QUESTION 6 Which of the following statements is true? O A. Companies look for investments with payback periods that are larger than their maximum accepted payback period O B. An investment with a profatibility index less than 1 is profitable and desirable OC.A projected is accepted if the IRR is less than the cost of capital O D. None of the above are true

QUESTION 6 Which of the following statements is true? O A. Companies look for investments with payback periods that are larger than their maximum accepted payback period O B. An investment with a profatibility index less than 1 is profitable and desirable OC.A projected is accepted if the IRR is less than the cost of capital O D. None of the above are true

Chapter15: Capital Structure Decisions

Section: Chapter Questions

Problem 12SP

Related questions

Question

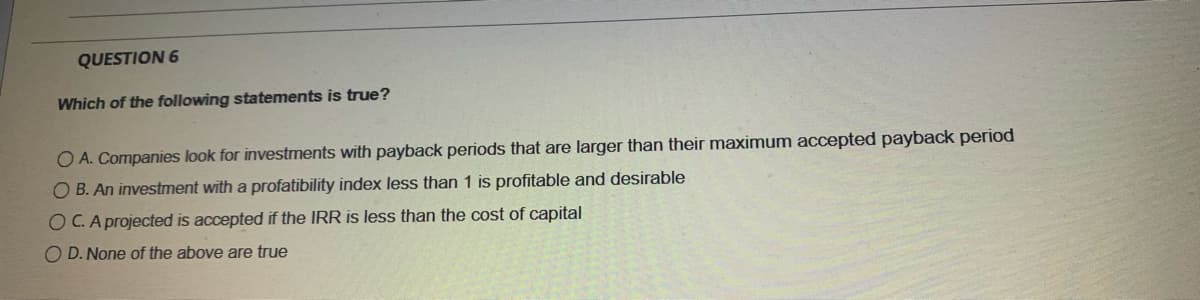

Transcribed Image Text:QUESTION 6

Which of the following statements is true?

O A. Companies look for investments with payback periods that are larger than their maximum accepted payback period

O B. An investment with a profatibility index less than 1 is profitable and desirable

O C.A projected is accepted if the IRR is less than the cost of capital

O D. None of the above are true

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning