Dec 1 Purchased P1,250,000 inventory on account. Dec 3 Received P200,000 from a lessee as an advance payment for rent over five months starting December 2020. Billed a customer who bought 400 units at P4,500 each. It is expected thate of the units will be defective and that repair costs will average P1,350 per u Dec 9 Dec 15 Borrowed P900,000 from a bank by signing a 9-month, 10%, interest-bearir note. Dec 21 Paid P820,000 on account for inventory purchased on December 1. Dec 27 Sued by a disgruntled employee. Legal counsel believes that it is possible t the company will have to pay P80,000 in damages next year. Dec 30 Purchased new equipment for P650,000, paying P200,000 cash and signin 3-year, 7% note for the remainder. The note will be paid in three equal, ann installments of P150,000 starting December 30, 2021. Honored warranty contracts on 22 units for a total cost of P27,000. Dec 31

Dec 1 Purchased P1,250,000 inventory on account. Dec 3 Received P200,000 from a lessee as an advance payment for rent over five months starting December 2020. Billed a customer who bought 400 units at P4,500 each. It is expected thate of the units will be defective and that repair costs will average P1,350 per u Dec 9 Dec 15 Borrowed P900,000 from a bank by signing a 9-month, 10%, interest-bearir note. Dec 21 Paid P820,000 on account for inventory purchased on December 1. Dec 27 Sued by a disgruntled employee. Legal counsel believes that it is possible t the company will have to pay P80,000 in damages next year. Dec 30 Purchased new equipment for P650,000, paying P200,000 cash and signin 3-year, 7% note for the remainder. The note will be paid in three equal, ann installments of P150,000 starting December 30, 2021. Honored warranty contracts on 22 units for a total cost of P27,000. Dec 31

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 10P: Worksheet Victoria Company has the following account balances on December 31, 2019, prior to any...

Related questions

Question

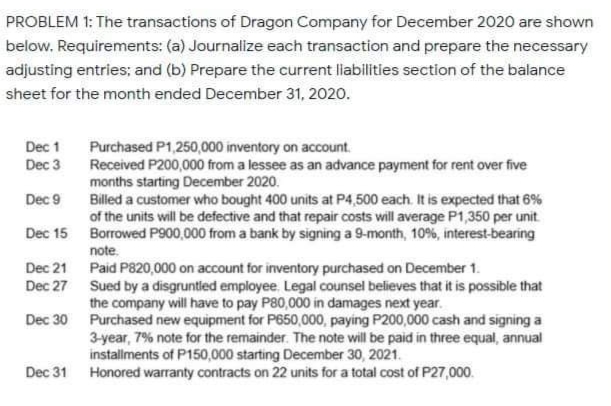

Transcribed Image Text:PROBLEM 1: The transactions of Dragon Company for December 2020 are shown

below. Requirements: (a) Journalize each transaction and prepare the necessary

adjusting entries; and (b) Prepare the current liabilities section of the balance

sheet for the month ended December 31, 2020.

Dec 1

Purchased P1,250,000 inventory on account.

Received P200,000 from a lessee as an advance payment for rent over five

months starting December 2020.

Billed a customer who bought 400 units at P4,500 each. It is expected that 6%

of the units will be defective and that repair costs will average P1,350 per unit

Dec 3

Dec 9

Dec 15 Borrowed P900,000 from a bank by signing a 9-month, 10%, interest-bearing

note.

Dec 21 Paid P820,000 on account for inventory purchased on December 1.

Dec 27 Sued by a disgruntied employee. Legal counsel believes that it is possible that

the company will have to pay P80,000 in damages next year.

Dec 30 Purchased new equipment for P650,000, paying P200,000 cash and signing a

3-year, 7% note for the remainder. The note will be paid in three equal, annual

installments of P150,000 starting December 30, 2021.

Dec 31 Honored warranty contracts on 22 units for a total cost of P27,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning