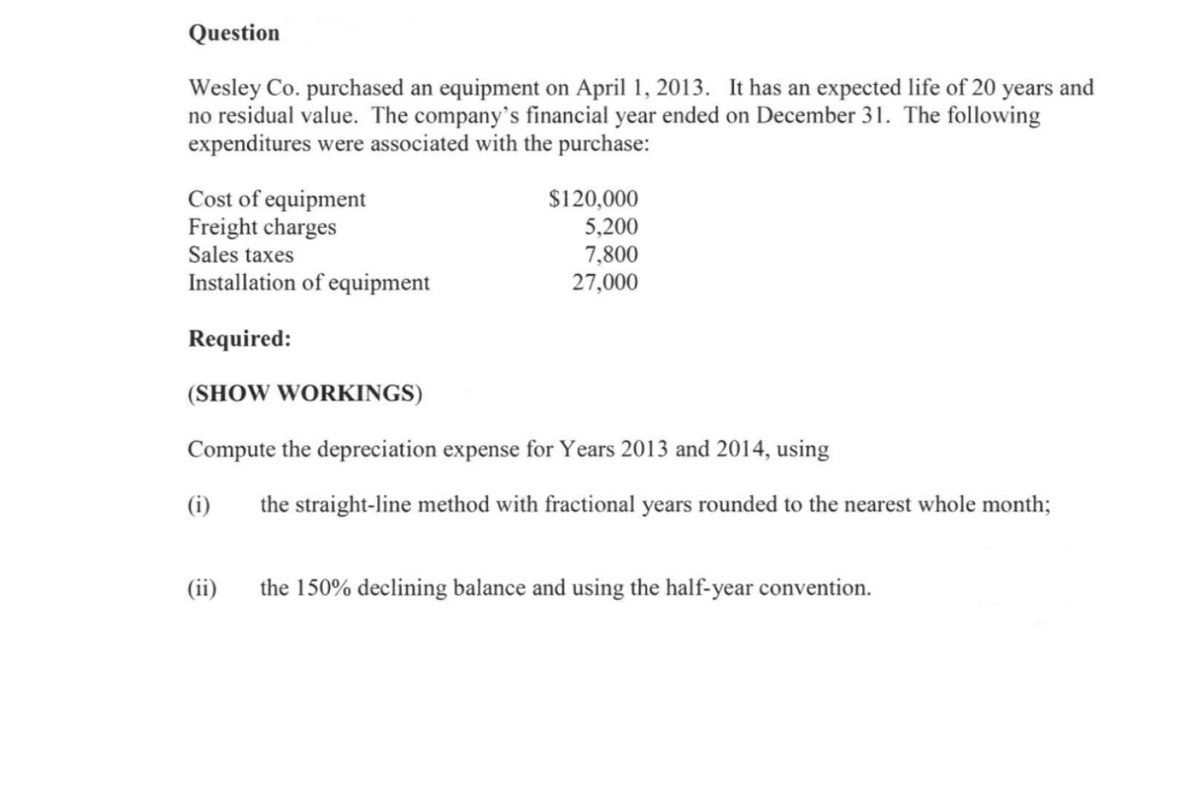

Question Wesley Co. purchased an equipment on April 1, 2013. It has an expected life of 20 years and no residual value. The company's financial year ended on December 31. The following expenditures were associated with the purchase: Cost of equipment Freight charges Sales taxes $120,000 5,200 7,800 27,000 Installation of equipment Required: (SHOW WORKINGS) Compute the depreciation expense for Years 2013 and 2014, using (i) the straight-line method with fractional years rounded to the nearest whole month; (ii) the 150% declining balance and using the half-year convention.

Question Wesley Co. purchased an equipment on April 1, 2013. It has an expected life of 20 years and no residual value. The company's financial year ended on December 31. The following expenditures were associated with the purchase: Cost of equipment Freight charges Sales taxes $120,000 5,200 7,800 27,000 Installation of equipment Required: (SHOW WORKINGS) Compute the depreciation expense for Years 2013 and 2014, using (i) the straight-line method with fractional years rounded to the nearest whole month; (ii) the 150% declining balance and using the half-year convention.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8P: Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of...

Related questions

Question

Transcribed Image Text:Question

Wesley Co. purchased an equipment on April 1, 2013. It has an expected life of 20 years and

no residual value. The company's financial year ended on December 31. The following

expenditures were associated with the purchase:

Cost of equipment

Freight charges

Sales taxes

$120,000

5,200

7,800

27,000

Installation of equipment

Required:

(SHOW WORKINGS)

Compute the depreciation expense for Years 2013 and 2014, using

(i)

the straight-line method with fractional years rounded to the nearest whole month;

(ii)

the 150% declining balance and using the half-year convention.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College