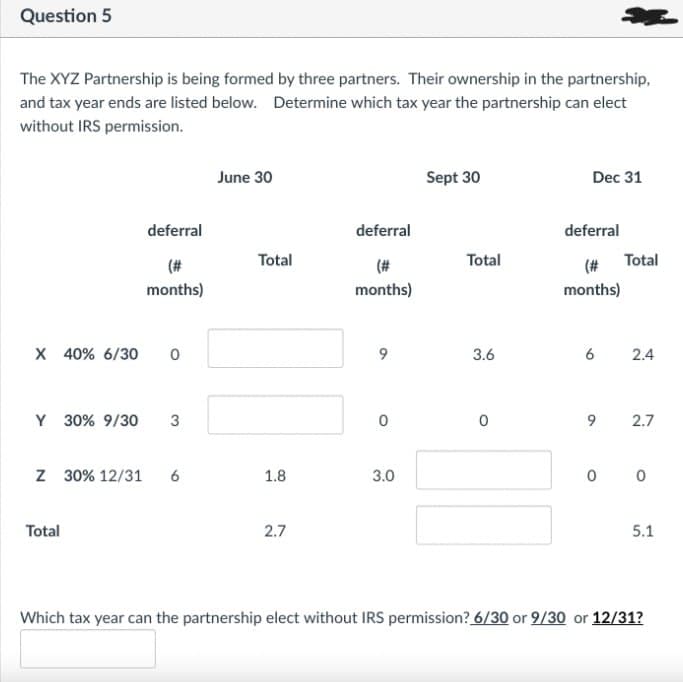

Question 5 The XYZ Partnership is being formed by three partners. Their ownership in the partnership, and tax year ends are listed below. Determine which tax year the partnership can elect without IRS permission. June 30 Sept 30 Dec 31 deferral deferral deferral (# Total (# Total months) months) (# Total months) X 40% 6/30 0 Y 30% 9/30 3 9 3.6 6 2.4 0 0 9 2.7 Z 30% 12/31 6 1.8 3.0 Total 2.7 0 0 5.1 Which tax year can the partnership elect without IRS permission? 6/30 or 9/30 or 12/31?

Question 5 The XYZ Partnership is being formed by three partners. Their ownership in the partnership, and tax year ends are listed below. Determine which tax year the partnership can elect without IRS permission. June 30 Sept 30 Dec 31 deferral deferral deferral (# Total (# Total months) months) (# Total months) X 40% 6/30 0 Y 30% 9/30 3 9 3.6 6 2.4 0 0 9 2.7 Z 30% 12/31 6 1.8 3.0 Total 2.7 0 0 5.1 Which tax year can the partnership elect without IRS permission? 6/30 or 9/30 or 12/31?

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 2DQ

Related questions

Question

Transcribed Image Text:Question 5

The XYZ Partnership is being formed by three partners. Their ownership in the partnership,

and tax year ends are listed below. Determine which tax year the partnership can elect

without IRS permission.

June 30

Sept 30

Dec 31

deferral

deferral

deferral

(#

Total

(#

Total

months)

months)

(# Total

months)

X 40% 6/30

0

Y 30% 9/30

3

9

3.6

6

2.4

0

0

9 2.7

Z 30% 12/31

6

1.8

3.0

Total

2.7

0 0

5.1

Which tax year can the partnership elect without IRS permission? 6/30 or 9/30 or 12/31?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning