Elona Zuckerberg is the CFO of Facenote company. made the following statements in a conference call after the financial report of fiscal year 2020 was released: Statement 1: We need to conduct a careful analysis to decide how much debt to issue because increasing our financial leverage could either increase or decrease Facenote's value. Statement 2: Increasing the debt-to-equity ratio will also make the payoff to equity investors more volatile (riskier) even with constant bankruptcy risk. Elona's Statements 1 and 2, respectively, correspond most closely to which of the following theories regarding capital structure? O Statement 1: Static trade-off theory; Statement 2: MM's propositions O Statement 1: MM's propositions; Statement 2: Pecking order theory O Statement 1: Pecking order theory; Statement 2: Static trade-off theory O Statement 1: MM's propositions; Statement 2: Static trade-off theory

Elona Zuckerberg is the CFO of Facenote company. made the following statements in a conference call after the financial report of fiscal year 2020 was released: Statement 1: We need to conduct a careful analysis to decide how much debt to issue because increasing our financial leverage could either increase or decrease Facenote's value. Statement 2: Increasing the debt-to-equity ratio will also make the payoff to equity investors more volatile (riskier) even with constant bankruptcy risk. Elona's Statements 1 and 2, respectively, correspond most closely to which of the following theories regarding capital structure? O Statement 1: Static trade-off theory; Statement 2: MM's propositions O Statement 1: MM's propositions; Statement 2: Pecking order theory O Statement 1: Pecking order theory; Statement 2: Static trade-off theory O Statement 1: MM's propositions; Statement 2: Static trade-off theory

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 3MC: David Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing....

Related questions

Question

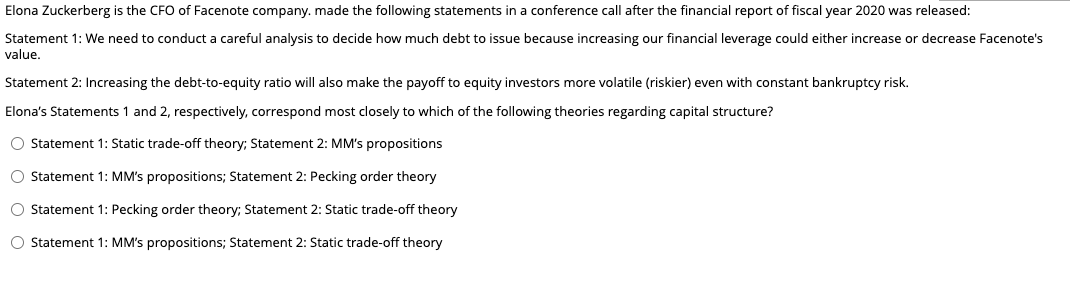

Transcribed Image Text:Elona Zuckerberg is the CFO of Facenote company. made the following statements in a conference call after the financial report of fiscal year 2020 was released:

Statement 1: We need to conduct a careful analysis to decide how much debt to issue because increasing our financial leverage could either increase or decrease Facenote's

value.

Statement 2: Increasing the debt-to-equity ratio will also make the payoff to equity investors more volatile (riskier) even with constant bankruptcy risk.

Elona's Statements 1 and 2, respectively, correspond most closely to which of the following theories regarding capital structure?

O Statement 1: Static trade-off theory; Statement 2: MM's propositions

O Statement 1: MM's propositions; Statement 2: Pecking order theory

O Statement 1: Pecking order theory; Statement 2: Static trade-off theory

O Statement 1: MM's propositions; Statement 2: Static trade-off theory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning