Question# Xiomi Co. is a retailer dealing in a single product. Beginning inventory at January 1 of this year is zero, operating expenses for this same year are $5,000, and there are 2,000 common shares outstanding. The following purchases are made this year: ITI Cost $ 1,000 3,300 7,200 Units Per Unit $ 10 January March 100 300 11 June 600 12 October December Total 300 14 4,200 7,500 23,200 500 15 1800 Ending inventory at December 31 is 800 units. End-of-year assets, excluding inventories, amount to $75,000, of which $50,000 of the $75,000 are current. Current liabilities amount to $25,000, and long-term liabilities equal $10,000.

Question# Xiomi Co. is a retailer dealing in a single product. Beginning inventory at January 1 of this year is zero, operating expenses for this same year are $5,000, and there are 2,000 common shares outstanding. The following purchases are made this year: ITI Cost $ 1,000 3,300 7,200 Units Per Unit $ 10 January March 100 300 11 June 600 12 October December Total 300 14 4,200 7,500 23,200 500 15 1800 Ending inventory at December 31 is 800 units. End-of-year assets, excluding inventories, amount to $75,000, of which $50,000 of the $75,000 are current. Current liabilities amount to $25,000, and long-term liabilities equal $10,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 5E: Multiple-Step and Single-Step In coin Statements The following items were derived from Gold...

Related questions

Topic Video

Question

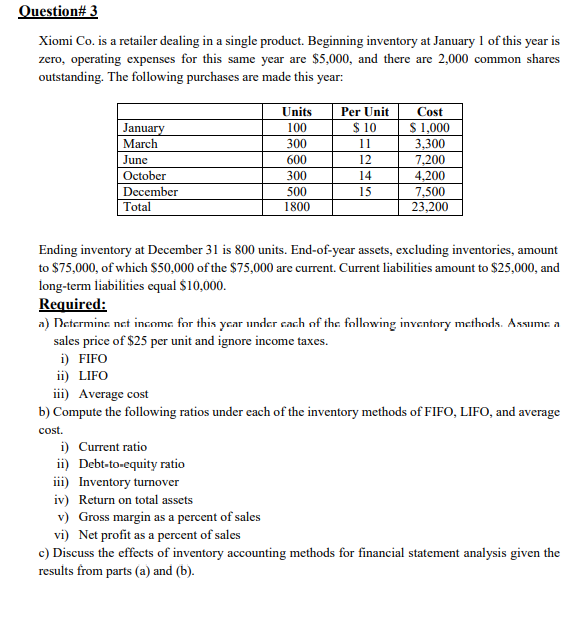

Transcribed Image Text:Question# 3

Xiomi Co. is a retailer dealing in a single product. Beginning inventory at January 1 of this year is

zero, operating expenses for this same year are $5,000, and there are 2,000 common shares

outstanding. The following purchases are made this year:

Units

Per Unit

Cost

$ 1,000

3,300

7,200

4,200

7,500

23,200

January

March

100

$ 10

300

11

June

600

12

October

300

14

December

500

15

Total

1800

Ending inventory at December 31 is 800 units. End-of-year assets, excluding inventories, amount

to $75,000, of which $50,000 of the $75,000 are current. Current liabilities amount to $25,000, and

long-term liabilities equal $10,000.

Required:

a) Determine net income for this year under cach of the following inventory methods. Assume a

sales price of $25 per unit and ignore income taxes.

i) FIFO

ii) LIFO

iii) Average cost

b) Compute the following ratios under each of the inventory methods of FIFO, LIFO, and average

cost.

i) Current ratio

ii) Debt-to-equity ratio

iii) Inventory turnover

iv) Return on total assets

v) Gross margin as a percent of sales

vi) Net profit as a percent of sales

c) Discuss the effects of inventory accounting methods for financial statement analysis given the

results from parts (a) and (b).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning