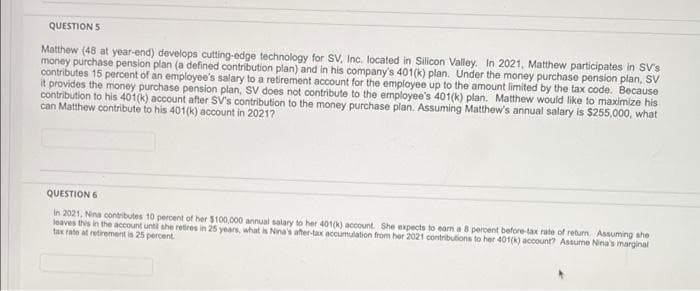

QUESTION S Matthew (48 at year-end) develops cutting-edge technology for SV, Inc. located in Silicon Valley. In 2021, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. Assuming Matthew's annual salary is $255,000, what can Matthew contribute to his 401(k) account in 2021?

QUESTION S Matthew (48 at year-end) develops cutting-edge technology for SV, Inc. located in Silicon Valley. In 2021, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. Assuming Matthew's annual salary is $255,000, what can Matthew contribute to his 401(k) account in 2021?

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 35P

Related questions

Question

Please answer within 30 minutes. Please answer both the questions. Its urgent.

Transcribed Image Text:QUESTION 5

Matthew (48 at year-end) develops cutting-edge technology for SV, Inc. located in Silicon Valley. In 2021, Matthew participates in SV's

money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV

contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because

it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his

contribution to his 401(k) account after SV's contribution to the money purchase plan. Assuming Matthew's annual salary is $255,000, what

can Matthew contribute to his 401(k) account in 2021?

QUESTION 6

In 2021, Nina contributes 10 percent of her $100,000 annual salary to her 401(k) account. She expects to earn a 8 percent before-tax rate of return. Assuming she

leaves this in the account until she retires in 25 years, what is Nina's after-tax accumulation from her 2021 contributions to her 401(k) account? Assume Nina's marginal

tax rate at retirement is 25 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT