The comparative partial balance sheets of Barry Company, for Years 1 below in condensed form. Year 2 Year 1 Assets $42,500 70,200 $72,000 Cash Accounts Receivable (net) Inventories Investments 61,000 121,000 105,000 100,000 575,000 425,000 mont

The comparative partial balance sheets of Barry Company, for Years 1 below in condensed form. Year 2 Year 1 Assets $42,500 70,200 $72,000 Cash Accounts Receivable (net) Inventories Investments 61,000 121,000 105,000 100,000 575,000 425,000 mont

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 5PA: Statement of cash flowsdirect method applied to PR 13-1A The comparative balance sheet of Livers...

Related questions

Question

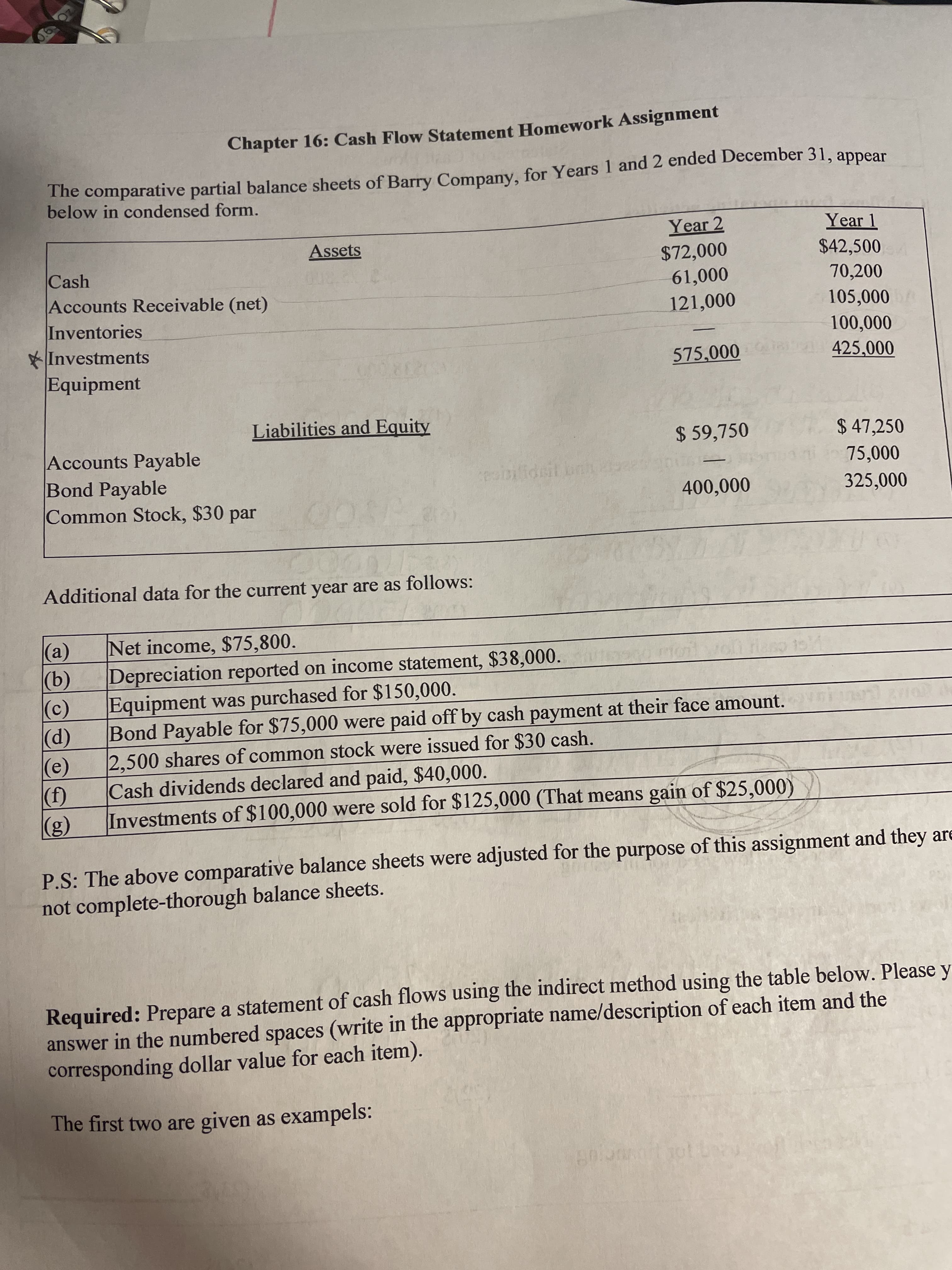

Transcribed Image Text:Chapter 16: Cash Flow Statement Homework Assignment

he comparative partial balance sheets of Barry Company, for Years 1 and 2 ended December 31, appear

below in condensed form.

Year 2

$72,000

Year 1

Assets

$42,500

Cash

61,000

70,200

Accounts Receivable (net)

Inventories

Investments

Equipment

121,000

105,000

100,000

-

575,000

425,000

Liabilities and Equity

$ 59,750

$ 47,250

Accounts Payable

Bond Payable

Common Stock, $30 par

75,000

400,000

325,000

Additional data for the current year are as follows:

Net income, $75,800.

(a)

Depreciation reported on income statement, $38,000.

(b)

Equipment was purchased for $150,000.

(p)

2,500 shares of common stock were issued for $30 cash.

Bond Payable for $75,000 were paid off by cash payment at their face amount.

Cash dividends declared and paid, $40,000.

()

Investments of $100,000 were sold for $125,000 (That means gain of $25,000)

(8)

P.S: The above comparative balance sheets were adjusted for the purpose of this assignment and they are

not complete-thorough balance sheets.

Required: Prepare a statement of cash flows using the indirect method using the table below. Please y

answer in the numbered spaces (write in the appropriate name/description of each item and the

corresponding dollar value for each item).

The first two are given as exampels:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning