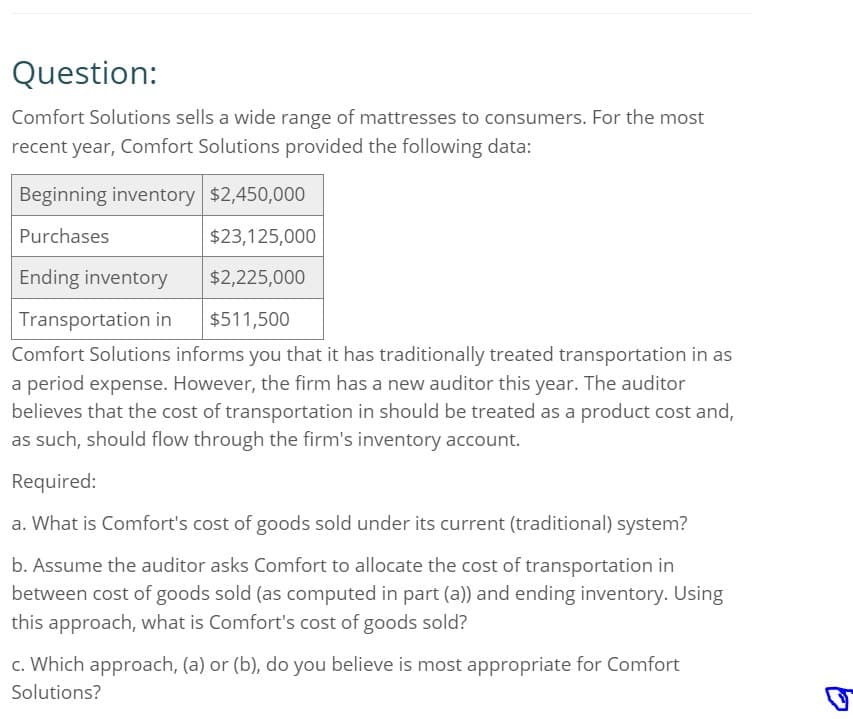

Question: Comfort Solutions sells a wide range of mattresses to consumers. For the most recent year, Comfort Solutions provided the following data: Beginning inventory $2,450,000 Purchases $23,125,000 Ending inventory Transportation in $2,225,000 $511,500 Comfort Solutions informs you that it has traditionally treated transportation in as a period expense. However, the firm has a new auditor this year. The auditor believes that the cost of transportation in should be treated as a product cost and, as such, should flow through the firm's inventory account. Required: a. What is Comfort's cost of goods sold under its current (traditional) system? b. Assume the auditor asks Comfort to allocate the cost of transportation in between cost of goods sold (as computed in part (a)) and ending inventory. Using this approach, what is Comfort's cost of goods sold? c. Which approach, (a) or (b), do you believe is most appropriate for Comfort Solutions?

Question: Comfort Solutions sells a wide range of mattresses to consumers. For the most recent year, Comfort Solutions provided the following data: Beginning inventory $2,450,000 Purchases $23,125,000 Ending inventory Transportation in $2,225,000 $511,500 Comfort Solutions informs you that it has traditionally treated transportation in as a period expense. However, the firm has a new auditor this year. The auditor believes that the cost of transportation in should be treated as a product cost and, as such, should flow through the firm's inventory account. Required: a. What is Comfort's cost of goods sold under its current (traditional) system? b. Assume the auditor asks Comfort to allocate the cost of transportation in between cost of goods sold (as computed in part (a)) and ending inventory. Using this approach, what is Comfort's cost of goods sold? c. Which approach, (a) or (b), do you believe is most appropriate for Comfort Solutions?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Question

Answer please

Transcribed Image Text:Question:

Comfort Solutions sells a wide range of mattresses to consumers. For the most

recent year, Comfort Solutions provided the following data:

Beginning inventory $2,450,000

Purchases

$23,125,000

Ending inventory

Transportation in

$2,225,000

$511,500

Comfort Solutions informs you that it has traditionally treated transportation in as

a period expense. However, the firm has a new auditor this year. The auditor

believes that the cost of transportation in should be treated as a product cost and,

as such, should flow through the firm's inventory account.

Required:

a. What is Comfort's cost of goods sold under its current (traditional) system?

b. Assume the auditor asks Comfort to allocate the cost of transportation in

between cost of goods sold (as computed in part (a)) and ending inventory. Using

this approach, what is Comfort's cost of goods sold?

c. Which approach, (a) or (b), do you believe is most appropriate for Comfort

Solutions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning