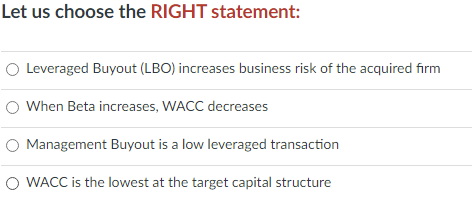

Let us choose the RIGHT statement: O Leveraged Buyout (LBO) increases business risk of the acquired firm O When Beta increases, WACC decreases O Management Buyout is a low leveraged transaction O WACC is the lowest at the target capital structure

Q: All else held constant, which one of these is most apt to increase the WACC of a leveraged firm?…

A: Weighted Average Cost of Capital =Kd1-T×DD+E+Ke×ED+E where Kd=Cost of Debt Ke=Cost of Equity T=Tax…

Q: OPTIMAL CAPITAL STRUCTURE Compugates Holdings is trying to deter- mine its optimal capital…

A: WACC takes all source of capital into account and assigns weights for computation. WACC increase…

Q: Which of the following does NOT directly affect a company's cost of equity? Select one: a. Return…

A: The capital asset pricing model (CAPM) describes the relationship between the expected return and…

Q: An increase in a firm's leverage ratio O A. tends to decrease the expected profit per unit of…

A: The financial leverage ratio is the amount of debt a company has compared to its total capital. The…

Q: All of the following are true of the trade-off capital structure theory EXCEPT the idea is to…

A:

Q: QUESTION 6 Which of the following statements is true? O A. Companies look for investments with…

A: Capital Budgeting: This question is related to capital budgeting where a company decides which…

Q: A. When retained earnings are exhausted, the MCC breaks upward. What happens if the firm continues…

A: Retained Earnings refer to that part of net income or profit that is just leftover after making…

Q: Which one of the following statements related to the Security Market Line approach to equity…

A: "The model is dependent upon a reliable estimate of the market risk premium". Since the equity is…

Q: Suppose a firm maintains its preferred debt-equity and pays dividends only after meeting its…

A: Company with growth opportunities available distribute dividend after meeting the requirements of…

Q: Barton Industries expects next year's annual dividend, D1, to be $1.70 and it expects dividends to…

A: Meaning of flotation cost - flotation cost are the costs incurred by a company at the time of…

Q: A working capital financing policy that finances almost all assets with long-term capital a.…

A: Working capital is the difference between current assets and current liabilities.…

Q: Each of the following factors affects the weighted average cost of capital (WACC) equation. Which of…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: Other things equal, which of the following will decrease the WACC of a firm that has both debt and…

A: The Weighted Average Cost of Capital and Capital Structure both are important factors in an…

Q: A very high degree of capital market efficiency a. mispricing never occurs. b. means share…

A: In this question we have four options for the given statement and we need to choose correct option.…

Q: A firm using a Leveraged vs a Conservative Capital Structure would have the following…

A: Capital structure is the structure of financing the funds from the different source. Sources are the…

Q: Match the following ✓ A premium over and above the risk-free rate. A. Financial Leverage ✓ The…

A: Answer - Match the Following : Particulars A premium over and above the risk free rate C.…

Q: The Cost of Capital: Cost of New Common Stock If a firm plans to issue new stock, flotation costs…

A: The computation of the flotation cost adjustment as follows: The formula used for the above table…

Q: The stockholders’ claim in a levered firm can beviewed as a call option; stockholders have the…

A: Stockholder: An individual or group holding the equity stock of the company is called the…

Q: If a firm increases its leverage, which extended Du Pont equation ratio is directly affected?

A: Du Pont Equation: The DuPont analysis is a structure for examining fundamental performance spread by…

Q: A rights offering

A: The correct answer is d. gives the firm a built-in market for new securities.

Q: Which combination of investment policy and financing policy related to working capital provides the…

A: A relaxed current asset investment policy is one under which relatively large amounts of current…

Q: Which one of the following statements is NOT CORRECT? o Investors may interpret a stock repurchase…

A: The question is related to Dividend Policy.

Q: Which of the following statements is CORRECT?

A: The capital structure simply refers to the make-up of capitalization or long-term capital of a…

Q: What does indifference point mean in EBIT-EPS analysis? Select one: O a. The point of indifference…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The market value of a firm's outstanding common shares will be higher, everything else equal, if…

A: Company means a form of business where the share holder invest money in business in form of shares…

Q: Suppose a firm invest in proects that are much riskier than its average investments. Do you think…

A: A firm funds its investments either with shareholders' equity or debt. One of the major criteria…

Q: In order to maximize the shareholder value, the financial manager should strive to move towards the…

A: Capital structure refers to the financial mix of debt and equity. A well-balanced capital structure…

Q: (WACC) and leverage

A: Cost of capital refers to the tool which is helpful in analyzing the cost of the capital projects…

Q: Which of the following events will reduce the company’s WACC?

A: Capital Asset Pricing Model (CAPM) describes the risk-return trade-off for securities. It…

Q: What is the blend of long-term financial sources used to finance the firm which may include debt,…

A: Explanation: The blend of long term financial resources that is used to finance the firm may include…

Q: Please explain if a company has already taken too much debt (exceeded the amount that they can…

A: A used buyout happens when an association buys one more association with the assistance of acquired…

Q: If the firm has excess liquidity, its shareholders consist of High Networth Individuals sunjected to…

A: A ratio that helps to evaluate the profitability of the company and also shows how efficient a…

Q: Assume that Modigliani-Miller Propositions 1 and 2 hold. Ex- plain carefully why the conclusion of…

A: The Modigliani-Miller theorem (MM) states that the market value of a company is calculated by its…

Q: a. Consider two investment opportunities A and B. Investment A: Expected return =0.08, Standard…

A: Since you have posted multiple questions, we will answer the first one for you. If you want a…

Q: Consider the following statements about a firm: I. The debt beta of a firm is usually quite low. If…

A: Weighted Average Cost of Capital is referred to as the common method for determining the required…

Q: Which of the following is not a typical characteristic of a leveraged buyout target O Low debt…

A: Leverage buyout is a strategy to acquire firm by substantially borrowed funds.

Q: This question is related to Chapter 18 of Berk & Demarzo "Capital Budgeting and Valuation with…

A: With constant debt-equity ratioAdjusted Present Value is used to value a firm’s total investment by…

Q: The higher the firm's flotation cost for new common equity, the more likely the firm is to use…

A: Flotation costs is defined as the costs, which are usually incurred through the publicly traded…

Q: Is this statement true or false? Give a reason for your answer. "The bird-in-hand theory suggests…

A: It indicates that the investors will generally prefer the stock dividends to expected capital gains…

Q: Identify the corect statement: O H EBIT is expected to be below the indifference point, the firm…

A: EBIT - EPS indifferent point is the EBIT level at which EPS is same

Q: retention rate × return on new investment.

A: Retention Ratio: Retention ratio is the amount taken out as retained earnings. Retained earning are…

Q: One position expressed in the financial literature is that firms set their dividends as aresidual…

A: A residual dividend policy is one where a company uses residual equity to fund dividend payments.…

Q: What is the advantage of an ETF relative to open-end and closed-end investment company? ____ A)…

A: ETF has quite advantages over open ended and closed ended investment company.

Q: Is the debt level that maximizes a firm's expected EPS the same as the one that maximizes its stock…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: company has only one project. Then The beta of their portfolio will be larger than the beta of…

A: Introduction : The uncertainty and systematic risk—of any securities or securities portfolio in…

Q: What is the blend of long-term financial sources used to finance the firm which may include debt,…

A: Debt is cheaper source of finance but increases volatility.

Q: Briefly explain the tradeoff hypothesis and how it is related to the long-run survival of a firm? “…

A: Leverage means the use of fixed costs, the firm increases manifold or levers up its…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Which of the following is correct a. In a leveraged recapitalization, a firm uses its excess cash to buyback shares b. In an LBO, a firm borrows and repurchases its shares thereby reducng the number of shares outstanding. c. In a leveraged recapitalization, a change of ownership occurs as the firm is sold d. In an LBO, debt is a major component of the financing and a change of control occurs. e. In an LBO, managers use excess cash to repurchase sharesReverse engineering share prices is an exercise in deductive reasoning. If we assume market price reflects share value, then through reverse engineering we can infer what the market assumes about a. the expected rate of return on equity capital, holding expected profitability and long-run growth constant. b. the expected profitability, holding the expected rate of return on equity capital and long-run growth constant. c. the expected long-run growth, holding the expected rate of return on equity capital and expected profitability constant.Which of the below statements does the MM Proposition I predict? A. In a perfect market, the value of a firm is independent of its capital structure B.In a perfect market, the discount rate depends on the capital structure C.In a perfect market, the value of a firm decreases in leverage D.In a perfect market, the NPY of investments depends on the existing debt/equity mix

- Is the debt level that maximizes a firm's expected EPS the same as the one that maximizes its stock price? Explain. Explain how a firm might shift its capital structure so as to change its weighted average cost of capital (WACC). What would be the impact on the value of the firm?Which one of the following statements related to the Security Market Line approach to equity valuation is correct? Assume the firm includes debt in its capital structure. Group of answer choices This model considers a firm's rate of growth. The model will never produce the same cost of equity as the dividend growth model. The model is dependent upon a reliable estimate of the market risk premium. This approach generally produces a cost of equity that equals the firm's overall cost of capital. The model applies only to non-dividend-paying firms.Which of the following statements regarding the capital structure is CORRECT? Group of answer choices: According to the M&M theory under perfect market assumptions, the value of a firm with no debt is the same as that with 100% debt. A firm's optimal capital structure is one that maximizes both its expected EPS and stock price. The pecking order model predicts that the equity financing is more preferred to debt financing. According to the M&M theory, if only corporate taxes are considered, the optimal capital structure is one with 0% debt financing. According to the static tradeoff model, a firm's optimal capital structure can be obtained by considering the debt-related costs only.

- One position expressed in the financial literature is that firms set their dividends as aresidual after using income to support new investment.a. Explain what a residual dividend policy implies, illustrating your answer with a tableshowing how different investment opportunities can lead to different dividend payoutratios.b. Think back to Chapter 14 where we considered the relationship between capital structureand the cost of capital. If the WACC-versus-debt-ratio plot was shaped like a sharp V,would this have a different implication for the importance of setting dividends accordingto the residual policy than if the plot was shaped like a shallow bowl (a flattened U)?Which of the following statements are true and which are false? o). High breakeven points in capital intensive industries are desirable. p). The fixed return on borrowed capital (i.e., interest) is more risky than profits paid to equity investors (i.e., stockholders) in a firm.The Cost of Capital: Cost of New Common Stock If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. Because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows:The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.80 and it expects dividends to grow at a constant rate g = 4.2%. The firm's current common stock price, P0, is $20.60. If it needs to issue new common…

- Which statement below is incorrect? Select one: A. Compared to interview, survey is more suitable to ask standardised questions. B. If a firm has more intangible assets, according to the trade-off theory, it is more likely to have a higher leverage. C. If a firm is more profitable, according to the pecking order theory, it should use less debt for financing. D. The CAPM model implies that a stock with a higher beta has a higher return on average.. If a publicly traded company has a large numberof undiversified investors, along with some whoare well diversified, can the undiversified investorsearn a rate of return high enough to compensatethem for the risk they bear? Does this affect thecompany’s cost of capital?Which of the following statements are CORRECT? Check all that apply: The aftertax cost of debt decreases when the market price of a bond increases. A decrease in a firm's WACC will increase the attractiveness of the firm's investment options. Cost of capital is also known as the minimum expected or required return an investment must offer to be attractive.