Q: Company A 8/10/15/3 Company B 10/6/16/5 a. Calculate the single equivalent discount rate for each…

A: The single equivalent discount rate represents the overall discount rate provided by the company.…

Q: ou are valuing a restaurant in Bergen with the following formation: - The restaurant had a pretax…

A: Quantum and timings of cash flows emanating from a restaurant are available. We have to value the…

Q: At December 31, 2020, Albrecht Corporation had outstanding 388,000 shares of common stock and 10,000…

A: Given: Particulars Amount Net loss -$2,038,000 Outstanding shares 388000 Preference shares…

Q: A middle-income worker with a dependent spouse older than the normal retirement age retired in…

A: Replacement rate refers to the annual employment income of an individual replaced by a retirement…

Q: For each of the following annuities, find the best matching description (given that each answer…

A: Contingent annuity: An annuity paid over a variable number of periods is known as a contingent…

Q: Guelph Inc. would like you to assess the after-tax viability of a new machine using annual worth…

A: An annual worth analysis is a widely used technique for assessing the viability of an investment. It…

Q: Elana and Wiyot borrowed $41,000 at 8.54% compounded monthly as a second mortgage loan against their…

A: Mortgage loans are very common for purchasing the homes and it make the home purchase very easy…

Q: You want to buy a computer for $2,000. The interest rate is on the loan is 12%, and you have 18…

A: First we will calculate EMI, so that we know how much we are paying in each payment. Formula for…

Q: 10. Consider the following price and dividend data for Quicksilver Inc.: Year Price (£)…

A: Concept. At annual rate of return , Sum of Present value of dividend and present value of share…

Q: Consider a borrow-and-invest strategy in which you use $1 million of your own money and borrow…

A: Solution:- Risk premium refers to the expected extra returned over the above the risk free rate of…

Q: If you invest £100 now and expect to receive £133.1 in 2 years time, what is the Internal Rate of…

A: Note: In Option, a) 0 is being used instead of the bracket, and accordingly it is 15% and not…

Q: Tribbles-R-Us has 200,000 shares outstanding and just paid a $0.25 per share dividend. The market…

A: Solution: Capital Asset Pricing Model (CAPM) is a model which gives a formula to calculate the…

Q: 3. You bought a bond (par=$1,000) three years ago for $1,040. The bond is now selling for $990. It…

A: The realized return from the means refers to the return received on a bond during the holding…

Q: United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would…

A: NPV method makes it easy for any company to take a decision about a particular project whether to…

Q: .How can options, futures, and forward contracts be used to devise simple hedging strategies?…

A: Options, futures and forwards are derivative contracts that can be used to hedge the underlying…

Q: Consider the following information about the various states of economy and the returns of various…

A: State of the Economy Probability T-Bills Philips Pay-up Rubber made Market Index Recession 0.2 7%…

Q: A company sold $200,000 bonds and set up a sinking fund that was earning 8.5% compounded…

A: A bond refers to an instrument that shows loan amount with interest rates made by an investor to a…

Q: 'Suppose an investment will cost $90,000 initially and will generate the following cash flows: 'Year…

A: We have to find the MIRR of a series of cash flows. For doing so, we need to find the PV of all…

Q: Compare the following 2 alternatives with a method of your choice. The market rate is 6% and inflat…

A: Present value of growing annuity With periodic interest rate (r), period (n), growth (g) and annuity…

Q: Suppose that BBB pays corporate taxes of 35% and that shareholders expects the change in debt to be…

A: An unlevered firm is one which has no debt in its capital structure. A levered firm is one which has…

Q: common stock of Leaning Tower of Pita, Inc., a restaurant chain, will generate the following payoffs…

A: Standard deviation is measure of risk of return of the stock and more is standard deviation than…

Q: What’s the interest rate of a 5-year, annual $5,200 annuity with present value of $21,000? (Use a…

A: Annual payment = $5,200 Present value = $21,000 Period = 5 years Interest rate = ?

Q: A premium bond is purchased to yield 4% convertible semiannually. The amount of premium amortized in…

A: Bond Amortization The amortization of excess premium paid over and above the face value of the Bond…

Q: Suppose a state lottery prive of $3 mition is to be paid in 20 peyments of si 50,000 each at the end…

A: An annuity consists of payments at regular intervals at a predetermined interest rate. The present…

Q: Scheduled payments of $1054, $789, and $508 are due in one-and-a-half years, four years, and six…

A: Here, Schedule payment (FV) $1,054.00 Time period (NPER) 1.50 Schedule payment (FV) $789.00…

Q: The units of Manganese Plus available for sale during the year were as follows: Mar. 1 20 units @…

A: The periodic inventory system is where the accounting and inventory records are not updated after…

Q: Juliana Cardenas, owner of the Baker Company, was approached by a total local dealer of…

A: In a typical capital budgeting decision, we need to know the annual cost savings that will make the…

Q: For each of the following annuities, find the best matching description (given that each answer…

A: An annuity refers to a stream of equal cash flows that occur at regular intervals. There are…

Q: What annual rate of return is earned on a $5,000 investment when it grows to $10,250 in five years?…

A: Investment (P) = $5,000 Accumulated amount (A) = $10,250 Period (n) = 5 Years

Q: Avondale Aeronautics has perpetual preferred stock outstanding with a par value of $100. The stock…

A: A company's preferred stock cost is effectively the price it pays in exchange for the income it…

Q: You are comparing Stock A to Stock B. Given the following information, what is the difference in the…

A: Expected rate is mean rate of return considering the different scenario and probability of different…

Q: Clark and Lana take a 30-year home mortgage of $128,000 at 7.9%, compounded monthly. They make their…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Fill the parts in the above table that are shaded in yellow. You will notice that there are nine…

A: Formula for calculating Mean, Standard deviation and coefficient of variation with probability is as…

Q: RatePicker Co.'s bonds, issued 2 years ago, currently sell for $1,076. They have an annual coupa…

A: Yield to maturity of bond is rate of return realized on the bond when that is held till maturity and…

Q: You wish to buy a $9,100 dining room set. The furniture store offers you a 2-year loan with an APR…

A: Loan amount (P) = $9,100 Monthly interest rate (r) = 0.0075 (i.e. 0.09 /12) Number of payments (n)…

Q: The part of finance concerned with design and delivery of advice and financial products to…

A: Finance is the amount of money needed to run a business. Finance is the study of banking, capital…

Q: The following table gives Foust Company's earnings per share for the last 10 years. The common…

A: Given: Year EPS Year EPS 2012 $3.90 2017 $5.73 2013 $4.21 2018 $6.19 2014 $4.55…

Q: What annual interest rate would you need to earn if you wanted a $600 per month contribution to grow…

A: The yearly rate of return technique, often known as the annual percentage rate, calculates the…

Q: The investor has R60,000 to invest. R15,000 will be invested into the market portfolio, R10,000 into…

A: Beta shows the risk related to overall market risk and it show that how stock is sensitive to the…

Q: A change in the risk premium, E(Rm) - Rf, results in... a) A change in the vertical intercept of…

A: concept. The security market line (SML) gives the market’s expected return at different levels of…

Q: Given the following information for Notten Power Co., find the WACC. Assume the company tax rate is…

A: WACC OR Weighted average cost of capital = ((Weight of equity or we)*(Cost of equity or ke) +…

Q: Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. It is considering the…

A: Net present value (NPV):The net present value is a technique used for making the investment…

Q: You are considering purchasing a new injection molding machine. This machine will have an estimated…

A: Concept. Maximum amount to be spent on purchasing the injection molding machine = present value of…

Q: J 8 What will be the nominal rate of return on a perpetual preferred stock with a $100 par value, a…

A: Solution:- Preferred stocks are that type of stocks which get preference over the common stock at…

Q: John Lewis of Hungerford plc may have returns next year as follows: Return probability…

A:

Q: 5. 1.) What is the difference between current assets and plant and equipment? Do you think land…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: QUESTION 31 Leo offers to sell Mona a computer. Mona sends an acceptance via the mai. This…

A: As per Bartleby honor code, when multiple questions are asked, the expert is required only to solve…

Q: Find the present value of an ordinary annuity with payments of $18,579 quarterly for 7 years at 8.4%…

A: Quarterly interest rate = Annual rateFrequency of compounding in a year = 0.0844 = 0.021 or 2.10%…

Q: A 10-year, 8.00%, $4,000 bond that pays dividends quarterly can be purchased for $3,515. This means…

A: EAR The total interest rate an investor can earn in a given year after accounting for the effects of…

Q: ur investment is growing at 20%, how would you calculate how long it would take to double in size?…

A: The future value of money is amount being deposited and amount of interest being accumulated over…

Step by step

Solved in 2 steps

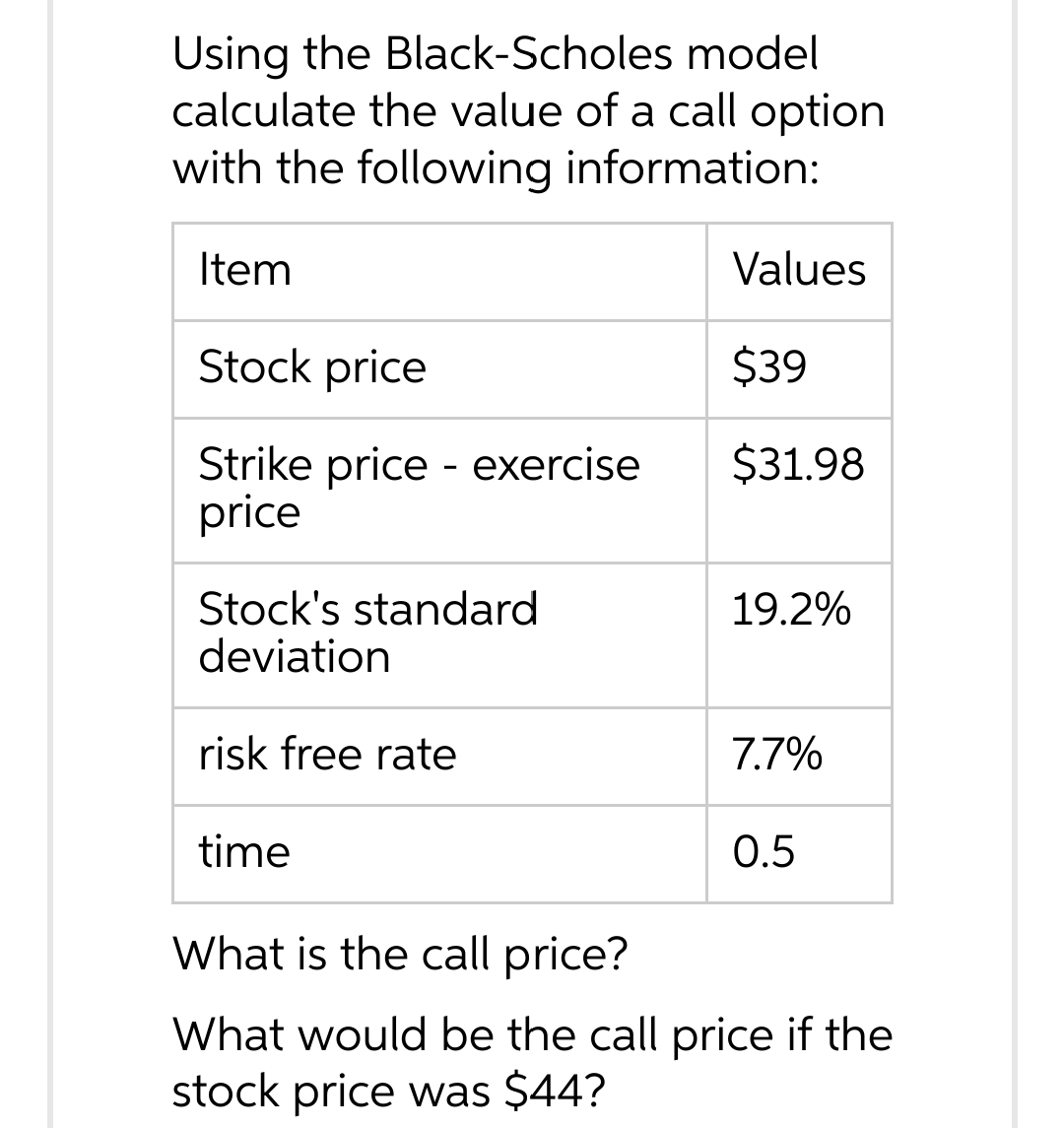

- A put option has a strike price of MYR3.00/SGD. If the option is exercised before maturity, what price in the followings would maximize gain? a. MYR3.00/SGD. b. MYR2.90/SGD. c. MYR3.05/SGD. d. MYR2.95/SGD.Topic: Option Pricing When computing, please do not round off. Only final answers must be rounded off to two decimal places Based on the Black-Scholes model, the price of a put option should be P2,800. If the underlying asset has a strike price of P60,000 and a market price of P58,500, how much is the extrinsic value of the option?Using the attached option pricing model and related data K = 45; St = 40 t = 4/12; r =03; SD/σ = 0.4; N = 0.07, calculate the value of the call option

- Put together a Black–Scholes option calculator in Excel to answer the following.(a) What is the call-option value withS0 = $45, K = $48, r = 6%, T = 15 months,and volatility = 40%?(b) What is the put-option value withS0 = $60, K = $65, r = 6%, T = 18 months,and volatility = 20%?(c) What is the put-option value withS0 = $38, K = $40, r = 6%, T = 3 months,and volatility = 60%?(d) What is the call-option value withS0 = $100, K = $95, r = 8%, T = 3 years,and volatility = 40%?In the context of single period binomial option pricing model with p*d = 0.75 and rf = 0.25 the values of the state price must be equal to A. PV$1u = $0.20 and PV$1d =$0.60 B. PV$1u = $ 0.25 and PV$1d = $0.50 C. PV$1u = $0.20 and PV$1d = $0.50 D. PV$1u = $0.60 and PV$1d =$0.20Consider a one-period binomial model in which the underlying is at 65 and can go up 30% and down 22%. The risk-free rate is 8%. The price of the call option with exercise prices of 70 would be: a. 84.50 b. 0.5769 c. 0 d. 7.75 Refer to Problem #1. Suppose that the call is selling for 9 in the market and assume that we would execute an arbitrage transaction, the rate of return on a 10,000 call option would be: a. 16.20% b. 18.19% c. 15.17% d. 16.78%

- use binomial option pricing model for this question. suppose the current spot rate for USD/CHF is 0.7. you need to find the one-year call option price of USD/CHF with the exercise price of 0.68 USD/CHF. Assume that our future states will be either 0.7739 U&SD/CHF or 0.6332 USD/CHF. 1) What are the payoffs of a call option (for both states) 2) what is the hedge ratio of the call option?With all other variables being equal (the same excerise price, underlying asset, implied volatility, interest rate, etc.), an at-the-money option with 30 days to expiration will tpyically have a gamma that is higher than an at-the-moeny option with 180 days to expiration (hint: think of the different shapes of the associated probability distribution and the change in delta) True or False?Assume the following inputs for a call option: (1) current stock price is $25, (2) strike price is $28, (3) time to expiration is 4 months, (4) annualized risk-free rate is 5%, and (5) variance of stock return is 0.33. Use the Black-Scholes model to find the price for the call option. Do not round intermediate calculations. Round your answer to the nearest cent.

- Use the Black-Scholes model to find the price for a call option with the following inputs: (1) current stock price is $32, (2) strike price is $37, (3) time to expiration is 3 months, (4) annualized risk-free rate is 6%, and (5) variance of stock return is 0.25. Do not round intermediate calculations. Round your answer to the nearest cent.A European call option has a strike price of K and maturity of T. If the stock price at the maturity is ST, what is the payoff from a short position in this call option (without considering the option price)? Group of answer choices: Max(K - ST, 0) -Max(ST - K, 0) -Max(K - ST, 0) Max(ST - K, 0)if the volatility was reduced to 10.500% when the spot rate fell to $1.2483=€1.00 ? The same call option cost if the volatility was reduced to 10.500% when the spot rate foll $1.2483=€1.00 would be ◻ Data table