Questions: 1. Make a comparison for each company based on computed ratio. 2. What is your financial analysis on their overall performance?

Questions: 1. Make a comparison for each company based on computed ratio. 2. What is your financial analysis on their overall performance?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 26MCQ

Related questions

Question

Questions:

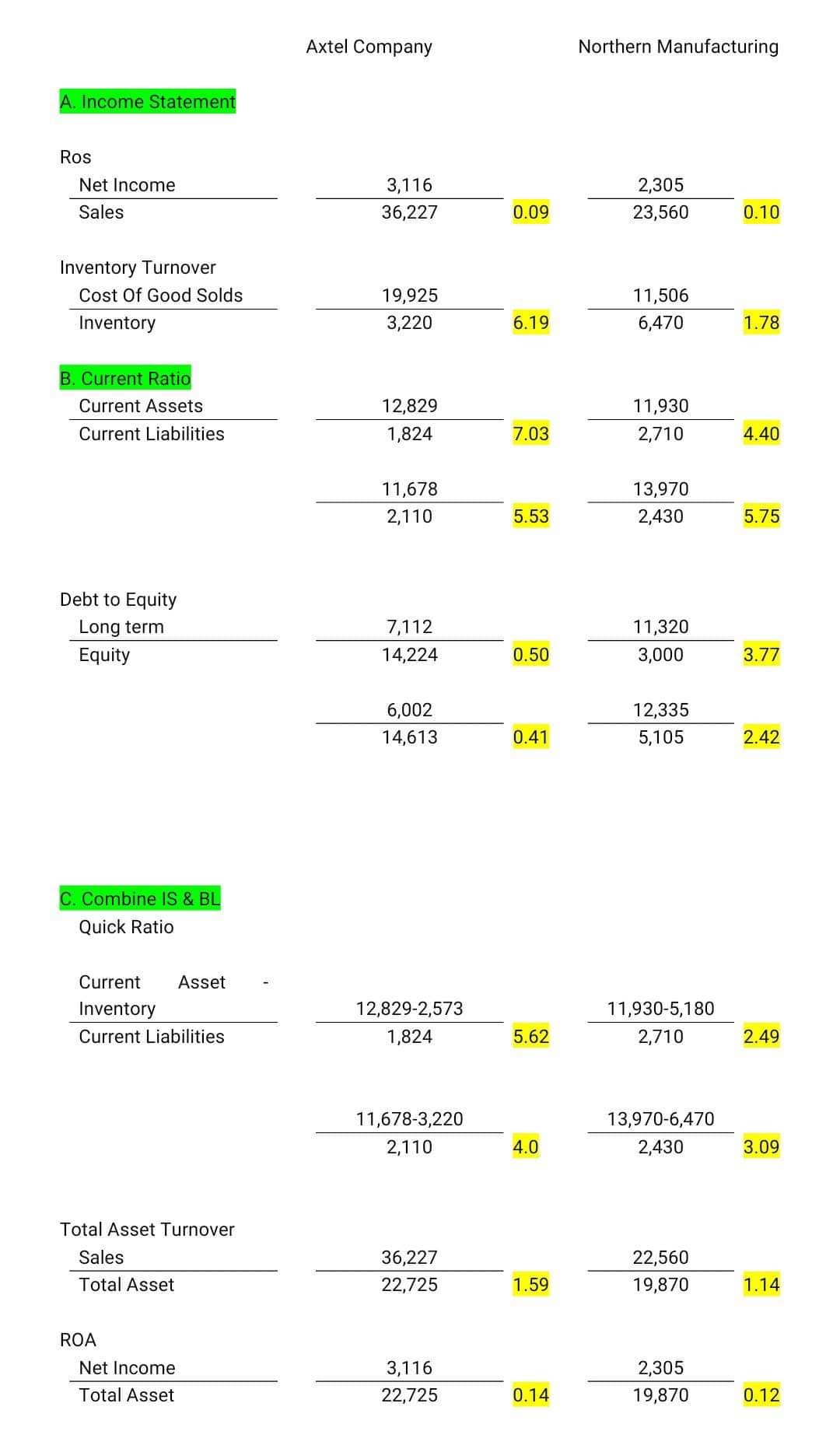

1. Make a comparison for each company based on computed ratio.

2. What is your financial analysis on their overall performance?

Transcribed Image Text:A. Income Statement

Ros

Net Income

Sales

Inventory Turnover

Cost Of Good Solds

Inventory

B. Current Ratio

Current Assets

Current Liabilities

Debt to Equity

Long term

Equity

C. Combine IS & BL

Quick Ratio

Current Asset

Inventory

Current Liabilities

Total Asset Turnover

Sales

Total Asset

Net Income

Total Asset

ROA

Axtel Company

3,116

36,227

19,925

3,220

12,829

1,824

11,678

2,110

7,112

14,224

6,002

14,613

12,829-2,573

1,824

11,678-3,220

2,110

36,227

22,725

3,116

22,725

0.09

6.19

7.03

5.53

0.50

0.41

5.62

4.0

1.59

0.14

Northern Manufacturing

2,305

23,560

0.10

11,506

6,470

1.78

11,930

2,710

4.40

13,970

2,430

5.75

11,320

3,000

3.77

12,335

5,105

2.42

11,930-5,180

2,710

13,970-6,470

2,430

22,560

19,870

2,305

19,870

2.49

3.09

1.14

0.12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College