During 2024, its first year of operations, Baginski Steel Corporation reported a net operating loss of $360,000 for financial reporting and tax purposes. The enacted tax rate is 25%. Required:

Q: Weighted average cost method with perpetual inventory The beginning inventory at Midnight Supplies…

A: In the weighted average perpetual inventory system, purchases and sales are dealt with in…

Q: Debt investment transactions, available-for-sale valuation Rios Co. is a regional insurance company…

A: Journal Entry is a part of accounting process which helps a company to maintain the record of…

Q: On January 1, 2021, Adams-Meneke Corporation granted 60 million incentive stock options to division…

A: Compensation Expense When referring to an employee of the manager, the term "compensation expense"…

Q: On January 1, Year 1, Bluestone Company issued bonds with a face value of $500,000 at 90. How will…

A: Bonds are usually issued by the company as to raise short term finance. These are basically issued…

Q: 28. The following trial balance was taken from the books of Nasir Rasool on 30 June 2005. Capital…

A: WORKING NOTES: 1.CALCULATION OF PROFIT/LOSS ON CAR SOLD ON 03 MARCH 2005 BOOK VALUE AS ON…

Q: Lee Werner is general manager of Stoneybrook Salons. During 2024, Werner worked for the company all…

A: Gross salary is the amount of salary after totalling all the benefits and allowances but before…

Q: How much is Cost of Goods Manufactured and Cost of Goods Sold?

A: Cost of goods sold is the cost incurred by the company on the goods sold. It is reported in the…

Q: Update the Income Statement Calculate the current ratio Calculate…

A: 1.Updated income statement of Tanesha D Company for the year ended December 31,2019 Tanesha D…

Q: Northern Airlines issued 25-year bonds with a maturity value of $3 million. Which statement is true…

A: The bonds are the financial instruments for the business that are used to raise money from the…

Q: June 4 June 11 June 18 June 25 Units Received A. $2.30 C. $2.26 2889 70 30 60 40 Unit Cost You sell…

A: Inventory Valuation Methods - Inventory can be valued using various methods - b. LIFO Method -Under…

Q: Avery, an unmarried taxpayer, had the following income items: $ 40,800 5,370 Salary Net income from…

A: The annual gross income is the total of all the incomes earned during the year. It includes income…

Q: Calculate the gross profit for Jefferson Company based on the following: Sales Selling Expenses Cost…

A: Gross profit is the amount earned after deducting all the direct expenses from the value of sales.…

Q: The following amortization schedule indicates the interest and principal to be repaid on an…

A: SOLUTION:- 1. Amortization Schedule…

Q: eginning Inventory urchase nurchase urchase oods Available for Sale 5 4 4 3 16

A: Answer : Option $602 is correct answer. Weighted average cost per unit =Total cost / Total units…

Q: Miller Company’s contribution format income statement for the most recent month is shown below:…

A: Contribution margin: The difference between the sales and the variable costs is called contribution…

Q: Vaughn Mining Company purchased land on February 1, 2025, at a cost of $1,031,100. It estimated that…

A: Total cost of depletion includes the cost of land and development cost and also includes the fair…

Q: Medical Precision Instruments Balance Sheet (Partial) December 31, 2024 Liabilities

A: Answer : Medical Precision Instruments Balance sheet (partial) December 31,2024…

Q: Eli O'Henry Associates reported short-term notes payable and salaries payable as follows: (Click the…

A: Journal Entries - Journal Entries are the records of the Transactions entered into by the company.…

Q: The following figures have been extracted from ZSX’s accounts for the three years to 31 May 2018: a)…

A: Introduction: For analyzing liquidity position of the company, two ratios are mostly used - (1)…

Q: Compute factory overhead cost from the following costs: Depreciation on factory buildings $ 45,950…

A: The costs of running a business that aren't directly related to a good or service are generally…

Q: ! Required information. [The following information applies to the questions displayed below.] Tiny…

A: Capital gain is an increase in the value of an asset or investment resulting from the price…

Q: 4. According to CAPM estimates, what is the cost of equity for a firm with beta of 1.5 when the…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: How are the balance sheet and income statement affected by fair value accounting?

A: How are the balance sheet and income statement affected by fair value accounting? The balance sheet…

Q: Kohler Corporation reports the following components of stockholders’ equity on January 1. Common…

A: INTRODUCTION: If a firm purchased a car, the value of the car would increase its assets. However, an…

Q: Mason Company uses a periodic inventory system and has the following: Beginning inventory, Sept 1…

A: The inventory can be valued using various methods as LIFO, FIFO and weighted average method. Using…

Q: Angela Company is concerned about its operating performance, as summarized below: Revenues (P12.50…

A: Break even is point at which an entity is in situation of no profit no loss. It is the point whereby…

Q: Gillooly Co. purchased $360,000 of 6%, 20-year Lumpkin County bonds on May 11, Year 1, directly from…

A: Journal entry is the procedure for initially documenting commercial transactions in the books of…

Q: Tamara owns interest in two different entities: a partnership and an S-Corp. Her basis in the…

A: A partnership interest is the percentage of a partnership owned by a particular member or…

Q: Play-with-fire Ltd manufactures plastic model kits for the toy market. It operates two production…

A: Predetermined overhead rate=Budgeted overhead costAllocation base

Q: Question 2B: Debt restructuring Kifer Corp. owes $450,000 (principal amount) to First Trust. The…

A: Lets understand the basics. When borrower is unable to repay the debt due from lender then leder…

Q: Periodic inventory by three methods The beginning inventory at Midnight Supplies and data on…

A: Inventory Valuation Methods - Inventory can be valued using various methods - FIFO Method - Under…

Q: The following facts relate to Kingbird Corporation. 1. Deferred tax liability, January 1, 2020,…

A: Income tax is the direct tax . It is a tax charged on the annual income earned by the individual.…

Q: From the given data for the current year, determine the inventory turnover. Net sales on account…

A: Inventory turnover shows the number of time inventory sold, used or rotated during the given period…

Q: I need to know where the contribution margin/unit of 80 comes from for the 5330 units manufactured.…

A: Contribution margin is used to determine the profitability of the product only taking sales and…

Q: Blue Ivy Inc. has the following transactions for the month of March: Issued common stock $60,000…

A: A company's liquidity—or capacity to pay off short-term obligations that are due in less than a…

Q: Marvel Parts, Incorporated, manufactures auto accessories. One of the company’s products is a set of…

A: Variances in standard costing means, the deviation of actual cost from budgeted cost, in other…

Q: Problem 4- Compute FIFO, LIFO, and Average Cost Some of the information found on a detail inventory…

A: The inventory can be valued using various methods as LIFO, FIFO and weighted average method. The…

Q: Required: 1- Calculate the contribution per unit for each product, and show which one is the most…

A: Contribution Margin per unit = Selling Price Per unit - Variable cost per unit Selling Price =…

Q: January 1 Year 1, Gordon Corporation issued bonds with a face value of $70,000, a stated rate of…

A: Bonds are long term sources of finance for the companies but when bonds are issued they may be…

Q: A P22,000 flow measurement instrument was installed and depreciated for 9 years. The instrument was…

A: The double declining balance method of depreciation is an accelerated method of depreciation. Here…

Q: Laura sold her office building to the accounting firm that bought her firm. Unfortunately, she had…

A: Gross profit is the profit a business makes after substracting all the costs that are related to…

Q: third year. Purchased a $176,500 machine on January 1 of this year for $35,300 cash. A five-year…

A: 1) Interest = $7300 Repayment at the end =$117600 Number of years =8 years year Cash…

Q: Journal Entries, Trial Balance and Income Statement Practice Problem 1: Prepare general journal…

A: The income statement is prepared to record the revenue and expenses of the current period. It tells…

Q: Cotrone Beverages makes energy drinks in three flavors: Original, Strawberry, and Orange. The…

A: The cost differential between two options is known as the differential cost. Different options have…

Q: Sky is also considering acquiring a piece of machinery that helps her print designs on new or used…

A: FIRST WE SHOULD CONSIDER THE POINT WHETHER IT IS A GOOD INVESTMENT OR NOT SECOND MEANING OF PAY…

Q: Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The…

A: An allocation rate for manufacturing costs that are incurred indirectly during the production of a…

Q: 10. What are the four functions associated with payroll activities?

A: The phrase "payroll" refers to both employee wages and paychecks. Payroll is a list of the company's…

Q: Thrasher Company reported income before taxes of $180,000. The company is in a 30% income tax…

A: Times interest earned ratio = Earnings before interest and tax / Interest expense Earnings before…

Q: In alphabetical order below are balance sheet items for Robinson Company at December 31, 2022.…

A: BALANCE SHEET Balanace sheet is one of the Important Financial Statement of the Company. Balance…

Q: Outstanding Publishing completed the following transactions during 2024: i (Click the icon to view…

A: Unearned Revenue: Unearned Revenue means money received from the customer in advance for the service…

Immediate Accounting ll Ch 16

3. During 2024, its first year of operations, Baginski Steel Corporation reported a net operating loss of $360,000 for financial reporting and tax purposes. The enacted tax rate is 25%.

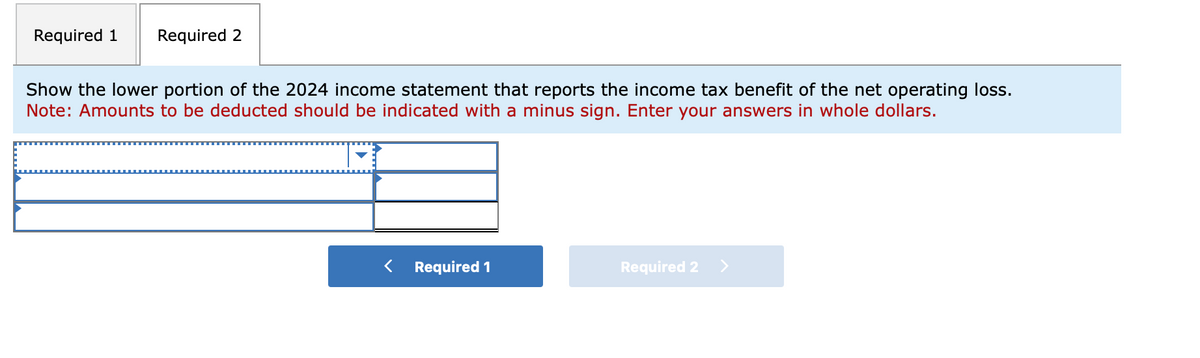

Required:

- Prepare the

journal entry to recognize the income tax benefit of the net operating loss. Assume the weight of available evidence suggests that future taxable income will be sufficient to benefit from future deductible amounts arising from the net operating loss carryforward. - Show the lower portion of the 2024 income statement that reports the income tax benefit of the net operating loss.

- Required 1

Record 2024 income tax benefit from operating loss

| Transaction | General Journal | Debit | Credit |

| 1 | |||

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- BLOCK D/2018/2 A company shows a taxable profit of € 1.3 million for t1 in the tax balance sheet. The income tax rate is 30%. In addition, net income under commercial law before taxes of € 1.6 million was reported in the same reporting period. What is the maximum amount this company can distribute to shareholders from the annual results of the current reporting period? Present your calculations comprehensibly!QUESTION 1 The following information has been provided for the year ended 31 December 2022 Depreciation for Accounting purposes Machinery R16 000 Equipment R27 500 Wear and Tear Machinery R25 000 Equipment R30 000 Dividends received R35 000 Revenue received in advance R26 000 (2022) Revenue received in advance R18 000 (2021) Profit before tax is R300 000 after taking the above figures into account. Assume a tax rate of 28% Required. CALCULATE the current tax for the year ended 31 December 2022 Show the calculationsRequired Answer each of the following questions by providing supporting computations. 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and after-tax amounts of the three items labeled pretax. 2. Compute the amount of income from continuing operations before income taxes. What is the amount of the income tax expense? What is the amount of income from continuing operations? 3. What is the total amount of after-tax income (loss) associated with the discontinued segment? 4. What is the amount of net income for the year?

- V4. The Ahram Company net income was 100,000 L.E. for the year ended on 31/12/2016. The examination of the income statement of this year revealed that the income statement included a deduction of the following a) The cost of computers that were purchased on 1/6/2016 for 15,000 b) Depreciation expense of 9,000 for furniture’s at a rate of 10% Required: Calculate Taxable net income and indicate the reasoning for your calculations for 2016. (Be careful, needs a bit of thought )Concept Review 3.1- Please turn to page 151 of the text and complete Financial Planning Problem 1. (Personal Finance, 13th ed., Kapoor, Dlabay) Computing Taxable Income: Ross Martin arrived at the following tax information… Gross salary: $56,145 Interest earnings: $205 Dividend income: $65 Standard deductions: $12,000 Itemized deductions: $11,250 Adjustments (subtractions) to income: $1,200 What amount would Ross report as taxable income?Question C5 Majan Ltd income statement for the year ended 31st Dec 2020 and the balance sheets as at 31st Dec 2009 and 2019 are as follows: Income statement OMR in million Revenue 312 Cost of sales (177) Gross profit 135 Distribution expenses (36) Administrative expenses (15) 84 Rental income 14 Operating profit 98 Interest payable (13) Profit before taxation 85 Taxation (18) Profit for the year 67 Balance sheet as at 31st Dec 2020 and 2019 2020 2019 OMR in million OMR in million Non – current assets Property, plant and equipment Land and buildings 155 155 Plant and machinery 157 163 312 318 Current assets Inventories 18 21 Trade receivables 73 70 Current liabilities…

- 1. How much is the gross profit for the year ended December 31, 2021? 2. How much is the gain on sale of delivery equipment for the year ended December 31, 2021? 3. How much is the operating expenses (EXCLUDING DEPRECIATION) incurred for the year ended December 31, 2021? 4. How much is the depreciation expense for the year ended December 31, 2021? 5. How much is the net income before income tax for the year ended December 31, 2021?Statement 1: 13th month pay is exempted from income tax but the exemption is only up to a certain amount. Statement 2: Gains from sale of bonds, debentures, or certificates of indebtedness is excluded from gross income. a. Both statements are true b. Both statements are false c. Only statement 1 is true d. Only statement 2 is trueQuestion 1 Loftus et al (2023) Exercise 13.5 Amended The following information was extracted from records of Nawa Ltd for the year ended 30 June 2024. NAWA LTD Statement of financial position (extract) as at 30 June 2024 Assets Accounts receivable $ 50 000 Allowance for doubtful debts (5 000 ) $ 45 000 Motor vehicles 250 000 Accumulated depreciation — motor vehicles (50 000 ) 200 000 Liabilities Interest payable 5 000 Additional information • The accumulated tax depreciation for motor vehicles at 30 June 2024 was $100 000. • As at 30 June 2023, the balance in the deferred tax asset was $2,000 and the balance in the deferred tax liability was $8,000. • The income tax rate is 30%. Required: Prepare a deferred tax worksheet for Nawa Ltd and the end of year deferred tax journal entry required to bring the deferred tax accounts to their ending balances as at 30 June 2024.

- Question 2 Staycate Travels Inc. reports a gross profit of $35,000, interest expense of $4,000, a tax rate of 30% and earning after taxes of $8,610. What is Staycate’s depreciation expense?Question 4Each of the following is determined according to IFRS exceptSelect one: a.taxable income. b.income for book purposes. c.income for financial reporting purposes. d.income before taxes. Question 5An assumption inherent in a company’s IFRS statement of financial position is that companies recover and settle the assets and liabilities atSelect one: a.the amount that is probable where “probable” means a level of likelihood of at least more than 50%. b.their reported amounts c.the present value of future cash flows. d.their net realizable value. Question 6Machinery was acquired at the beginning of the year. Depreciation recorded during the life of the machinery could result in Future Future Taxable Amounts Deductible AmountsSelect one: a.Yes No b.No Yes c.Yes Yes d.No No5.1. ABC(LTD) is a manufacturer of Stationery. The Following information is given regarding ABC Ltd for 2021 and 2022 Income tax Expense for 2021 is R9 565 and for 2022 is R8 575 The Income tax for 2021 according to the final assessment for SARS is R9 800.00 Total Dividends declared for 2021 is R5 000. The dividends tax rate is 15% Prepare the journal entries for the year ended 31 December 2021 and 2021 (Include journal narrations) 5.2. State when will a deferred tax liability arising from temporary differences will not be recognised?