QUESTION 7 S started a new business on Jan 1, 2018. P purchased 30% stock of S on Jan 1 2018 for $200,000. The net income and dividends paid by S for 2018 and 2019 am s follows Year 2018 2019 Net income of S 60,000 40,000 Dividends paid by S 40,000 70,000 Using the cost method, the increase in the net income of P related to its investment in S for the year 2019 will be O $21,000 O $14,000 $12,000 $18,000

QUESTION 7 S started a new business on Jan 1, 2018. P purchased 30% stock of S on Jan 1 2018 for $200,000. The net income and dividends paid by S for 2018 and 2019 am s follows Year 2018 2019 Net income of S 60,000 40,000 Dividends paid by S 40,000 70,000 Using the cost method, the increase in the net income of P related to its investment in S for the year 2019 will be O $21,000 O $14,000 $12,000 $18,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 25E

Related questions

Question

1.

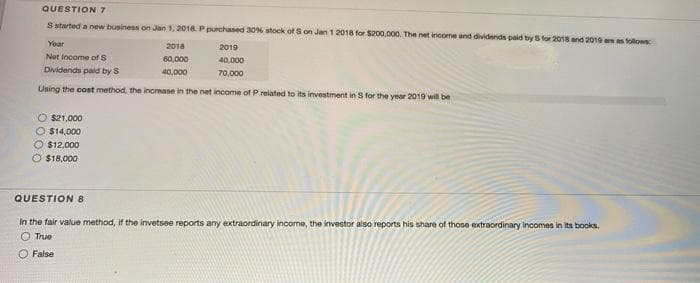

Transcribed Image Text:QUESTION 7

S started a new business on Jan 1, 2018. P purchased 30% stock of S on Jan 1 2018 for $200,000. Thn net income and dividends paid by S for 2018 and 2019 am as follows

Year

2018

2019

Net Income of S

60,000

40.000

Dividends paid by S

40,000

70,000

Using the cost method, the increase in the net income of P related to its investment in S for the year 2019 will be

O s21,000

O $14,000

$12,000

O $18,000

QUESTION 8

In the fair value method, if the invetsee reports any extraordinary income, the investor also reports his share of those extraordinary Incomes in its books.

O True

O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning