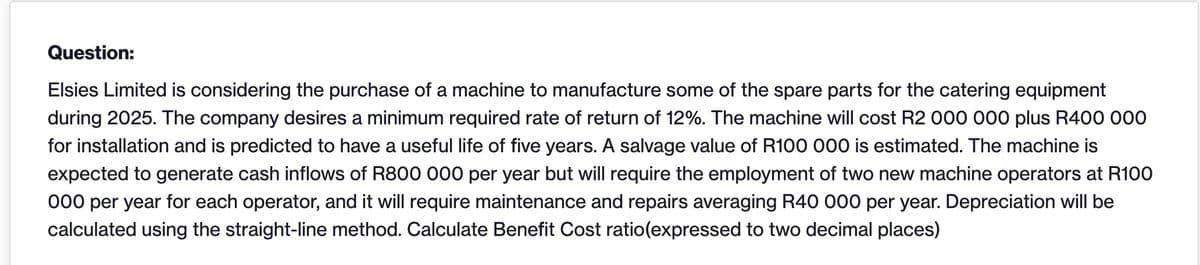

Question: Elsies Limited is considering the purchase of a machine to manufacture some of the spare parts for the catering equipment during 2025. The company desires a minimum required rate of return of 12%. The machine will cost R2 000 000 plus R400 000 for installation and is predicted to have a useful life of five years. A salvage value of R100 000 is estimated. The machine is expected to generate cash inflows of R800 000 per year but will require the employment of two new machine operators at R100 000 per year for each operator, and it will require maintenance and repairs averaging R40 000 per year. Depreciation will be calculated using the straight-line method. Calculate Benefit Cost ratio(expressed to two decimal places)

Question: Elsies Limited is considering the purchase of a machine to manufacture some of the spare parts for the catering equipment during 2025. The company desires a minimum required rate of return of 12%. The machine will cost R2 000 000 plus R400 000 for installation and is predicted to have a useful life of five years. A salvage value of R100 000 is estimated. The machine is expected to generate cash inflows of R800 000 per year but will require the employment of two new machine operators at R100 000 per year for each operator, and it will require maintenance and repairs averaging R40 000 per year. Depreciation will be calculated using the straight-line method. Calculate Benefit Cost ratio(expressed to two decimal places)

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

Transcribed Image Text:Question:

Elsies Limited is considering the purchase of a machine to manufacture some of the spare parts for the catering equipment

during 2025. The company desires a minimum required rate of return of 12%. The machine will cost R2 000 000 plus R400 000

for installation and is predicted to have a useful life of five years. A salvage value of R100 000 is estimated. The machine is

expected to generate cash inflows of R800 000 per year but will require the employment of two new machine operators at R100

000 per year for each operator, and it will require maintenance and repairs averaging R40 000 per year. Depreciation will be

calculated using the straight-line method. Calculate Benefit Cost ratio(expressed to two decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub