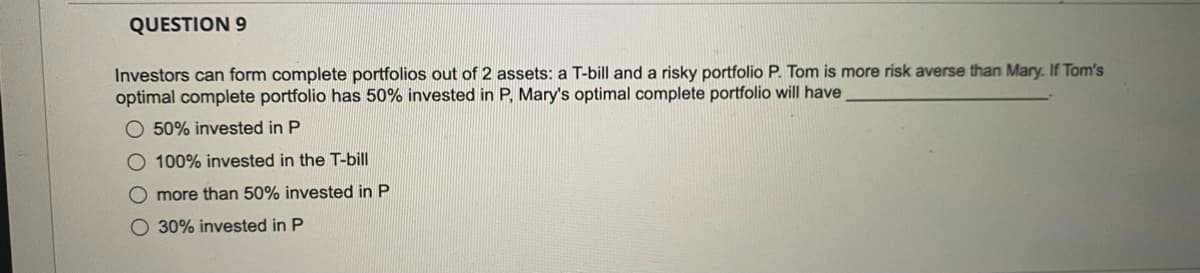

QUESTION 9 Investors can form complete portfolios out of 2 assets: a T-bill and a risky portfolio P. Tom is more risk averse than Mary. If Tom's optimal complete portfolio has 50% invested in P, Mary's optimal complete portfolio will have O 50% invested in P O 100% invested in the T-bill O more than 50% invested in P O 30% invested in P

Q: Dual classes of common stock are common in a number of countries. Assume that Yehti Manufacturing…

A: The ability to vote allows shareholders to participate in the company's annual general meeting. Only…

Q: Question 1 The TLC Yogurt Company has decided to capitalize on the exercise fad and plans to open…

A: As per the given information: Equipment cost - $50,000Shipping and installation charges -…

Q: Suppose that a perpetual annuity has a present value of $33 million. What interest rate r would…

A: Present Value = $33,000,000 Annual Payout = $1,800,000

Q: Constant growth rate, infinite horizon (with growth rate estimate) from past history: using the…

A: As the given information: Required rate of return - 18%…

Q: Say that you purchase a house for $174,000 by getting a mortgage for $155,000 and paying a down…

A: Monthly payments refer to an amount that is being paid at the end of each month for the repayment…

Q: 4. How many years are the following zero coupon bonds, if they all yield 4% and have a face value of…

A: A zero coupon bond, as its name indicates, is a bond that has zero coupons. In other words, these…

Q: A gentleman bought a limited edition Wolverine figurine in 1974 for $0.15. In 2012, 38 years later,…

A: The return earned on an investment can be calculated using the future value, present value and…

Q: n the following information for Sookie’s Cookies Co., calculate the depreciation expense: sales =…

A: The net income is the income earned after doing payment for all expenses that are required for…

Q: ABC company has issued a bond that is pays semi-annually at an annual coupon 1.75% and the risk…

A: Bonds are long term source of finance for government and companies and the yield on bond depends on…

Q: alculate the value of a R1,000 bond which has 10 years until maturity and pays quarterly interest at…

A: Price of bond is the present value of coupon payment and plus present value of face value of bond…

Q: million and a cost of goods so

A: = Current Assets -Current Liabilities Whereas current assets = Cash+Inventory+Accounts…

Q: Usir

A: Given Stock Price S = 44, Strike Price x = 31.98, Rf = Risk-free rate of return, =7.7%,=0.077Time…

Q: a) Assuming Treasury bills yield is 1% and the market risk premium is 7%. If your portfolio beta is…

A: Note: Hi! Thank you for the question, As per the Honor code, we are allowed to answer one question…

Q: Explain how capital adequacy requirements may affect a commercial bank’s dividend payout and growth…

A: Capital adequacy requirement refers to the amount of capital a bank must have as per the requirement…

Q: hat relationship exists between the length of the loan and the monthly payment? How does the…

A: Loans are paid by the monthly payments that are fixed payments and the monthly payments carry the…

Q: An investment advisor has recommended a R50,000 portfolio containing assets R, J, and K; R25,000…

A: There are 3 assets with different return with different amount. Portfolio return will be computed…

Q: Assume that the risk-free rate is 3.5% and the required return on the market is 11%. What is the…

A: An asset's expected returns are determined using the CAPM algorithm. It is predicated on the notion…

Q: A monthly deposit of $300 is put into an account earning 5% interest compounded monthly. Round to…

A: Solution:- When an equal amount is depsited each period at end of period, it is called ordinary…

Q: Q22 A small business owner visits his bank to ask for a loan. The owner states that he can repay a…

A: The amounts being paid for the loans are like an annuity. As two different amounts are involved…

Q: financial option is. Give an example

A: A financial instrument which is based on the market value of underlying securities, such as stocks,…

Q: 1-Jan $33.88 5-Feb $30.67 14-May $29.49 13-Aug $32.38 12-Nov $39.07 31-Dec $41.99 $0.17 $0.17 $0.17…

A: Cumulative return is an aggregrate return on the investment and is not annualized. It is the total…

Q: he company we work for wi ceiving payments from cust uring this year in dollar, as p ble below…

A: The payments are received from the company and some time they are lesser and sometime they are more…

Q: A corporate bond with semi-annual interest payments has a yield to maturity of 6.05% and a current…

A: Solution:- Bond price means the price at which a bond is trading in the market. It is the summation…

Q: or the data set Download data set, perform a 3 month moving average to determine the forecast for…

A: Moving Average Formula= C1+C2+C3+C4+.....CnN C1, C2, C3, C4, ....Cn stands for closing prices,…

Q: You invested money in two funds. Last year, the first fund paid a dividend of 9% and the second a…

A: As per Bartleby honor code, when multiple questions are aksed, the expert is required only to solve…

Q: 5 B 3. What is the semi-annual coupon rate on the following government bonds? YTM 4.00% Semi-ann…

A: Here, To Find: Semi-annual coupon rate =?

Q: A company sold $250,000 bonds and set up a sinking fund that was earning 7% compounded semi-annually…

A: A sinking fund refers to an account in which money is kept aside for making payments of debt or…

Q: stock is a special form of stock having a fixed periodic dividend that must be paid prior to payment…

A: Preferred stocks are very different kind of equity that carry the fixed dividend payments to be paid…

Q: Use the following tax table to determine how much income tax is paid on 915000 of taxable income.…

A: Rate Taxable Income Bracket 10% $0 to $9,325 15% $9,325 to $37,950 25% $37,950 to $91,900…

Q: A young couple wants to have a college fund that will pay $40,000 at the end of each half-year for 8…

A: Investment refers to the financial asset that is being invested for generating income further in the…

Q: Company Zero is a non-listed private company with total equity of P10 million and debt of P4.5…

A: Levered beta means the capital structure of the company has debt and that the risk of debt is…

Q: DR 1 Future Value 2 Interest Rate 3 Part a 4 Present Value 5 Part b Payment 7 Part c 8 Future Value…

A: You have a very specific doubt about an input used in calculation of PV and FV. We need to…

Q: if had a fund of RM55,000 and planned to invest his money in two different schemes. He invested 60%…

A: More is the compounding of interest than more is the effective interest rate and more is the future…

Q: IRR - Discuss why some investment analysts prefer NPV methods to rank investments while others…

A: NPV and IRR are two main capital budgeting methods that are used quite extensively in the selection…

Q: 4. A large corporation subjected to 35% tax is investing in a new income producing asset that is…

A: Internal Rate of Return: The discount rate that reduces a project's net present value to zero is…

Q: ABC company borrows $300,000 at 7.4% compounded monthly. The loan is due in 10 years. How much…

A: Compounded amount is the value determined where the interest earned on the loan also earns interest.…

Q: 6. Assume a bank has $200 million of assets with a duration of 2.5, and $190 million of liabilities…

A: Bank profitability and interest rates are related, with banks profiting from higher interest rates.…

Q: Find the amount that should be invested now to accumulate the following amount, if the money is…

A: Future Value (FV) $ 13,000.00 Interest Rate 6.30% Time Period 5 Frequency…

Q: f. To help you reach your $1,000 goal, your father offers to give you $400 in one year. You will get…

A: The future value of an amount is the value of the investment after certain time period when invested…

Q: Q 17 You invested $2,000 in the stock market one year ago. Today, the investment is valued at…

A: Solution:- Rate of return means the percentage of income earned to the initial investment made. So,…

Q: u are analyzing the cost of debt for a firm. You know that the firm’s 14-year maturity, 6.60 percent…

A: Yield to maturity is the rate of return realized when bond is held to maturity and all payments are…

Q: Liam Hernandez paid 112,000 for a single family home on July 1, 2021 and immediately placed it in…

A: Depreciation refers to the reduction in the value of an asset due to tear, obsolescence, market…

Q: Consider a financial institution with two assets: 10 percent of the portfolio in one-month Treasury…

A: We have to find the one month liquidity index value. We know the value today and a month later.

Q: STM Inc. is considering a 3-year project with an initial cost of $825,590. The project will n…

A: NPV is the net present value which is main fundament capital budgeting technique that is used most…

Q: (Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase…

A: Net present value(NPV) is the difference between present value of all cash inflows and Initial…

Q: Which of these cases would be subject to the "kiddie tax"? Mina, age 12, earned $800 in dividends,…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: You are given the following information for Lighting Power Company. Assume the company's tax rate is…

A: Here, Cost of debt: No. of bonds outstanding 21,000.00 Coupon rate 7.00% Maturity period…

Q: it says its wrong

A: Data given: FV= $60000 n=6 years rate=12% (compounded annually) Required: Amount to be invested at…

Q: growing rapidly. Dividends are expected to grow at rates of 25%, 18%, and 12% over the next three…

A: Dividends are cash amount that is paid out the shareholders out the net income because they are…

Q: entory balance was $1.67

A: First of all, find ITOR (Inventory Turnover Ratio) = Cost of Goods Sold COGS/ Average Inventory.…

Step by step

Solved in 2 steps

- Quantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $300,000 1.3 B 200,000 1.6 C 500,000 0.75 D 0 -0.15 Total investment 1,000,000 The market's required return is 11% and the risk-free rate is 3%. What is the portfolio's required return? Round your answer to 3 decimal places. Do not round intermediate calculations.%Problem 11-23 Analyzing a Portfolio You want to create a portfolio equally as risky as the market, and you have $2,400,000 to invest. Given this information, fill in the rest of the following table: (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Asset Investment Beta Stock A $360,000 1.00 Stock B $624,000 1.10 Stock C 1.20 Risk-free assetQuantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $300,000 1.2 B 200,000 1.6 C 400,000 0.75 D 100,000 -0.35 Total investment $1,000,000 The market's required return is 11% and the risk-free rate is 4%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places.

- INV 1 4b You have invested in a portfolio of 60% in risky assets (Portfolio R) and 40% in T-bills. The risky portfolio is described below: E(rR)=12% σR =15% T-bill rate 3% Expected Return on Overall Portfolio is 8.4% What is the standard deviation of your overall portfolio?QUESTION 10 An investor wishes to construct a portfolio by borrowing 35 percent of his original wealth and investing all the money in a stock index. The return on the risk-free asset is 4.0 percent, and the expected return on the stock index is 15 percent. Calculate the expected return on the portfolio. a. 9.50 percent b. 18.25 percent c. 11.15 percent d. 15.00 percent e. 18.85 percentQUESTION 7 An investor wishes to construct a portfolio consisting of a 70 percent allocation to a stock index and a 30 percent allocation to a risk-free asset. The return on the risk-free asset is 4.5 percent, and the expected return on the stock index is 12 percent. Calculate the expected return on the portfolio. a. 16.50 percent b. 17.50 percent c. 14.38 percent d. 9.75 percent e. 8.25 percent

- Question content area top Part 1 (Portfolio expected rate of return) Barry Swifter is 60 years of age and considering retirement. Barry's retirement portfolio currently is valued at $750,000 and is allocated in Treasury bills, an S&P 500 index fund, and an emerging market fund as follows: LOADING... Expected Return $ Value Treasury bills 2.5% 90,000 S&P 500 Index Fund 7.2% 410,000 Emerging Market Fund 13.5% 250,000 . a. Based on the current portfolio composition and the expected rates of return given above, what is the expected rate of return for Barry's portfolio? b. Barry is considering a reallocation of his investments to include more Treasury bills and less exposure to emerging markets. If Barry moves all of his money from the emerging market fund and puts it in Treasury bills, what will be the expected rate of return on the resulting portfolio? Question content area…INV 1 4b You have invested in a portfolio of 60% in risky assets (Portfolio R) and 40% in T-bills. The risky portfolio is described below: E(rR)=12% σR =15% Compute the standard deviation of your overall portfolio.Question 6 Suppose that an investor has £1,000,000 to invest in a portfolio containing stocks A, B and a risk-free asset. The investor must invest all her money, and she is using the Capital Asset Pricing Model (CAPM) to make predictions of the expected return-beta relationship. Her objective is to create a portfolio that has an expected return of 14% and which has a beta of 0.75. If stock A has an expected return of 30% and a beta of 1.9, stock B has an expected return of 20% and a beta of 1.4, and the risk-free rate is 8%, how much money will she invest in stock A? Explain your answer and show your calculations.

- Ch 13] Julia has $5,000.00 to invest in a portfolio. She will build the portfolio from threeassets: Stock A with an expected return of 16.0% and a standard deviation of 42% Stock B with an expected return of 12.0% and a standard deviation of 32% T-Bills with an expected return of 4.00% and a standard deviation of 0%.Assume that she can short sell T-bills, the risk-free asset (or borrow at the risk-free rate).Assume also that she will invest the same amount in Stock A and Stock B. How muchmoney will she invest in Stock A if her goal is to create a portfolio with an expected returnof 20.00%.$(to nearest $0.01)Finance Your portfolio consists of 75 shares of CSH and 60 shares of EJH, which you just bought at 21 and 30 per share, respectively. a. What fraction of your portfolio is invested in CSH? In EJH? b. If CSH increases to 23 and EJH decreases to 27 , what is the return on your portfolio? fraction invested CSH is fraction invested EJH Return % Note Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Do not provide Excel Screet shot rather use tool table Answer completely.Question a The expected return and standard deviation of a portfolio that is 50 percent invested in 3 Doors, Incorporated, and 50 percent invested in Down Company. are the following: 3 Doors, Incorporated Down Company Expected return, E(R) 14% 10% Standard deviation, σ 42 31 What is the standard deviation if the correlation is +1? 0? −1? Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line