Question No. 2 You have discovered in your first audit of STUVWXYZ Corp., the Account "Other Assets and Charges" was utilized to booktransactions on receivables, payables and othercharges: Other Assets and Charges Credit Sales to customers Installment Sales made by consignee 545,000 Insurance Premium advanced 855,500 Customeraccount written-off 65,200 347,000 27,000 19,900 230,000 Taxes withheld from salaries Unpaid wages Accrued utility bills Raw Materials purchased on account 527,400 47,200 Employees IOUS Notes Received from customers 55,000 Advances paid to contractors Delivery expenses to customers Delivery expenses to customers 92,250 85,000 Payment on credit sales Bank Overdraft accommodation 270,000 176,000 85,000 Interest received from notes 28,000 Required: Prepare adjusting entries to reclassify the items to proper accounts required under the PFRS using the following Chart of Accounts:

Question No. 2 You have discovered in your first audit of STUVWXYZ Corp., the Account "Other Assets and Charges" was utilized to booktransactions on receivables, payables and othercharges: Other Assets and Charges Credit Sales to customers Installment Sales made by consignee 545,000 Insurance Premium advanced 855,500 Customeraccount written-off 65,200 347,000 27,000 19,900 230,000 Taxes withheld from salaries Unpaid wages Accrued utility bills Raw Materials purchased on account 527,400 47,200 Employees IOUS Notes Received from customers 55,000 Advances paid to contractors Delivery expenses to customers Delivery expenses to customers 92,250 85,000 Payment on credit sales Bank Overdraft accommodation 270,000 176,000 85,000 Interest received from notes 28,000 Required: Prepare adjusting entries to reclassify the items to proper accounts required under the PFRS using the following Chart of Accounts:

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 47E: OBJECTIVE 9 Exercise 2-47 Debit and Credit Effects of Transactions Lincoln Corporation was involved...

Related questions

Concept explainers

Question

give solutions and explain

Transcribed Image Text:Group 3

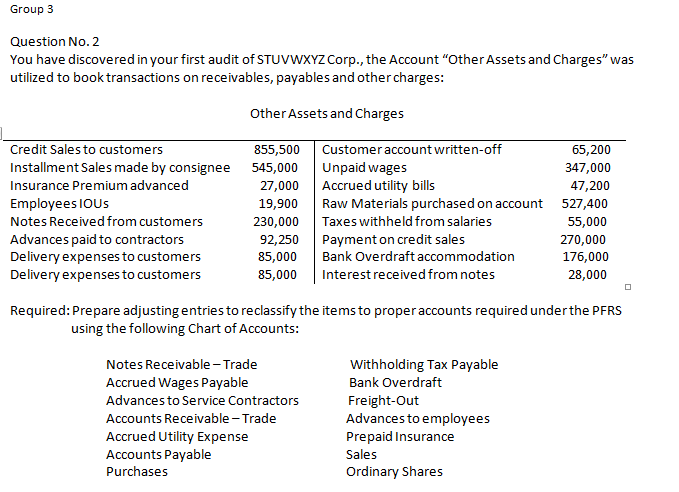

Question No. 2

You have discovered in your first audit of STUVWXYZ Corp., the Account "Other Assets and Charges" was

utilized to book transactions on receivables, payables and other charges:

Other Assets and Charges

Credit Sales to customers

Installment Sales made by consignee 545,000

Customer account written-off

Unpaid wages

Accrued utility bills

Raw Materials purchased on account

855,500

65,200

347,000

Insurance Premium advanced

27,000

47,200

Employees IOUS

19,900

527,400

Notes Received from customers

230,000

Taxes withheld from salaries

55,000

Advances paid to contractors

Delivery expenses to customers

Delivery expenses to customers

92,250

Payment on credit sales

270,000

85,000

Bank Overdraft accommodation

176,000

85,000

Interest received from notes

28,000

Required: Prepare adjusting entries to reclassify the items to properaccounts required underthe PFRS

using the following Chart of Accounts:

Notes Receivable- Trade

Withholding Tax Payable

Accrued Wages Payable

Bank Overdraft

Freight-Out

Advances to employees

Prepaid Insurance

Advances to Service Contractors

Accounts Receivable - Trade

Accrued Utility Expense

Accounts Payable

Sales

Purchases

Ordinary Shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,