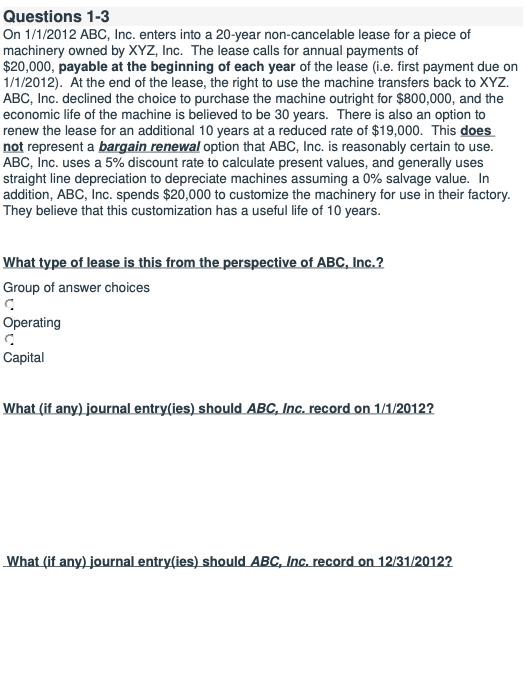

Questions 1-3 On 1/1/2012 ABC, Inc. enters into a 20-year non-cancelable lease for a piece of machinery owned by XYZ, Inc. The lease calls for annual payments of $20,000, payable at the beginning of each year of the lease (i.e. first payment due on 1/1/2012). At the end of the lease, the right to use the machine transfers back to XYZ. ABC, Inc. declined the choice to purchase the machine outright for $800,000, and the economic life of the machine is believed to be 30 years. There is also an option to renew the lease for an additional 10 years at a reduced rate of $19,000. This does not represent a bargain renewal option that ABC, Inc. is reasonably certain to use. ABC, Inc. uses a 5% discount rate to calculate present values, and generally uses straight line depreciation to depreciate machines assuming a 0% salvage value. In addition, ABC, Inc. spends $20,000 to customize the machinery for use in their factory. They believe that this customization has a useful life of 10 years. What type of lease is this from the perspective of ABC, Inc.? Group of answer choices Operating Capital What (if any) journal entry(ies) should ABC, Inc. record on 1/1/2012? What (if any) journal entry(ies) should ABC, Inc. record on 12/31/20122

Questions 1-3 On 1/1/2012 ABC, Inc. enters into a 20-year non-cancelable lease for a piece of machinery owned by XYZ, Inc. The lease calls for annual payments of $20,000, payable at the beginning of each year of the lease (i.e. first payment due on 1/1/2012). At the end of the lease, the right to use the machine transfers back to XYZ. ABC, Inc. declined the choice to purchase the machine outright for $800,000, and the economic life of the machine is believed to be 30 years. There is also an option to renew the lease for an additional 10 years at a reduced rate of $19,000. This does not represent a bargain renewal option that ABC, Inc. is reasonably certain to use. ABC, Inc. uses a 5% discount rate to calculate present values, and generally uses straight line depreciation to depreciate machines assuming a 0% salvage value. In addition, ABC, Inc. spends $20,000 to customize the machinery for use in their factory. They believe that this customization has a useful life of 10 years. What type of lease is this from the perspective of ABC, Inc.? Group of answer choices Operating Capital What (if any) journal entry(ies) should ABC, Inc. record on 1/1/2012? What (if any) journal entry(ies) should ABC, Inc. record on 12/31/20122

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 3E: Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides...

Related questions

Question

Transcribed Image Text:Questions 1-3

On 1/1/2012 ABC, Inc. enters into a 20-year non-cancelable lease for a piece of

machinery owned by XYZ, Inc. The lease calls for annual payments of

$20,000, payable at the beginning of each year of the lease (i.e. first payment due on

1/1/2012). At the end of the lease, the right to use the machine transfers back to XYZ.

ABC, Inc. declined the choice to purchase the machine outright for $800,000, and the

economic life of the machine is believed to be 30 years. There is also an option to

renew the lease for an additional 10 years at a reduced rate of $19,000. This does

not represent a bargain renewal option that ABC, Inc. is reasonably certain to use.

ABC, Inc. uses a 5% discount rate to calculate present values, and generally uses

straight line depreciation to depreciate machines assuming a 0% salvage value. In

addition, ABC, Inc. spends $20,000 to customize the machinery for use in their factory.

They believe that this customization has a useful life of 10 years.

What type of lease is this from the perspective of ABC, Inc.?

Group of answer choices

Operating

Capital

What (if any) journal entry(ies) should ABC, Inc. record on 1/1/2012?

What (if any) journal entry(ies) should ABC, Inc. record on 12/31/2012?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning