Question: based on the above information, calculate the Motorway CO's leading price to earnings (P/E) ratio that is attributable to PVGO. Explain what the results indicate in your response and include the calculation in your answer

Question: based on the above information, calculate the Motorway CO's leading price to earnings (P/E) ratio that is attributable to PVGO. Explain what the results indicate in your response and include the calculation in your answer

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 25P

Related questions

Question

M1

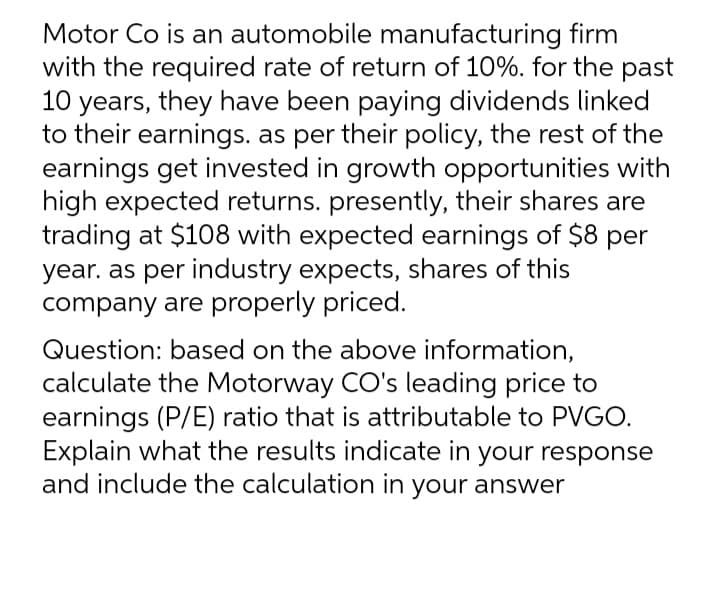

Transcribed Image Text:Motor Co is an automobile manufacturing firm

with the required rate of return of 10%. for the past

10 years, they have been paying dividends linked

to their earnings. as per their policy, the rest of the

earnings get invested in growth opportunities with

high expected returns. presently, their shares are

trading at $108 with expected earnings of $8 per

year. as per industry expects, shares of this

company are properly priced.

Question: based on the above information,

calculate the Motorway CO's leading price to

earnings (P/E) ratio that is attributable to PVGO.

Explain what the results indicate in your response

and include the calculation in your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning