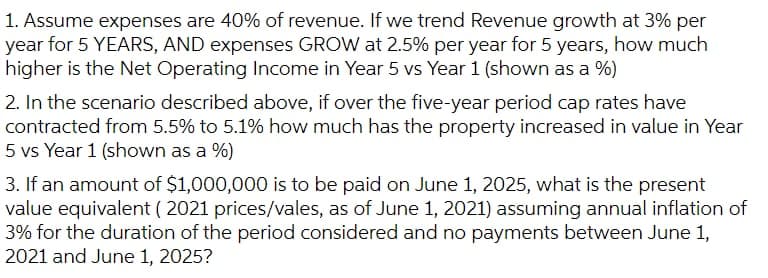

1. Assume expenses are 40% of revenue. If we trend Revenue growth at 3% per year for 5 YEARS, AND expenses GROW at 2.5% per year for 5 years, how much higher is the Net Operating Income in Year 5 vs Year 1 (shown as a %) 2. In the scenario described above, if over the five-year period cap rates have contracted from 5.5% to 5.1% how much has the property increased in value in Year 5 vs Year 1 (shown as a %) 3. If an amount of $1,000,000 is to be paid on June 1, 2025, what is the present value equivalent ( 2021 prices/vales, as of June 1, 2021) assuming annual inflation of 3% for the duration of the period considered and no payments between June 1, 2021 and June 1, 2025?

1. Assume expenses are 40% of revenue. If we trend Revenue growth at 3% per year for 5 YEARS, AND expenses GROW at 2.5% per year for 5 years, how much higher is the Net Operating Income in Year 5 vs Year 1 (shown as a %) 2. In the scenario described above, if over the five-year period cap rates have contracted from 5.5% to 5.1% how much has the property increased in value in Year 5 vs Year 1 (shown as a %) 3. If an amount of $1,000,000 is to be paid on June 1, 2025, what is the present value equivalent ( 2021 prices/vales, as of June 1, 2021) assuming annual inflation of 3% for the duration of the period considered and no payments between June 1, 2021 and June 1, 2025?

Chapter14: Capital Structure Management In Practice

Section: Chapter Questions

Problem 15P

Related questions

Question

ASAP!!

Transcribed Image Text:1. Assume expenses are 40% of revenue. If we trend Revenue growth at 3% per

year for 5 YEARS, AND expenses GROW at 2.5% per year for 5 years, how much

higher is the Net Operating Income in Year 5 vs Year 1 (shown as a %)

2. In the scenario described above, if over the five-year period cap rates have

contracted from 5.5% to 5.1% how much has the property increased in value in Year

5 vs Year 1 (shown as a %)

3. If an amount of $1,000,000 is to be paid on June 1, 2025, what is the present

value equivalent ( 2021 prices/vales, as of June 1, 2021) assuming annual inflation of

3% for the duration of the period considered and no payments between June 1,

2021 and June 1, 2025?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning