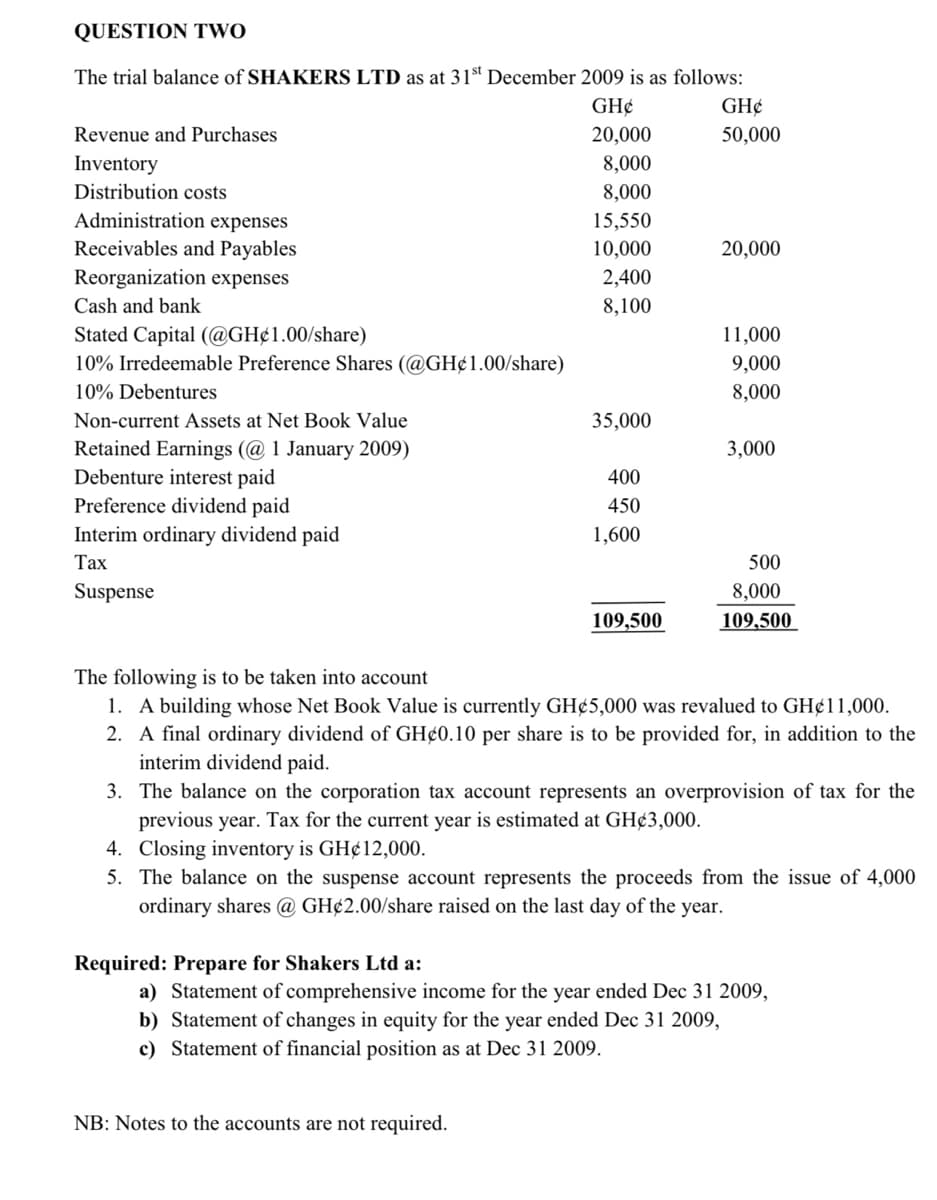

QUESTION TWO The trial balance of SHAKERS LTD as at 31st December 2009 is as follows: GH¢ GH¢ Revenue and Purchases 20,000 50,000 8,000 Inventory Distribution costs 8,000 Administration expenses 15,550 Receivables and Payables 10,000 20,000 Reorganization expenses 2,400 Cash and bank 8,100 Stated Capital (@GH¢1.00/share) 10% Irredeemable Preference Shares (@GH¢1.00/share) 11,000 9,000 10% Debentures 8,000 Non-current Assets at Net Book Value 35,000 Retained Earnings (@ 1 January 2009) Debenture interest paid Preference dividend paid Interim ordinary dividend paid 3,000 400 450 1,600 Тах 500 Suspense 8,000 109,500 109,500 The following is to be taken into account 1. A building whose Net Book Value is currently GH¢5,000 was revalued to GH¢11,000. 2. A final ordinary dividend of GH¢0.10 per share is to be provided for, in addition to the interim dividend paid. 3. The balance on the corporation tax account represents an overprovision of tax for the previous year. Tax for the current year is estimated at GH¢3,000. 4. Closing inventory is GH¢12,000. 5. The balance on the suspense account represents the proceeds from the issue of 4,000 ordinary shares @ GH¢2.00/share raised on the last day of the year. Required: Prepare for Shakers Ltd a: a) Statement of comprehensive income for the year ended Dec 31 2009, b) Statement of changes in equity for the year ended Dec 31 2009, c) Statement of financial position as at Dec 31 2009. NB: Notes to the accounts are not required.

QUESTION TWO The trial balance of SHAKERS LTD as at 31st December 2009 is as follows: GH¢ GH¢ Revenue and Purchases 20,000 50,000 8,000 Inventory Distribution costs 8,000 Administration expenses 15,550 Receivables and Payables 10,000 20,000 Reorganization expenses 2,400 Cash and bank 8,100 Stated Capital (@GH¢1.00/share) 10% Irredeemable Preference Shares (@GH¢1.00/share) 11,000 9,000 10% Debentures 8,000 Non-current Assets at Net Book Value 35,000 Retained Earnings (@ 1 January 2009) Debenture interest paid Preference dividend paid Interim ordinary dividend paid 3,000 400 450 1,600 Тах 500 Suspense 8,000 109,500 109,500 The following is to be taken into account 1. A building whose Net Book Value is currently GH¢5,000 was revalued to GH¢11,000. 2. A final ordinary dividend of GH¢0.10 per share is to be provided for, in addition to the interim dividend paid. 3. The balance on the corporation tax account represents an overprovision of tax for the previous year. Tax for the current year is estimated at GH¢3,000. 4. Closing inventory is GH¢12,000. 5. The balance on the suspense account represents the proceeds from the issue of 4,000 ordinary shares @ GH¢2.00/share raised on the last day of the year. Required: Prepare for Shakers Ltd a: a) Statement of comprehensive income for the year ended Dec 31 2009, b) Statement of changes in equity for the year ended Dec 31 2009, c) Statement of financial position as at Dec 31 2009. NB: Notes to the accounts are not required.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.14EX: Balance sheet presentation of available-for-sale investments During 20Y8, its first year of...

Related questions

Question

100%

Transcribed Image Text:QUESTION Two

The trial balance of SHAKERS LTD as at 31st December 2009 is as follows:

GH¢

GH¢

Revenue and Purchases

20,000

50,000

8,000

Inventory

Distribution costs

8,000

Administration expenses

Receivables and Payables

Reorganization expenses

15,550

10,000

20,000

2,400

Cash and bank

8,100

Stated Capital (@GH¢1.00/share)

10% Irredeemable Preference Shares (@GH¢1.00/share)

11,000

9,000

10% Debentures

8,000

Non-current Assets at Net Book Value

35,000

Retained Earnings (@ 1 January 2009)

Debenture interest paid

3,000

400

Preference dividend paid

Interim ordinary dividend paid

450

1,600

Тах

500

Suspense

8,000

109,500

109,500

The following is to be taken into account

1. A building whose Net Book Value is currently GH¢5,000 was revalued to GH¢11,000.

2. A final ordinary dividend of GH¢0.10 per share is to be provided for, in addition to the

interim dividend paid.

3. The balance on the corporation tax account represents an overprovision of tax for the

previous year. Tax for the current year is estimated at GH¢3,000.

4. Closing inventory is GH¢12,000.

5. The balance on the suspense account represents the proceeds from the issue of 4,000

ordinary shares @ GH¢2.00/share raised on the last day of the year.

Required: Prepare for Shakers Ltd a:

a) Statement of comprehensive income for the year ended Dec 31 2009,

b) Statement of changes in equity for the year ended Dec 31 2009,

c) Statement of financial position as at Dec 31 2009.

NB: Notes to the accounts are not required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning