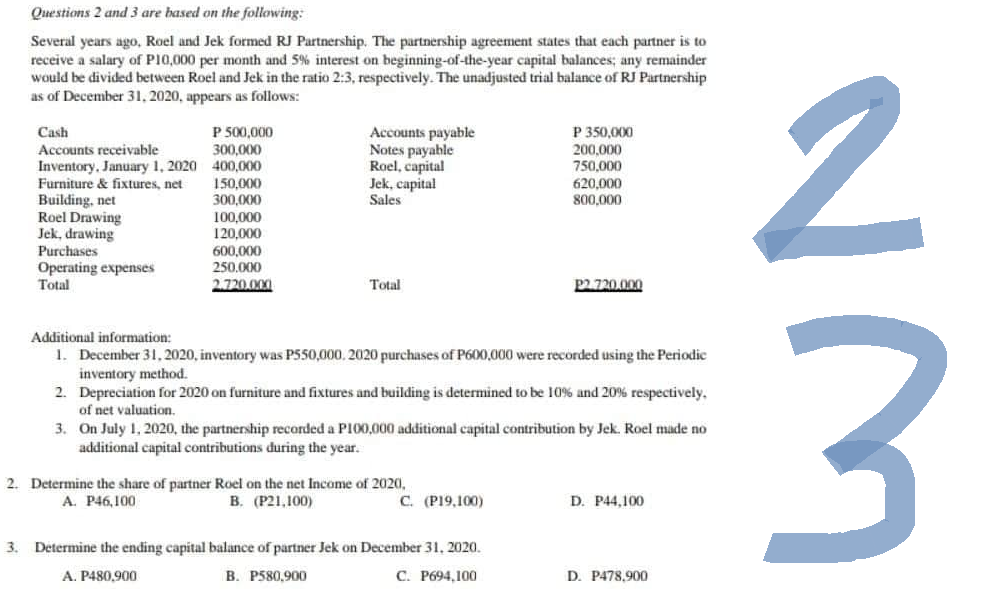

Questions 2 and 3 are based on the following: Several years ago, Roel and Jek formed RJ Partnership. The partnership agreement states that each partner is to receive a salary of P10,000 per month and 5% interest on beginning-of-the-year capital balances; any remainder would be divided between Roel and Jek in the ratio 2:3, respectively. The unadjusted trial balance of RJ Partnership as of December 31, 2020, appears as follows: Cash Accounts receivable Inventory, January 1, 2020 Furniture & fixtures, net Building, net Roel Drawing Jek, drawing Purchases Operating expenses Total P 500,000 300,000 400,000 150,000 300,000 100,000 120,000 600,000 250.000 2.720.000 Accounts payable Notes payable Roel, capital Jek, capital Sales Total 2. Determine the share of partner Roel on the net Income of 2020, A. P46,100 B. (P21,100) Additional information: 1. December 31, 2020, inventory was P550,000. 2020 purchases of P600,000 were recorded using the Periodic inventory method. 2. Depreciation for 2020 on furniture and fixtures and building is determined to be 10% and 20% respectively. of net valuation. 3. On July 1, 2020, the partnership recorded a P100,000 additional capital contribution by Jek. Roel made no additional capital contributions during the year. C. (P19,100) P 350,000 200,000 750,000 620,000 800,000 3. Determine the ending capital balance of partner Jek on December 31, 2020. A. P480,900 B. P580,900 C. P694,100 P2.720.000 D. P44,100 D. P478,900

Questions 2 and 3 are based on the following: Several years ago, Roel and Jek formed RJ Partnership. The partnership agreement states that each partner is to receive a salary of P10,000 per month and 5% interest on beginning-of-the-year capital balances; any remainder would be divided between Roel and Jek in the ratio 2:3, respectively. The unadjusted trial balance of RJ Partnership as of December 31, 2020, appears as follows: Cash Accounts receivable Inventory, January 1, 2020 Furniture & fixtures, net Building, net Roel Drawing Jek, drawing Purchases Operating expenses Total P 500,000 300,000 400,000 150,000 300,000 100,000 120,000 600,000 250.000 2.720.000 Accounts payable Notes payable Roel, capital Jek, capital Sales Total 2. Determine the share of partner Roel on the net Income of 2020, A. P46,100 B. (P21,100) Additional information: 1. December 31, 2020, inventory was P550,000. 2020 purchases of P600,000 were recorded using the Periodic inventory method. 2. Depreciation for 2020 on furniture and fixtures and building is determined to be 10% and 20% respectively. of net valuation. 3. On July 1, 2020, the partnership recorded a P100,000 additional capital contribution by Jek. Roel made no additional capital contributions during the year. C. (P19,100) P 350,000 200,000 750,000 620,000 800,000 3. Determine the ending capital balance of partner Jek on December 31, 2020. A. P480,900 B. P580,900 C. P694,100 P2.720.000 D. P44,100 D. P478,900

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 59P

Related questions

Question

DO THIS TYPEWRITTEN FOR UPVOTE

Transcribed Image Text:Questions 2 and 3 are based on the following:

Several years ago, Roel and Jek formed RJ Partnership. The partnership agreement states that each partner is to

receive a salary of P10,000 per month and 5% interest on beginning-of-the-year capital balances; any remainder

would be divided between Roel and Jek in the ratio 2:3, respectively. The unadjusted trial balance of RJ Partnership

as of December 31, 2020, appears as follows:

3.

Cash

Accounts receivable

Inventory, January 1, 2020

Furniture & fixtures, net

Building, net

Roel Drawing

Jek, drawing

Purchases

Operating expenses

Total

P 500,000

300,000

400,000

150,000

300,000

100,000

120,000

600,000

250,000

2.720.000

Accounts payable

Notes payable

Roel, capital

Jek, capital

Sales

Total

2. Determine the share of partner Roel on the net Income of 2020,

A. P46,100

B. (P21,100)

Additional information:

1. December 31, 2020, inventory was P550,000. 2020 purchases of P600,000 were recorded using the Periodic

inventory method.

2. Depreciation for 2020 on furniture and fixtures and building is determined to be 10% and 20%

P 350,000

200,000

750,000

620,000

800,000

respectively.

of net valuation.

3.

On July 1, 2020, the partnership recorded a P100,000 additional capital contribution by Jek. Roel made no

additional capital contributions during the year.

C. (P19,100)

P2.720.000

Determine the ending capital balance of partner Jek on December 31, 2020.

A. P480,900

B. P580,900

C. P694,100

D. P44,100

D. P478,900

WN

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning