Question 6 of 9 Current Attempt in Progress Crane Inc. incurred a net operating loss of $455,000 in 2025. The tax rate for all years is 30%. Assume that it is more likely than not that the entire net operating loss carryforward will not be realized in future years. Prepare all the journal entries necessary at the end of 2025. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation (To record carryforward) (To record allowance) eTextbook and Media ||| Debit Credit

Question 6 of 9 Current Attempt in Progress Crane Inc. incurred a net operating loss of $455,000 in 2025. The tax rate for all years is 30%. Assume that it is more likely than not that the entire net operating loss carryforward will not be realized in future years. Prepare all the journal entries necessary at the end of 2025. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation (To record carryforward) (To record allowance) eTextbook and Media ||| Debit Credit

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 25P: LO.2 Oak Corporation has the following general business credit carryovers. If the general business...

Related questions

Question

Transcribed Image Text:Question 6 of 9

Current Attempt in Progress

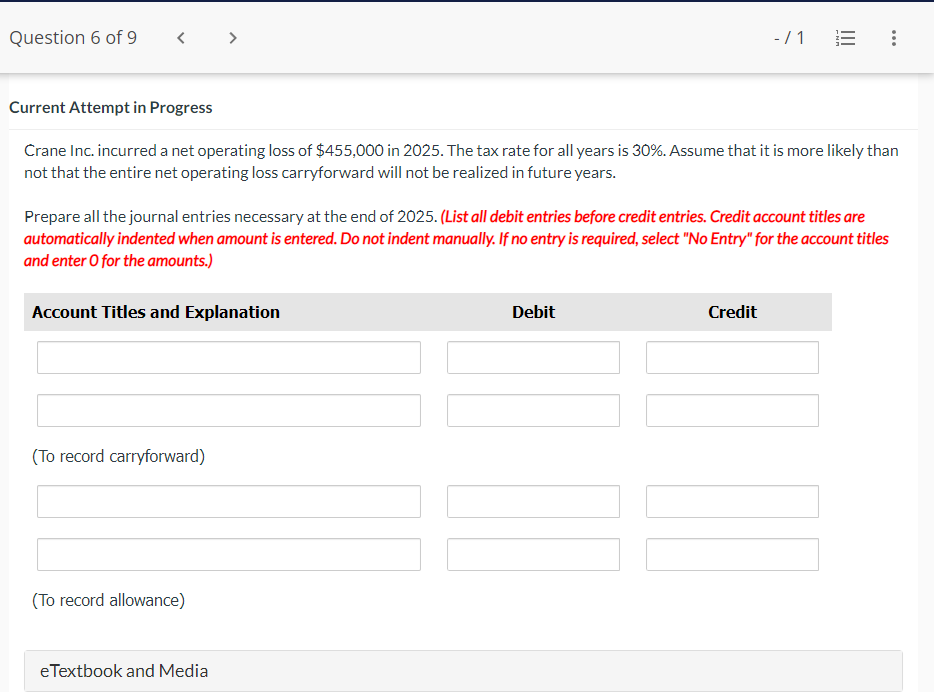

Crane Inc. incurred a net operating loss of $455,000 in 2025. The tax rate for all years is 30%. Assume that it is more likely than

not that the entire net operating loss carryforward will not be realized in future years.

Prepare all the journal entries necessary at the end of 2025. (List all debit entries before credit entries. Credit account titles are

automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter o for the amounts.)

Account Titles and Explanation

(To record carryforward)

(To record allowance)

eTextbook and Media

-/1

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning