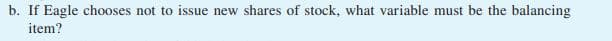

12. Using Percentage of Sales. Eagle Sports Supply has the following financial statements. Assume that Eagle's assets are proportional to its sales. (LO18-2) INCOME STATEMENT, 2019 Sales $950 Costs 250 Interest 50 Тахes 150 $500 Net income BALANCE SHEET, YEAR-END 2018 2019 2018 2019 Assets $2,700 $3,000 Debt $ 900 $1,000 1,800 $2,700 Equity 2,000 $3,000 Total $2,700 $3,000 Total

12. Using Percentage of Sales. Eagle Sports Supply has the following financial statements. Assume that Eagle's assets are proportional to its sales. (LO18-2) INCOME STATEMENT, 2019 Sales $950 Costs 250 Interest 50 Тахes 150 $500 Net income BALANCE SHEET, YEAR-END 2018 2019 2018 2019 Assets $2,700 $3,000 Debt $ 900 $1,000 1,800 $2,700 Equity 2,000 $3,000 Total $2,700 $3,000 Total

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 12QTD

Related questions

Question

Transcribed Image Text:b. If Eagle chooses not to issue new shares of stock, what variable must be the balancing

item?

Transcribed Image Text:12. Using Percentage of Sales. Eagle Sports Supply has the following financial statements.

Assume that Eagle's assets are proportional to its sales. (LO18-2)

INCOME STATEMENT, 2019

Sales

$950

Costs

250

Interest

50

Taxes

150

Net income

$500

BALANCE SHEET, YEAR-END

2018

2019

2018

2019

Assets

$2,700

$3,000

Debt

$ 900

$1,000

Equity

1,800

2,000

$3,000

Total

$2,700

$3,000

Total

$2,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning