QUESTION 5 The principal legal duties imposed upon partners in their relations with one another include: O 4 a duty to vote for candidates that will help the business. Oba duty to devote full time and expertise to the partnership. Oc the duty to compensate other partners for their time and efforts spent on partnership business. Od the fiduciary duty or the duty of loyalty. D QUESTION 6 In deciding whether property owned by a partner before formation of the partnership and used in the business is a capital contribution that belongs to the firm, a court will consider which of the following? Oa Whether the property was improved with partnership funda Ob Whether the property was carried on the books of the partnership as an asset OL Admissions or declarations of the partners Od. All of these would be considered.

QUESTION 5 The principal legal duties imposed upon partners in their relations with one another include: O 4 a duty to vote for candidates that will help the business. Oba duty to devote full time and expertise to the partnership. Oc the duty to compensate other partners for their time and efforts spent on partnership business. Od the fiduciary duty or the duty of loyalty. D QUESTION 6 In deciding whether property owned by a partner before formation of the partnership and used in the business is a capital contribution that belongs to the firm, a court will consider which of the following? Oa Whether the property was improved with partnership funda Ob Whether the property was carried on the books of the partnership as an asset OL Admissions or declarations of the partners Od. All of these would be considered.

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 21DQ

Related questions

Question

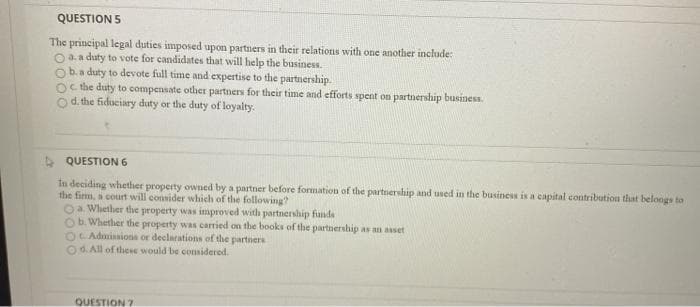

Transcribed Image Text:QUESTION 5

The principal legal duties imposed upon partners in their relations with one another include:

O a. a duty to vote for candidates that will help the business.

Ob.a duty to devote full time and expertise to the partnership.

O cthe duty to compensate other partners for their time and efforts spent on partnership business.

Od.the fiduciary duty or the duty of loyalty.

A QUESTION 6

In deciding whether property owned by a partner before formation of the partnership and used in the business is a capital contribution that belongs to

the firm, a court will consider which of the following?

Oa Whether the property was improved with partnership funds

Ob. Whether the property was carried on the books of the partnership as an asset

OC Admissions or declarations of the partners

Od. All of these would be considered.

QUESTION 7

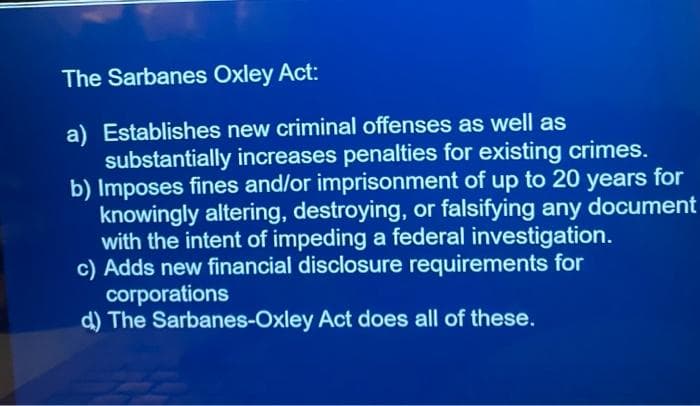

Transcribed Image Text:The Sarbanes Oxley Act:

a) Establishes new criminal offenses as well as

substantially increases penalties for existing crimes.

b) Imposes fines and/or imprisonment of up to 20 years for

knowingly altering, destroying, or falsifying any document

with the intent of impeding a federal investigation.

c) Adds new financial disclosure requirements for

corporations

d) The Sarbanes-Oxley Act does all of these.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT