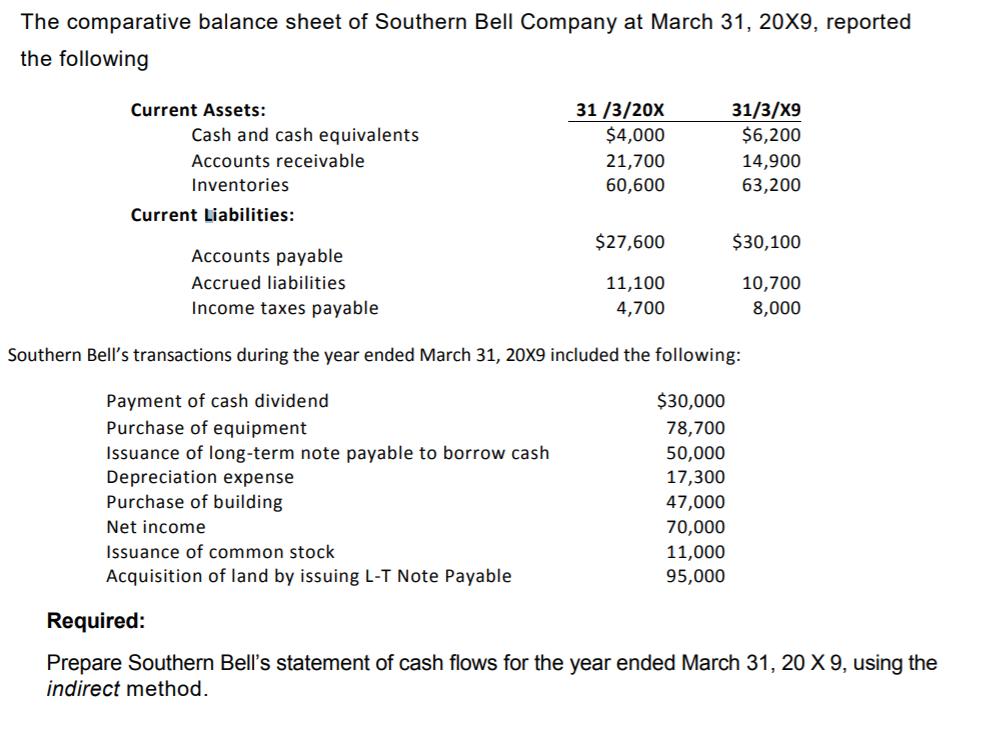

The comparative balance sheet of Southern Bell Company at March 31, 20X9, reported the following 31 /3/20X $4,000 31/3/X9 $6,200 Current Assets: Cash and cash equivalents 21,700 60,600 Accounts receivable 14,900 63,200 Inventories Current Liabilities: $27,600 $30,100 Accounts payable Accrued liabilities 11,100 10,700 Income taxes payable 4,700 8,000 Southern Bell's transactions during the year ended March 31, 20X9 included the following: Payment of cash dividend Purchase of equipment $30,000 78,700 Issuance of long-term note payable to borrow cash Depreciation expense Purchase of building 50,000 17,300 47,000 Net income 70,000 Issuance of common stock 11,000 95,000 Acquisition of land by issuing L-T Note Payable Required: Prepare Southern Bell's statement of cash flows for the year ended March 31, 20 X 9, using the indirect method.

Step by step

Solved in 2 steps with 1 images

Question 5

The Income Statement and additional data of Crawford Properties, Inc., follows:

CRAWFORD PROPERTIES Inc.

Income Statement

For Year Ended June 30, 20X6

Revenues:

Sales revenue $237,000

Expenses:

Cost of goods sold $103,000

Salary expense 58,000

Depreciation expense 29,000

Income taxes expense 9,000 199,000

Net Income $38,000

Additional data:

a) Acquisition of plant assets is $116,000. Of this amount $101,000 is paid in cash and

$15,000 by signing a note payable.

b) Proceeds from sale of land total $24,000

c) Proceeds from issuance of common stock total $30,000

d) Payment of long-term note payable is $15,000

e) Payment of dividends is $11,000

f) From the balance sheet

30/6/X 6 30/6/X 5

Current Assets:

Cash & cash equivalents $27,000 $20,000

Accounts receivable 43,000 58,000

Inventories 92,000 85,000

Current Liabilities:

Accounts payable $35,000 $22,000

Accrued liabilities 13,000 21,000

Required:

Prepare Crawford Properties, Inc.’s statement of cash flows for the year ended

June 30, 20X6, using the indirect method?