There is a combination of a positive net cash flow from operating activities and a negative cash flow trom investing activities. Is this good for the company? Explain. INFORMATION: Conlog Limited Extracts of Cash Flow Statement for the year ended 31 December 2020 Cash flow from operating activities Cash flow from investing activities 210 000 (330 000) (330 000) Additions to plant and machinery Cash flow from financing activities Increase in long term borrowings 120 000 120 000 5.2 Calculate the incremental profit/loss after tax. INFORMATION: Lubners Traders is considering extending credit to some customers who may be at risk of defaulting in payment. Sales will increase by R200 000 if credit is granted to these customers. From the new accounts receivable generated, 8% is expected to be uncollectable. Additional collection costs will be 3% of sales, and the production and selling costs will be 65% of sales. Taxation is 28%.

QUESTION 5 5.1 Study the extracts of the Cash Flow Statement of Conlog Limited for the year ended 31 December 2020 and answer the following: 5.1.1 What do you understand by "Cash flow from operating activities R 150 000"? 5.1.2 Name three transactions that improve cash flow but do not increase profit. 5.1.3 There is a combination of a positive net cash flow from operating activities and a negative cash flow trom investing activities. Is this good for the company? Explain. INFORMATION: Conlog Limited Extracts of Cash Flow Statement for the year ended 31 December 2020 Cash flow from operating activities Cash flow from investing activities 210 000 (330 000) (330 000) Additions to plant and machinery Cash flow from financing activities Increase in long term borrowings 120 000 120 000 5.2 Calculate the incremental profit/loss after tax. INFORMATION: Lubners Traders is considering extending credit to some customers who may be at risk of defaulting in payment. Sales will increase by R200 000 if credit is granted to these customers. From the new accounts receivable generated, 8% is expected to be uncollectable. Additional collection costs will be 3% of sales, and the production and selling costs will be 65% of sales. Taxation is 28%.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 16.18EX: Statement of cash flowsindirect method The following statement of cash flows for Shasta Inc. was not...

Related questions

Question

100%

Transcribed Image Text:QUESTION 5

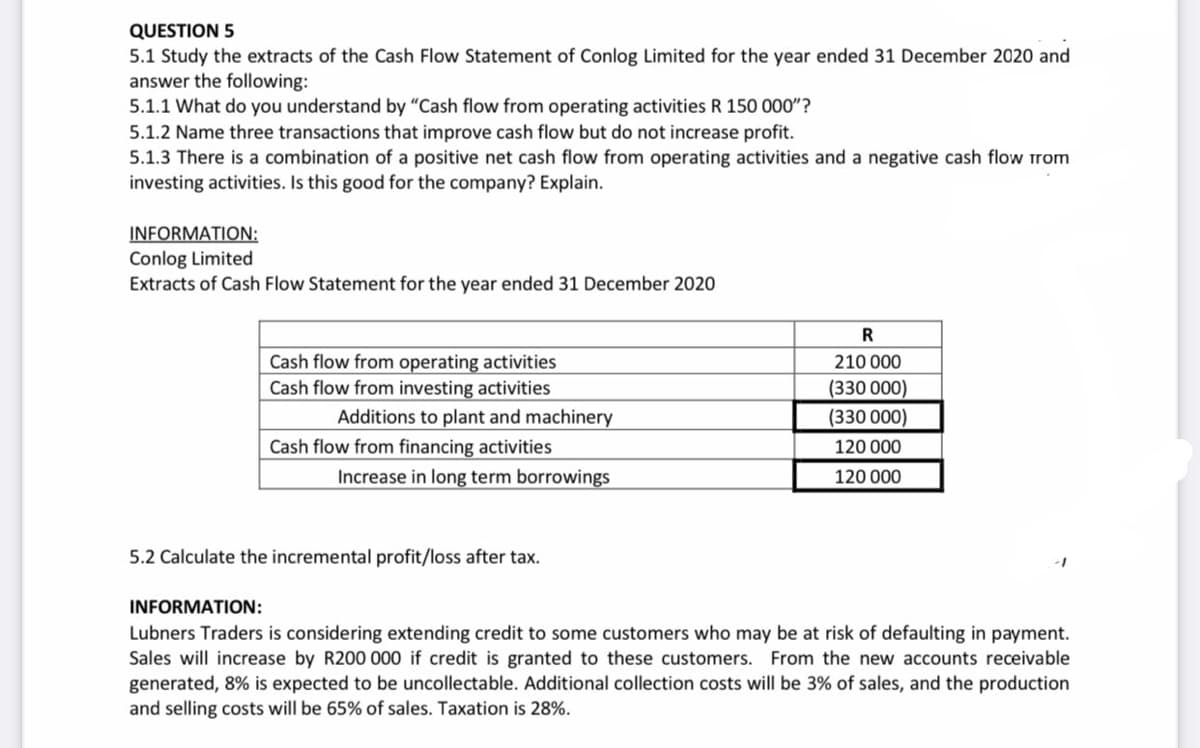

5.1 Study the extracts of the Cash Flow Statement of Conlog Limited for the year ended 31 December 2020 and

answer the following:

5.1.1 What do you understand by "Cash flow from operating activities R 150 000"?

5.1.2 Name three transactions that improve cash flow but do not increase profit.

5.1.3 There is a combination of a positive net cash flow from operating activities and a negative cash flow trom

investing activities. Is this good for the company? Explain.

INFORMATION:

Conlog Limited

Extracts of Cash Flow Statement for the year ended 31 December 2020

R

Cash flow from operating activities

Cash flow from investing activities

Additions to plant and machinery

Cash flow from financing activities

210 000

(330 000)

(330 000)

120 000

Increase in long term borrowings

120 000

5.2 Calculate the incremental profit/loss after tax.

INFORMATION:

Lubners Traders is considering extending credit to some customers who may be at risk of defaulting in payment.

Sales will increase by R200 000 if credit is granted to these customers. From the new accounts receivable

generated, 8% is expected to be uncollectable. Additional collection costs will be 3% of sales, and the production

and selling costs will be 65% of sales. Taxation is 28%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning